A fifth of women and twice as many men make decisions on financial and property matters for the entire household. 35% of people decide on these issues together in the household. Women are more likely to have mixed feelings when making decisions about investments and assets, with a fifth saying they are even insecure and feel worried. On the other hand, a quarter of women make decisions about their assets with confidence and clarity. Traditional gender stereotypes and inequalities in the field of assets are thus gradually disappearing. Women are becoming wealthier and more successful, taking a more active role in asset management and continuing to develop the family assets and increase their value. They tend to make conservative investments that are consistent with their values and goals. This was found in a survey as part of the NextŽeny project, which was conducted among respondents with above-average incomes by HAVEL & PARTNERS and RSM CZ in cooperation with the research agency Ipsos. The international partner of the project is UBS.

Men are twice as likely as women to take care of the finances and assets of the whole household themselves (40% of men), while a fifth of women (20%) take decisions about the finances and assets of the whole family themselves. Women most often stated (39%) that they deal with finances and assets together with someone in the household. On the other hand, about a third of men (32%) also make decisions about finances and family assets together with someone.

A quarter of women think that both they and their partner have the final say in property matters together, but about a fifth of women think that their partner ultimately decides on finances and assets. Compared to the global figures of UBS’ study (UBS Women and Investing – reimagining wealth advice 2022), where the majority of married women reported that they leave their financial decisions to their husbands, Czech women have a greater tendency to be involved in decision-making or to deal with these matters directly on their own.

“Traditional gender stereotypes and inequalities in the field of assets are gradually disappearing. More than ever, couples and families tend to approach financial and property issues as a partnership task in which both partners are actively involved and often work together to find the best solution for the family. However, we still perceive that men have greater self-confidence and a tendency to have the final say” commented David Neveselý of HAVEL & PARTNERS. In fact, for people who make decisions about assets in the household jointly, nearly 70% of men said that they make the final decision. Only 45% of women had a final say.

Both men and women are most likely to feel responsible when making decisions about finances and assets (76%). A quarter of both women and men make decisions with confidence and clarity. “Women and men today have an equal level of access to financial literacy and financial education. Knowledge of financial instruments, the ability to read the market and understand risks and returns contribute to their confidence. Thus, we observe an equal tendency for them to make decisions with greater certainty and clarity. At the same time, both men and women are aware that their decisions about finances and assets can affect their own financial stability and future. Therefore, when making decisions about finances and assets, responsibility is a key factor that influences their individual financial and investment behaviour,” said Monika Marečková, managing partner of RSM CZ.

However, there is still a group of investors who are not so confident when it comes to finances. For a fifth of women, these situations cause insecurity and fear, three times more often than for men. Women are also more stressed by property issues. Young women up to the age of 34 (42%) are the most worried about these situations, with women’s fear decreasing with increasing age. Single investors (29%) and people who do not make financial decisions alone but together with someone else (28%) are also more likely to feel insecure.

Most often, women and men split their investment portfolio and invest part of their funds conservatively, i.e., in investments with lower risk and return, and part in riskier areas with higher returns. This strategy is chosen by 68% of men and 45% of women. However, there is a second and almost equally significant group of women (40%) who invest their entire portfolio conservatively, i.e., in areas with a lower level of risk. For men, only 23% of investors think this way.

“Women are more likely to prefer investments that are proven and have a long-term track record of success. They place greater emphasis on security and stability and want to be sure that their investments are protected from significant losses. In addition, women become wiser and more confident with age when it comes to investments, while men put more emphasis on less risk as they age,” described David Neveselý of HAVEL & PARTNERS.

Conservative investing is most often preferred by female investors with assets worth CZK 5-20 million (46%) and also female investors aged 35-44 (47%). The strategy changes gradually as they become older and female investors aged over 55 (67%) are more likely to also add more risky assets to diversify their portfolios. For men, it is exactly the opposite. As they age, their preference for diversified investments decreases and they tend to invest more conservatively.

According to the survey, Czechs in general do not like investing only in risky products and 8% of people do not invest at all, with women two and a half times more often than men.

Women want to use investments to protect their assets from depreciation and to provide for their old age. Men do so for similar reasons. Motivation to provide for the family is also important for both groups. According to the survey, men are more likely to feel responsible for their family’s financial security – 72% of them, i.e., 19% more than women – and investing is one of the tools they use to secure their family’s future.

According to UBS’ study (UBS Women and Investing – reimagining wealth advice 2022), women in general tend to favour risk reduction and positive impact of their investments. They are less likely to change their investment profile during volatility, are more disciplined, and invest in line with their goals. While men tend to give more weight to pure performance and make investment decisions based on historical results. According to the NextŽeny survey, men are more likely to have investments as a side income or to invest because they simply enjoy it and it brings them personal satisfaction.

Men and women are most likely to put money in savings accounts (82%), and three-quarters of people also save for retirement. However, over 70% of them leave money in their current account. In all this, women are no different from men. More than half of respondents, regardless of gender, also use conservative investment funds.

Real estate is particularly popular among Czechs. 85% of people identified it as an area of investment confidence. Currently, 75% of men and 17% fewer women use real estate as an investment. However, their number should increase in the future, as a third of women stated in the survey that they want to invest in real estate in the future.

“Women are investing increasingly in real estate via direct investments. Based on a recent survey, men are much more likely to list real estate investment trusts as their primary real estate investing method, while women are more likely to favor rental property. Data also shows that the gender gap in buy-to-let is narrowing, with more women becoming landlords and growing their property portfolios,” said Emma Wheeler, UBS Head of Women’s Wealth.

Female investors are less likely than men to invest in stocks, according to the NextŽeny survey. So far, only 38% of women use them, compared to 64% of men. But here too the gender gap could narrow in the future, as 22% of women plan to use stocks as an investment.

The gender gap is also noticeable for venture capital funds. Only a fifth of female investors invest in them, compared to 44% of men. And women also put fewer assets in bonds (29% for women v. 39% for men). Male and female investors also have a different view of cryptocurrencies. These are currently owned by a fifth of male investors, but only 8% of female investors. Moreover, according to the survey results, it does not seem that these figures will increase significantly in the upcoming period. 84% of women and 71% of men do not plan to invest in cryptocurrencies.

Czechs have the greatest trust in real estate investments. More than half of male and female investors also trust technology, according to the NextŽeny survey, with men preferring this area more often, with 62% trusting it, 18% more than women. The same is true for innovation, which is considered promising by 14% more men than women. Compared to female investors, male investors are also more inclined towards pharmaceuticals and healthcare, raw materials, automotive or almost three times more likely to trust cryptocurrencies.

Women, on the other hand, identify investments as promising areas if they are in line with their values and if they see them as a social benefit. They are therefore more likely than men to invest in education or sustainability.

Advisory services on property and financial matters are currently used by 45% of people. Slightly more women than men. Their advisers are overwhelmingly male. A third of women have a female adviser, but only a fifth of men. Women are therefore more likely to entrust these matters to women.

61% of people try to rely on themselves in managing their assets and finances but turn to advisers when dealing with more complex matters and longer-term financial decisions. Women are more likely than men to take advice on financial investments, including investments in conservative funds, and to also seek advice on investments in venture capital funds or retirement savings. They usually turn to financial advisers or experts in banks or insurance companies.

“Women value professional advice more than men. Increasingly, women who are successful in business are turning to us with the need to plan and organise their asset management and invest wisely. Not only do they address investment strategies and plans with advisers, but they are also interested in facilitating discussions and implementing succession plans,” pointed out Monika Marečková of RSM CZ.

Men most often consult with advisers about investments in both conservative and venture capital funds and financial investments in general. They are also more likely than women to take advice on stock investments. Like women, they rely on the advice of financial specialists or advisers in banks and insurance companies. Compared to women, however, they are significantly more likely to address property and financial matters with business partners. More than a third of men (36%) seek advice from them.

Only 10% of respondents have a stable team of advisers or their own family office with whom they regularly discuss property and financial matters. “Women are much more open-minded in this respect, they like to work with several opposing opinions before choosing the most appropriate path, and given that the sample concerned high-income groups, in the future I would expect a higher percentage of people to use a stable team of advisers or family office,” said Monika Marečková from the consulting firm RSM CZ.

Almost every second respondent (47%) has precautionary rules for unexpected events and deals with what will happen to their assets and finances. Men are slightly more prepared for this situation. There are about 8.5% fewer women.

A quarter of people have the rules written down in one document, more often men. Another third or so has prepared actions, but they are not gathered in one place. Again, this is more often the case with women. 10% of men and 5% of women have sophisticated rules in place for unexpected events within a functional family office.

Almost 80% of people who prepare for adverse events have addressed the issue of securing the family’s future and know how the needs of children and loved ones will be covered in such situations. 60% also discussed the precautionary rules directly with their relatives, who know what will happen to their assets and finances. “On the other hand, the discussion with the family itself only partially addresses this issue and it is necessary to think about the best way to ensure that the rules are written and regulated comprehensively and in compliance with the law. This is the only way to prevent unpleasant situations and disputes in the family, which often have a negative impact on family relations when the division or transfer of family assets between relatives is discussed,” Neveselý pointed out.

UBS’ research (Women and investing – planning for your legacy 2023) shows that more women than men claim that having a professional to facilitate discussions such as a client advisor or wealth planner would help ease discussions around inheritance plans (55% vs. 49%).

The survey also showed that half of respondents have not yet addressed the question of what will happen to their or their family’s assets in the event of an inheritance, for example. Of these, more than half (52%) expect to develop these rules in the future, either by themselves or in cooperation with advisers. However, a fifth of people do not want to address this issue in the future.

NextŽeny survey sample and methodology

Clients and business partners of HAVEL & PARTNERS and RSM CZ responded to the survey. It involved 348 people of all ages, 143 of whom were women (41%). This is a group of affluent clients, most often from the ranks of owners or co-owners of companies or top and middle management, with assets reaching tens to hundreds of millions of crowns. The survey, data collection and evaluation were carried out by the research agency Ipsos. The survey was conducted in May 2023 using the CAWI method. For each completed questionnaire, HAVEL & PARTNERS contributed CZK 200 to the non-profit organization Dejme dětem šanci (Give Children a Chance), and RSM supported the operation of the Paraple Centre with the same amount for each questionnaire.

Authors: Robert Nešpůrek, Ivan Rámeš, Tomáš Pavlica, Kateřina Trzaska, Tomáš Havelka

As of 1 June 2023, the Unitary Patent (UP) system will come into force. At the same time, a brand-new institution – the Unified Patent Court (UPC) – will start its work. As a result, the mechanism will bring about the biggest change in the field of patents in decades.

The Czech Republic has not yet ratified the necessary documents. Therefore, the most significant changes will not yet take place in the Czech Republic. Nevertheless, the UP system will also have a significant impact on the foreign patent portfolios of Czech entities. Existing European patents will be subject to the jurisdiction of the UPC except for opt-outs, i.e., where patent pending application or patent is excluded from the exclusive jurisdiction of the UPC.

Since the UPC is still a big unknown for patent owners, it is high time to consider whether to let the UPC decide on disputes or to keep the current system of national decision-making and thus opt out. It will be possible to opt out without any restrictions until 31 May 2023, but even after that date it will still be possible to do so, except for patents where cases have already been brought before the UPC.

When and how will it be possible to opt out? And what other changes will need to be taken into account?

Until now, the term European patent has so far been used to describe a system of protection of an intangible asset by means of individual national patents obtained on the basis of a single European application. Under this system, once granted, the patent had to be validated in each country separately. This involved filing translations, paying maintenance fees, etc.

The current system could lead to paradoxical situations where, for example, the Polish Office would revoke a patent granted on the basis of an identical European application, while the Czech Office would uphold the patent. Although filed jointly, the patents were completely independent of each other in accordance with the principle of territoriality of industrial property rights protection. It was up to the individual national bodies to decide on their validity or on infringement cases. And they would often take different approaches.

If you wanted to enforce your patent rights against your competitors in court, you had to file a lawsuit in each country for each of your patents separately.

Simply put, the UPC system will allow decisions on these disputes to be transferred to the UPC. Although the idea of a single proceeding before the UPC may seem more appealing, many foreign owners of European patents may still prefer the old model because it has been tried and tested throughout the time. The opt-out will allow them to proceed on the basis of the current system.

Until now, the European unitary patent system has only been half used. After filing a single European application (stage 1), it was possible to obtain separate national patents in the participating countries (stage 2).

The unitary patent particularly changes stage 2. Once a European application has been filed, it will be possible to obtain a unitary patent valid in all participating countries. This will eliminate the need for additional national validations or translations for each country where protection is sought. One application – one patent for the whole territory.

The protection of unitary patents will be overseen by a new body – the Unified Patent Court. It will have exclusive jurisdiction to make binding decisions on whether patent rights have been infringed or, for example, whether a unitary patent should be revoked, with effects throughout the territory in which the unitary patent enjoys protection. This is similar to the well-known system for EU trademarks and Community designs, where there is a single decision-making authority with effect throughout the EU.

No, it will not. The European patent application phase will remain unchanged. It will still be possible to file for a European patent application. Once a European patent has been granted, the applicant can choose whether to apply for a unitary patent or to obtain a series of individual national patents.

We recommend that you carefully consider which strategy is best for you, which we will be happy to help you with.

The Czech Republic has not yet ratified the UPC Agreement. For that reason, the UPC will not have jurisdiction to decide on the protection of patent rights in the Czech Republic. Similarly, unitary patents will not confer any rights on their owners in the Czech Republic.

Czech entities may still apply for patent protection abroad. This includes protection by a unitary patent in countries where the UP system will be effective. Therefore, the changes brought about by the Unitary Patent and the Unified Patent Court may also directly affect your patent strategy in relation to foreign countries.

The introduction of the UPC will have an impact on your existing European patents abroad. They will still be subject to the old regime – each country will assess their validity and any infringement of the rights attached to them, if any, through its own courts and authorities. However, your existing European patents in countries that have already ratified the agreements will now come directly under the jurisdiction of the UPC. The Unified Patent Court will rule on patent disputes and will decide on the revocation of individual patents unless you decide to opt out.

Thus, if a Czech owner of European patents retains the jurisdiction at the UPC to decide on patent infringement or revocation disputes for countries that have already ratified the treaties, he or she can gain advantage of having a single proceeding to decide that someone else is infringing their patent or that the patent should remain in force for all of these countries, thus avoiding the need to conduct potentially parallel proceedings in many individual countries. On the other hand, this can also have drawbacks: in such a single proceeding, a decision may be taken to revoke the applicant’s patent for all countries that have already ratified the treaties. The current decision-making system may therefore be preferable when defending against claims by others.

The states that will be subject to the new system from the date of its entry into force will be: Austria, Belgium, Bulgaria, Denmark, Estonia, Finland, France, Germany, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovenia and Sweden.

Therefore, if you are interested in applying for European patents for these countries, you will be able to apply directly for a UP with all the benefits it brings.

For the remaining EU Member States, it will be possible to use a combination of the new and old regimes, i.e. to apply for a UP for protection in the participating countries and, for non-participating countries (such as the Czech Republic or Slovakia), to obtain protection by means of the “old” European patent.

In countries where the unitary patent system will be in force from June, the previously granted European patents will automatically fall under the jurisdiction of the UPC.

A number of patentees are now opting out in an attempt to avoid the new regime and continue to be governed by the old system to which they are accustomed.

An opt-out is a notification by the UPC that European patents are not to fall under the jurisdiction of the Unified Patent Court.

There are a number of reasons for opting out. The main ones are, for example:

You will not lose patent protection throughout the territory in a single decision. In the case of an opt-out, the UPC will not have the power to revoke patent protection in all participating countries in a single decision. Your competitors challenging the patent will still have to seek revocation of individual patents before national authorities.

Opt-out can be revoked. If you decide that you do not want to sue your competitor in each state, you can revoke the opt-out and initiate litigation before the UPC. An opt-out can only be revoked once.

The UPC is a new judicial body. This means that it does not have any decision-making practice or settled case-law yet. Its decisions may be erratic at the beginning. Patent holders may therefore prefer the certainty of the “old” system to the new, unknown regime in many cases.

Litigation before the UPC can be very costly. The basic fee for initiating litigation before the UPC for patent infringement proceedings is € 11,000, plus a percentage of the value of the particular litigation (up to € 325,000 if the value of the litigation exceeds € 50,000,000).

There is no administrative fee charged for the opt-out. Only the cost of the work to secure the opt-out notification.

It should also be noted that the opt-out will also affect the Supplementary Protection Certificates (SPCs).

It is possible to opt out now. It is advisable to accede to it by 31 May 2023. The Unified Patent Court will start operating as of 1 June 2023.

It will also be possible to opt out during the next 7 years. However, if the proceedings on existing European patents are initiated before the UPC in the meantime, it will not be possible to opt out from the jurisdiction of the UPC in pending cases.

UP opens up new possibilities to patent owners and new applicants to protect and enforce their rights. There is, however, no one-size-fits-all solution. The most appropriate approach may differ not only for various sectors but also for individual patents.

You should therefore consider whether an opt-out is suitable for you. We will be happy to help and advise you in this matter.

Of course, we will also arrange the appropriate opt-out and notification to the Unified Patent Court for you if you decide to pursue this course for your European patents.

In the field of patent consultancy, the demand for the necessary expertise, including international dimension, is constantly increasing.

As the largest Czech-Slovak law firm with an international approach, HAVEL & PARTNERS boasts one of the largest teams of IP lawyers and patent attorneys. We have helