With our venture capital expertise since 2005, our team of approximately 20 lawyers has been providing intensive advice to investors, promising startups, VC funds, and family offices. We focus on fund structures and tax consultancy. We are well-versed in modern technological trends, with detailed knowledge of the market, investment environment, and startup business.

On Thursday, 29 May 2025, the Startup Money 2025 conference will take place at the Divadlo Husa na provázku theatre in Brno. This inspiring international event is aimed at the startup and investor community from the CEE region. HAVEL & PARTNERS is a partner of the event.

VC Community Meeting in Bratislava

On 28 May 2025, the next annual invite-only Startup & Investor Meetup will take place at Rivers Club. This event will once again bring valuable connections, inspiring discussions, and opportunities for building cooperation. It will be preceded by a meeting of successful Slovak technology investors in cooperation with ONE FAMILY OFFICE. Interested in Participating? Contact Us!

How to Become a Successful Angel Investor? Spring Workshops in Brno Will Show You

Angel investing is not just about capital. It also involves strategy, legal certainty, and the ability to recognize promising startups. This year’s series of workshops by the innovation agency JIC, in cooperation with HAVEL & PARTNERS, will provide angel investors with essential information.

How to Profit Smartly from Technological Trends? An exclusive event by ONE FAMILY OFFICE, HAVEL & PARTNERS, and Tensor Ventures brought together investment leaders and technology innovators. About seventy selected individuals, including tech entrepreneurs, top managers, enthusiasts, and angel investors, attended to explore the latest trends in technology investments.

Investment Academy for Promising Startups with JIC

In cooperation with the innovation agency JIC and supported by CzechInvest, we organized an Investment Academy in Brno for founders of promising startups. Over four sessions, they learned everything necessary to find the right investment partner from leading domestic investors, lawyers, and business experts.

TA3 Kapučíno Podcast: Startups Today and Tomorrow. How to Seize the Opportunity

Startups are about the courage to take risks, seize opportunities, and find support for innovative ideas. What are the real financing options for new projects in our region? What risks does a startup founder face after securing investment? Jaroslav Baier, partner at HAVEL & PARTNERS and expert in venture capital, private equity, and transactional law, answers these and many other questions in a conversation with Martin Rinčo on the TA3 Kapučíno podcast.

Czech Venture Capital Has Much to Learn

Jaroslav Havel, Managing Partner at HAVEL & PARTNERS, shares his current perspective on the local venture capital ecosystem in an article for CzechCrunch.cz.

More Information in Czech HERE

Legal Advice for Investors Entering Wultra Startup

HAVEL & PARTNERS’ venture capital experts represented the Central European deep tech fund Tensor Ventures and Elevator Ventures, the corporate VC fund of Raiffeisen Bank, in their entry into the Czech fintech startup Wultra, which engages in cybersecurity. More Information HERE

Setting Up an ESOP for Luigi’s Box

Legal and tax experts at HAVEL & PARTNERS advised the founders of the Slovak startup Luigi’s Box on setting up employee stock ownership plans (ESOP) for key employees. More Information HERE

Legal Advice for Photoneo on Slovakia’s Largest Venture Debt

HAVEL & PARTNERS in Slovakia assisted Photoneo in a unique and extensive transaction. It involved securing financing for the Brightpick division, focused on developing automated robotic systems, combining debt and equity financing totalling USD 12 million. More Information HERE

Establishing the Unique Investment Fund Rohlík Growth SICAV

HAVEL & PARTNERS was involved in one of the largest and most exceptional deals at the intersection of fund structuring and venture capital in the Czech Republic last year. We represented the Rohlík Group, led by entrepreneur Tomáš Čupr, in establishing the unique investment fund Rohlík Growth SICAV, valued at over EUR 120 million (more than CZK 3 billion). More Information HERE

We have summarized what we know about pharmaceutical law at HAVEL & PARTNERS in the life cycle of the imaginary medicine “HAVELEX”.

HAVEL & PARTNERS, a law firm, joined the public consultation on the review of Czech merger control rules initiated by the Czech Competition Authority (the “CCA”). The proposed review may result in the most extensive changes to the current system since 2001. Experts of the competition team at HAVEL & PARTNERS submitted their comprehensive position on individual issues.

A team of HAVEL & PARTNERS consisting of Robert Neruda, a partner, Roman Světnický, a counsel, Dušan Valent, a managing associate, Martin Rott, a senior associate, Tomáš Varšo, an associate, and Igor Kučera, a legal assistant, drafted a 25-page statement for the CCA. In particular, they assessed the notification criteria, including the option to introduce a call-in model, and the scope of information to be provided to the CCA as part of the notification.

“We believe it is an important part of our mission and responsibility to society that we are actively involved in the legislative process. The goal of the consultation was to assess any regulatory gaps in the merger control. We also looked at the current setup, transparency, efficiency, and legal certainty of the notification criteria”, says Robert Neruda, a partner at HAVEL & PARTNERS. The full version of the HAVEL & PARTNERS submission to the CCA’s consultation is available here (in Czech).

With thirty competition experts, HAVEL & PARTNERS has one of the largest competition teams in Central Europe. Headed by Robert Neruda, a partner and a former vice-president of the CCA, and Lenka Štiková Gachová, a partner, the specialised group offers a combination of legal and economic expertise and extensive experience in competition protection and regulation. The team puts their know-how to use in the academia and legislative processes.

Over the past two years, a dedicated team of HAVEL & PARTNERS experts has been involved in more than a dozen absolutely critical projects focused on the implementation and maintenance of core IT systems that play a key role in the daily operations of our clients. For our clients, the total acquisition cost of these solutions constitutes an investment worth high units of billions of CZK.

Everything was done in the form of traditional waterfall approach as well as modern agile methodologies, which allowed us to adapt to the specific needs and dynamics of each project. Projects in the area of core IT systems consist of either the replacement of outdated systems with completely new solutions, the expansion into entirely new business areas or the introduction of the very first core IT system.

In addition to in-depth legal knowledge, our team required considerable technical overlap and practical experience – the provision of related services and especially the negotiation of contractual documentation, including the alignment of the contractor and client project teams, which tend to be extremely challenging. These projects often require more than a year-long engagement of our experts.

Our services also included legal advice on the implementation of systems ensuring basic public administration processes.

The largest local team of technology lawyers consisting of over 50 members allows the law firm HAVEL & PARTNERS to specialise in providing highly professional legal services in the IT sector.

Our experts provide legal support to both private sector clients, including major financial institutions, as well as public sector clients such as ministries and central administrative authorities. We also have extensive experience in delivering legal solutions to IT service providers.

Moreover, our law firm has ample experience in cloud computing, where we provide legal support in connection with both private use of cloud solutions and compliance with public regulations. We are also intensely involved in cyber security issues: the new regulation following the NIS 2 Directive has recently been a hotly debated topic among our clients.

All our projects are implemented with an emphasis on maximum efficiency and with regard to the needs of our clients, which also allows us to provide tailored solutions in the IT sector, typical for its high dynamics and complexity. That is why our clients often come back to us when addressing comprehensive IT implementation and related issues. We would like to use this opportunity to thank them for their trust and cooperation.

Autoři: Kateřina Slavíková, Anna Sergejko

The Chamber of Deputies has approved a draft amendment to the Healthcare Services Act promising a major shift in the Czech healthcare sector digitisation. Telemedicine – a modern way of providing healthcare remotely using digital technologies – will finally be legislatively implemented. How will this legislative change affect the digital era of the healthcare sector and what can healthcare service providers prepare for?

Telemedicine – the provision of healthcare services remotely via information technology without physical contact between the patient and the doctor – is becoming more and more widespread in practice. The amendment to the Healthcare Services Act, which enshrines the definition of telemedicine and other parameters of its provision, is now heading from the Chamber of Deputies to the Senate. After a long debate about whether telemedicine healthcare services can be legally provided at all, healthcare service providers may finally see greater legal certainty. We wrote about the shortcomings of the current legislation and the forthcoming amendment last year (HERE). What is the final form of the amendment and what is the most important thing it will bring about? Here is a summary of the most important changes.

The amendment defines telemedicine healthcare services as healthcare services that are provided remotely using telecommunications and information technology. Telemedicine has not yet been defined in the Act itself, which causes several uncertainties for healthcare service providers – whether it is a question of what telemedicine healthcare services may still be provided under the current “lege artis” legislation, or how the patient should grant consent to the provision of healthcare services. Telemedicine can now be classified under the category of consulting services that may be provided remotely, as allowed in the Healthcare Services Act. However, telemedicine services can have much wider applications. An example is telemonitoring – monitoring the patient’s health condition remotely, evaluating the data and sending it to the healthcare service provider. More specific legal regulation is thus an important step towards facilitating the use of modern technologies in the healthcare sector.

The amendment only lays down very general conditions for the provision of telemedicine services; in particular, the requirements for security and quality of communication must be met. Even after the amendment comes into force, telemedicine services may only be provided by healthcare service providers. According to the explanatory memorandum, a healthcare service provider will not be able to obtain a licence only for the provision of telemedicine services, meaning that the amendment will not change the conditions for obtaining a licence to provide healthcare services (including the requirements for minimum technical services and human resources that each healthcare service provider must meet).

It also specifies which telemedicine services may be provided outside the healthcare facility if they are provided without the patient’s presence – e.g. reading radiological images remotely (the wording is not entirely clear, but a logical interpretation suggests that in these cases the provider may also be outside the healthcare facility).

More detailed requirements are to be laid down in implementing regulations currently being prepared by the Ministry of Health. These are to specify, for example, how to identify a patient remotely, technical requirements for communication devices, and conditions for registering the patient’s consent to the recording of communication.

The conditions for keeping electronic medical documentation are also to be simplified and streamlined – the current legislation allows for keeping documentation electronically, but in practice it still favours its paper form. The legislation imposes unclear requirements for keeping electronic documentation that are difficult for providers to meet – therefore, many of them keep documentation impractically in both forms (we have discussed this in our article HERE).

The amendment introduces a specific definition of medical documentation, which is currently missing in the Act – this may cause uncertainty, which documents still fall under it. The amendment defines medical documentation according to the purpose of its processing – as a set of information maintained, processed and stored by a healthcare service provider for the purpose of providing healthcare services to a specific patient, regardless of how it was collected and in what form. The new negative definition of which documents are not included in medical documentation is also crucial. Information that is not processed for the purpose of providing healthcare services to the patient will not be considered medical documentation. This can be, for example, orders, documents processed for insurance companies or support documents for litigation matters. These documents will then be subject to looser rules for their keeping and thus their digitisation, as it will not be necessary to comply with the legal requirements for keeping medical documentation.

Other key changes include:

Among other things, the amendment should be one of the steps to prepare the technical conditions for future health data sharing under the pending EU Regulation on the European Health Data Space (EHDS) More precise parameters, such as the method of signing or the time limits for making electronic records, are to be laid down in implementing regulations.

If the amendment is approved by the Senate, it should take effect this autumn. Despite several uncertainties that remain in the legislation, the amendment is an important step towards the healthcare sector digitisation. The legal regulation could thus at least partially catch up with the practice of healthcare service providers, who are increasingly using modern technologies.

Experts from the law firm HAVEL & PARTNERS led by David Krch, a tax partner, and Kamila Chládková, a tax manager, provided their client, an Indian company, with comprehensive support and procedural guidance in processing an application for an investment incentive. At the end of November 2023, the Government endorsed the investment incentive as one out of only four that have been approved, and the company has now received the final decision.

The Indian company is a top manufacturer of automotive lighting and plans to build a technology centre fitted with state-of-the-art technical equipment for the development of lighting and other technology for motor vehicles in Ostrava. It offers a wide range of comprehensive systems and lighting solutions.

HAVEL & PARTNERS tax partner David Krch commented on the success: “At present, it is extremely difficult to obtain an investment incentive. Even if all conditions were met, the Government always had the final say by the end of the last year, and it approves only a low number of projects. In the past, incentives had not been subject to this regime and had been granted to dozens of investors annually. We assisted the client in this complicated process with the overall preparation of the project, including related documentation and communication with the relevant authorities.”

The investment incentive approval process is expected to be easier since this year onwards. The Chamber of Deputies has approved an amendment to the Investment Incentives Act repealing the obligation to submit every application to the Government for consideration. The decision-making power goes back to the Ministry of Industry and Trade that will grant incentives based on opinions of the ministries concerned, which should speed up the whole process considerably. The Government will henceforth decide on applications relating to strategic investments only. The amendment has entered into effect in January 2024.

Authors: Kateřina Slavíková, Tomáš Hric, Alžběta Pospíšilová

To tackle rising costs and other current needs in public healthcare, the Ministry of Health presented a bill in April to amend the Public Health Insurance Act. Intended to take effect on 1 January 2026, the amendment concerns the regulation of prices and reimbursement of medicinal products and medical devices, preventive care support, reimbursement of dental care services, and reimbursement of cross-border healthcare services. Read the following article to learn about all the changes in a nutshell.

Enabling earlier initiation of proceedings for a new indication

The draft amendment enables marketing authorization holders (“MAHs”) and health insurance companies to initiate new administrative proceedings to determine the price and/or reimbursement of a medicinal product with the State Institute for Drug Control (SIDC), even if the proceedings for the same product are already pending, provided that the applicant initiates the proceedings for a different indication and the pending proceedings are at least at the stage where a decision (even a non-final one) has been issued.

Exclusion of foreign reference prices in reimbursement proceedings

The draft amendment unifies the proceedings to determine the price and reimbursement of medicinal products using foreign reference prices. Under the proposed amendment, a party to the reimbursement proceedings of a medicinal product (typically an MAH) may ask the SIDC to exclude the foreign price if the party provides evidence that the reference medicinal product is not actually traded on the respective foreign market.

Significant medicinal products

To address the shortage of medicinal products significant for the provision of health care, the draft amendment proposes special procedural rules for determining the price of such medicinal products. As a result, the price determined by the SIDC for these medicinal products should be higher than that determined in the standard proceedings.

Medicinal products to which the above rules will apply will be selected by the Ministry of Health, taking into account the public interest in maintaining their availability.

Modification of the definition of highly innovative drugs (HIDs)

The draft amendment adds the progression-free survival parameter to the current definition of HIDs. Pursuant to the explanatory memorandum, the aim is to eliminate cases where a cancer medicinal product enters the public health insurance system as an HID, but due to no impact on survival and a nominally minimal impact on progression-free survival it should not profit from HID regulation, as it does not provide a significant innovation.

Promoting prevention through positive motivation of insured persons

The draft amendment also aims to encourage insured persons in maintaining their health through proper preventive self-care practices. As one of the instruments, health insurance companies are about to see a significant increase in the financing of their prevention funds, from which they will provide financial contributions to insured persons who engage in preventive self-care practices, including engaging in routine preventive health screenings or vaccinations.

The draft amendment also proposes expanding the range of healthcare services for which insured persons can draw the contribution, such as healthcare services not otherwise reimbursed, co-payment for a partially reimbursed healthcare services, services offered by providers to insured persons in connection with reimbursed healthcare services, other products and services intended to alleviate or compensate for a disability or illness of the insured, or which have a preventive function, or recreational activities.

In addition, insurance companies are to have new powers to create their own incentive programs to promote better self-care practices.

Dental care

The draft amendment also addresses systemic shortcomings in reimbursement of dental care. According to the Ministry, the current reimbursement regulations prioritize the use of inexpensive materials, which are, however, frequently viewed by dentists as outdated. Consequently, insured patients opt to pay out of pocket for more advanced treatment options rather than going for one of the options reimbursed from the public health insurance system.

To involve more dentists in the public health insurance system (currently more and more dentists opt for private practices) and to prevent further decline in the share of public spending on dental care, the draft amendment proposes some new legislative instruments, in particular the possibility of partial reimbursement in the case of costly methods. For insured persons who undergo regular preventive health screenings, it will be possible to draw a contribution from the prevention fund to cover the non-reimbursed part of the price.

Cross-border healthcare

The draft amendment allows for the authorization of healthcare services abroad at the level of foreign reimbursement, even for repeated or long-term cases (i.e. not just for one-off cases), if there is a lack of availability in a certain field in a certain region. Insurance companies will also be allowed to conclude contracts with foreign healthcare providers located near borders.

The draft amendment introduces a multitude of changes, primarily aimed at refining the efficacy and precision of the public health insurance system while avoiding significant systemic overhauls. The draft amendment has recently undergone the inter-ministerial comment procedure. As quite a lot of significant comments were raised – specifically, by 29 of 58 parties to the comment procedure, the final text of the amendment may be subject to considerable changes in the coming stages of the legislative process.

Authors: Robert Neruda, Lenka Štiková Gachová, Dušan Valent, Tomáš Varšo

Foreign Direct Investment (“FDI”) screening has been in full swing in Slovakia since March 2023. 1 Slovakia has had a functional FDI regime consistent with the EU framework for a year now. 2 Below, we share our practical insights and experiences after the first year of its operation.

1. Our Practical Experience

Our experience with the Slovak FDI screening process so far has been rather positive. The Slovak Ministry of Economy (“MoE”) seems to be keen to make the process smooth and encourages transparent communication, which is always welcome. However, there are some legal requirements in the Slovak FDI Act that unnecessarily delay the review process.

Before issuing a final decision, the MoE is required to provide a draft opinion to both the foreign investors and the target. The MoE should send the draft opinion only when it has concerns in relation to the investment. Currently, it also sends the draft to the investor when it has no concerns at all and intends to approve the investment without remedies. In this case, the requirement is an administrative hurdle that causes unnecessary delays without any value.

There is a similar issue with the appeal period. Foreign investors have a right to appeal the first instance MoE’s decision – on which the Minister of Economy decides. The deadline for the appeal is 15 days from the day the foreign investor receives the decision. The decision does not become effective until this period expires. The timeframe for appeal is of standard duration. However, the FDI Act does not provide for the possibility of a waiver. Therefore, in a situation where the MoE approves an investment, the foreign investor still has to wait for the expiration of the appeal period before it may implement its investment. This delay does not bring any value to the process.

2. When Should Foreign Investors Consider a Voluntary Notification?

The MoE also provided guidance 3 to foreign investors who do not fall under the obligatory notification regime but may consider making a voluntary notification. If voluntary notification is not submitted, the MoE may initiate an ex officio review within two years after the completion of the investment (typically the closing). The MoE recommends foreign investors to make a voluntary notification in the following scenarios:

The MoE’s guidance is a welcome and useful. On the other hand, the list is not exhaustive. Foreign investors should thus remain alert, and carefully assess the impact of their investment on security and public order in Slovakia and the EU.

3. The MoE’s FAQ Document: Pre-notifications, greenfield investments and other

The MoE helpfully published an FAQ document 5 shortly after the Slovak FDI Act came into force and updated it throughout the year. The document provides guidance to foreign investors on a number of technical and substantive issues.

In our view, it is important that the MoE welcomed informal consultations with foreign investors. While not required by law (they do not represent pre-notification customary for competition merger filings), the consultations allow investors to seek guidance on specific issues.

The MoE also confirmed that the Slovak FDI Act covers greenfield investments. In case foreign investors must notify the investment, they must do so prior to the establishment of the Slovak target.

4. The Path Forward

Slovakia’s FDI screening regime demonstrates the government’s commitment to protecting national security interests and public order while maintaining a welcoming environment for foreign investors. The availability of guidelines and the FAQ document from the MoE supports this endeavour by ensuring clarity and transparency in the review process.

Our practical experience has revealed some procedural shortcomings in the current regime. These should be improved. However, there’s hope on the horizon – an amendment to the Slovak FDI Act is expected to be introduced this year. This legislative update provides an opportunity to address these issues, streamline the processes, and create a more investor-friendly framework.

FDI screening has become an integral part of Slovakia’s regulatory framework, requiring serious consideration from foreign investors. HAVEL & PARTNERS stands ready to assist in navigating this process safely. Feel free to reach out to any of the authors of this article for guidance.

[1] Available at: https://www.mhsr.sk/podnikatelske-prostredie/preverovanie-zahranicnych-investicii/usmernenia?csrt=5174674660446053875

[2] The MoE refers to the Annex to Regulation (EU) 2019/452 of the European Parliament and of the Council of 19 March 2019 establishing a framework for the screening of foreign direct investments into the Union.

[3] Available at: https://www.mhsr.sk/podnikatelske-prostredie/preverovanie-zahranicnych-investicii/faq?csrt=5174674660446053875

[4] Act No. 497/2022 Coll., on the screening of foreign investments and on amendments to certain acts, as amended.

[5] For those interested in the basic aspects of the Slovak FDI screening regime, have a look at our videos or the attached brochure on our services in this area.

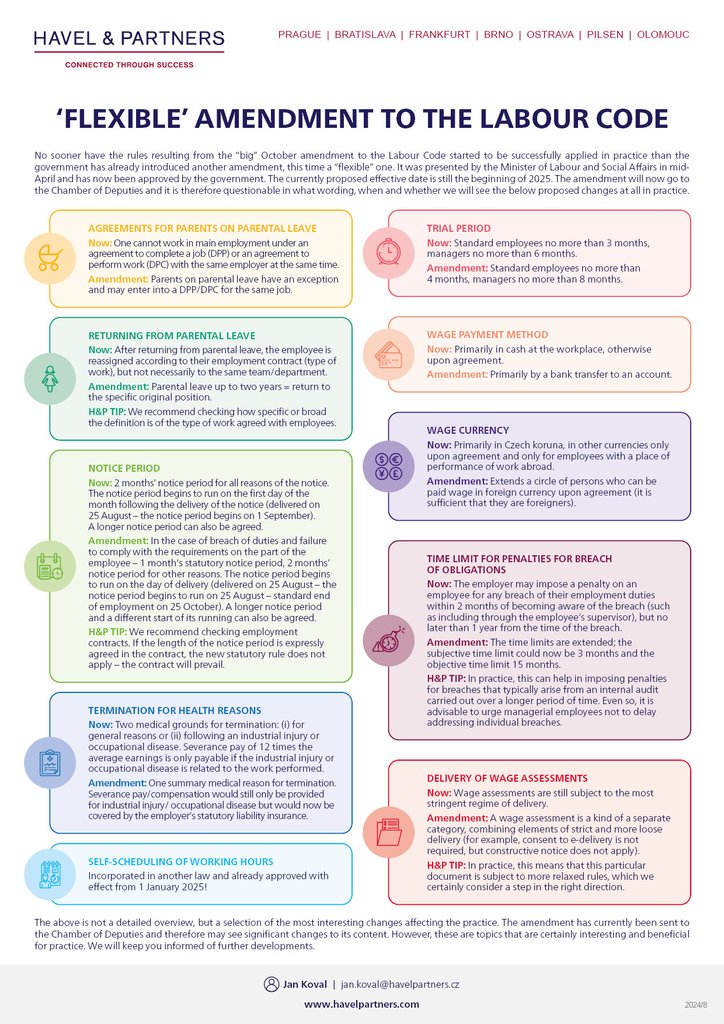

Authors: Jan Koval, Vojtěch Katzer, Pavla Kaufmannová, Ema Černá

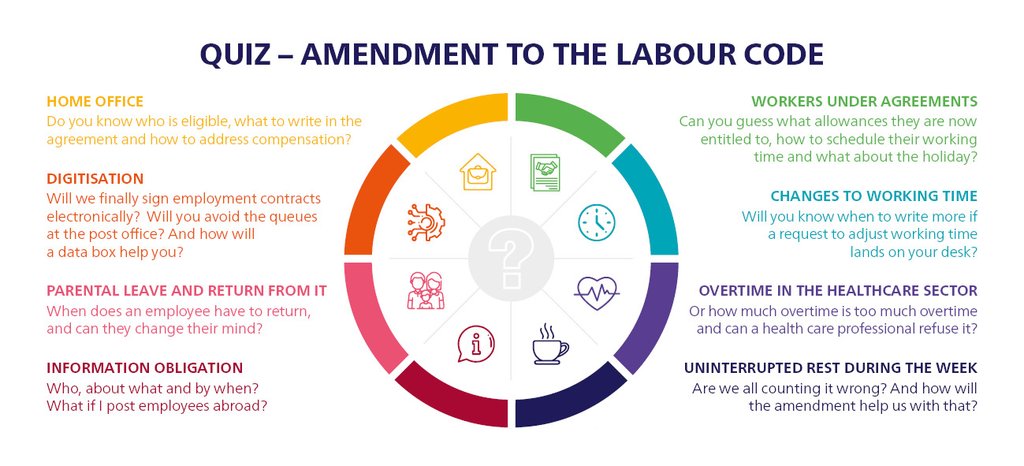

The amendment to the Labour Code, which will bring about many fundamental changes to Czech employment law, was approved by the Chamber of Deputies on 12 September 2023. We informed you about the most important changes this February, however, the amendment has undergone several further changes during the legislative process. The amendment, with the exception of some provisions, will come into effect in the month following its publication in the Collection of Laws (it is therefore possible that it will come into effect as early as 1 October 2023) and it is therefore high time to clarify what requirements and changes the amendment brings into practice.

In response to the increasing use of home-office, provisions on remote work have been significantly modified. Remote work will only be possible to perform under a written agreement. The exception will include a situation where remote work is ordered in writing, which will be possible on the basis of a measure of a public authority for a strictly necessary period of time, if the nature of the work to be performed allows it and on condition that the place of performance of remote work is suitable for the performance of work. If remote work is ordered by the employer, the employee will have to, upon the employer’s request, specify his/her (eligible) place of performance of remote work or to inform the employer that no such place is available to him/her.

The standard notice period for a remote work agreement is 15 days, but it will be possible to agree on a different period provided that it is the same for both parties. The proposal also allows the parties to agree that the obligation under the agreement cannot be terminated by either party.

The amendment also regulates the reimbursement for costs incurred by the employee in connection with the performance of remote work. The employer will reimburse for these costs either at the amount duly proved by the employee or at a flat-rate amount if the parties have so agreed or if an internal regulation so provides. However, the employer and the employee may also agree in writing in advance that the employee will not be entitled to reimbursement for costs in connection with the performance of remote work. This is a change from the initial proposals, which envisaged reimbursement for costs only in a flat-rate amount.

According to the current legislation, employment documents are divided into important documents (so-called documents under Section 334 of the Labour Code) and other documents. In order to electronically sign and deliver important documents remotely, it is necessary to meet relatively strict conditions. The amendment narrows the list of important documents, making it possible to now deliver some of them without meeting the existing strict requirements. The stricter conditions for delivery will continue to apply only to:

Delivery of documents by the employer to the employee will also be easier in other respects. In place of the mandatory confirmation by the employee of the delivery of the above documents via an electronic communications network or service, such documents will be considered to have been delivered after expiry of 15 days “from delivery”. However, electronic delivery to the employee will only be possible provided that the employee grants his/her consent to this in a separate written declaration, specifying, inter alia, an electronic address for this purpose that is not in the employer’s possession (i.e., it cannot be a business e-mail address that the employer has set up for the employee).

This should make the conclusion of employment contracts or even agreements on the termination of employment relationships much easier for the parties.

If the employment contract, work activity agreement, work performance agreement or amendments to them or agreements to terminate them are concluded via an electronic communications network or service, the employer will be obliged to send a copy of them to the employee’s electronic address which is not in the employer’s possession and which the employee has communicated in writing to the employer for these purposes. The employee will have the right to withdraw from these documents in writing from the moment of their conclusion, but no later than 7 days from the date of their delivery.

The amended Labour Code will also facilitate delivery of documents by the employee to the employer via an electronic communications network or service or to an electronic address. It will now no longer be necessary for a document delivered in this way to bear a qualified electronic signature of the employee, which was a requirement that basically excluded this form of acting in practice.

Agreements on work performed outside the employment relationship have been substantially changed by the amendment. In general, all these changes are aimed at bringing agreement-based work closer to the employment relationship and increasing the rights of employees working under agreements.

The most important novelty in the area of agreements on work performed outside the employment relationship (i.e., WAAs and WAAs) is the right of employees to paid leave. The amount of leave will be determined on the basis of a notional working time of 20 hours per week. The provision on leave for so-called agreement-based workers will take effect on 1 January 2024.

The new entitlement for agreement-based workers will also include time off due to all permissible obstacles to work on the part of the employee (caused, for example, by visiting a doctor or attending a funeral), but they will not be entitled to compensation for remuneration, unless the employer and employee agree otherwise. However, for the purposes of calculating leave, obstacles to work will be counted as time worked.

Employees working under an agreement will also be entitled to extra pay for work on public holidays, night work, work in difficult working environment, and weekend work.

The amendment also provides for the employer’s obligation to inform the employee of the working time schedule at least 3 days before the start of the shift or period for which the schedule is drawn up, unless both parties agree on a different working time.

Employees working under an agreement will now have an explicit right to request employment under an employment contract, to which the employer will be obliged to provide them with a reasoned written response.

In addition, employees will be able to ask the employer, in certain circumstances, to give reasons for having served the notice. The employer will then be obliged to inform the employee in writing of the reasons for the termination by notice without undue delay.

Another novelty in the area of the employer’s obligations will be the extended notification of the employee of certain facts related to the content of the employment relationship within 7 days from the date of its commencement, or of changes to the content of the employment relationship no later than on the day when such changes take effect. The required information can be included, for example, in an employment contract, an internal regulation (and referred thereto) or the employee can be informed electronically – see below.

The set of information provided to employees when posted to another EU Member State or to a third country will also be significantly extended.

In the case of informing in electronic form, the information must be accessible to the employee and the employee must be able to save or print it. The employer is still obliged to keep proof of the transmission of this information to the employee.

The amendment also touches upon the issue of requesting parental leave and thus responds to the existing complications that employers had to deal with in cases where the employee did not announce the commencement of parental leave in advance, which, however, was not his/her obligation until now. However, the employee will now be obliged to submit a written request for parental leave at least 30 days prior to commencement. Such a request must include information on the duration of the parental leave and can be submitted repeatedly.

Employers will also be obliged to give reasons in writing to the employee for their decision not to grant the employee’s request for shorter working time or remote work for protected groups of employees. It will also be possible to request remote work, but employers will not be obliged to comply with such requests – the original versions of the proposals even envisaged the right to work from home for such persons.

Similarly, the employer must give reasons in writing for rejecting the employee’s request for a renewal or partial renewal of the scope of the original weekly working time before it was reduced.

The amendment further provides for that shorter working time (below the scope set out in Section 79) or so-called part-time work may only be agreed between the employer and the employee, and only in writing. At first glance, this may seem to be a minor change, but failure to comply with the written form may not be worthwhile for the employer, as compliance with this obligation will now also be monitored by the labour inspection authorities.

In response to the staffing situation in the healthcare sector and the experience from the COVID-19 pandemic, the legislators also introduced into the amendment to the Labour Code the regulation of additional agreed overtime work beyond the scope specified in Section 93(4) of the Labour Code, namely for listed professions performing work in continuous operation related to the provision of health services by an inpatient care provider or a medical emergency service provider.

This agreed overtime work of healthcare workers may not exceed an average of 8 hours per week and, in the case of medical emergency service workers, an average of 12 hours per week over a period of no more than 26 consecutive weeks (unless the collective agreement provides for a longer period, but no more than 52 weeks).

The employee cannot be compelled to perform the additional agreed overtime work and may not be subjected to any detriment if he/she refuses to do so. The employer is obliged to notify the competent labour inspection authority in writing of the application of the institute of additional agreed overtime work. The employer is also obliged to keep an up-to-date list of all its employees performing additional agreed overtime work.

In view of the currently very unclear interpretation of the calculation of uninterrupted weekly rest period, a new wording of the provision of Section 92 of the Labour Code is proposed, which regulates uninterrupted weekly rest period. It is primarily a matter of clarifying the wording of the provision so that its interpretation reflects recent European case law.

According to European case law, the uninterrupted weekly rest period is added to the uninterrupted rest period between two shifts. In order to achieve a total minimum of 35 hours of uninterrupted weekly rest period, employers will now be obliged to actually provide an employee over the age of 18 with at least 24 hours of uninterruptedrest and an immediately following uninterrupted daily rest of at least 11 hours.

Author: Kateřina Nešpůrková

Co-author: Lívia Djukić

The legislative process by which the Czech Republic implemented the EU Whistleblowing Directive took almost three years. Three bills were drafted and debated by two Chambers of Deputies. A year and a half after the deadline set by the European Union on 17 December 2021, forced by a heavy fine of tens of millions of Czech crowns, the Czech Republic finally completed the legislative process as one of the last EU countries, with only Poland and Estonia left behind.

Although the Whistleblower Protection Act passed by the Chamber of Deputies failed to gain support in the Senate, the President did not hesitate and signed it into law last week. Today, the law has been published in the Collection of Laws of the Czech Republic, so we can say with certainty that it will come into force on 1 August 2023.

As early as 1 August 2023 if you have 250 or more employees. As the Czech legislator did not adopt a deferred effect of sanctions (unlike, for example, the neighbouring Slovakia), the Ministry of Justice can theoretically check from the very first day of the law coming into effect whether you meet all the obligations under the new law.

If you have more than 50 but less than 250 employees, you are required to introduce the internal reporting system by 15 December 2023 at the latest. However, even in this case, we recommend you shouldn’t wait too long to introduce a whistleblowing solution – the public reporting channel operated by the Ministry of Justice is already up and running and can be used by all whistleblowers who have no other (in-house) alternative.

Again, we recommend that you make sure and check that your ethical line meets all the requirements of the new law. What are the most common mistakes?

We have informed about the details of the Czech legal regulation in our previous publications. Let us summarise only the most important differences between the Czech law and the EU Whistleblowing Directive.

The Ministry of Justice, as the central state administrative authority for the protection of whistleblowers, and the labour inspectorates have divided their powers in respect of monitoring compliance with the whistleblower protection laws.

In cooperation with our sister company FairData Professionals a.s., we help our clients introduce FairWhistle, a comprehensive whistleblowing solution. Our services are always tailored to the client’s needs: we can provide one-off assistance with the implementation or revision of the internal reporting system, including the setup of reporting channels, processes and internal documentation. Our long-term assistance takes up the form of a completely outsourced reporting system as we administer the reporting channels for our clients and act as their whistleblowing officer.

For more information about our whistleblowing solution, please visit www.fairwhistle.cz or contact us directly. We will be happy to share with you our long-term whistleblowing experience and recommendations.

For the last few years, our team members have shared on LinkedIn a selection of the most interesting Supreme Court judgments affecting corporate laws manners each month. Recently, the judgment selection has been complemented with another series of LinkedIn posts providing insight into areas that all members of statutory bodies should know and keep in mind when exercising their office. If you wish to learn more about the rules and duties applicable to members of a statutory body, you can now find them in one place in the form of a brief guide. The guides are available for free download below.

The Guide reflects the special features of performing an office in the statutory bodies of all legal forms of companies in the Czech Republic. Thus, information and advice contained in the Guide may be useful both for executive directors of limited liability companies and members of the administrative board or the board of directors of joint stock companies. Each of the versions differs in part, depending on differences between these legal forms of companies. The Guide will provide you with a comprehensive overview of the activities of a member of the statutory body from appointment to termination of his/her office. The Guide covers the fundamental rights, obligations, and rules related to the performance of the office and thus provides an introductory insight into the issues that are relevant to the performance of the office of a member of the statutory body. The Guide is available in Czech and English.

The Guide brings basic information on, for example, the commencement and termination of the member’s office or the activities of the statutory body.

It is important to bear in mind that this brief Guide serves as a basic and general summary of the issues related to the performance of the office of the statutory body and cannot replace individually prepared legal analyses and legal advice. Indeed, the Guide itself states that the statutory body “does not need to be an expert in every conceivable area. But the statutory body must correctly assess as to when it is appropriate to seek professional assistance”. When in doubt, one should seek advice from an expert in the relevant area.

In any such case, we are ready to help you at any time and our corporate team is available to review specific cases. A more detailed legal analysis addressing such cases can avert the potential risk of damage caused to the company or to you as a member of the statutory body.

THE GUIDES ARE AVAILABLE FOR DOWNLOAD HERE: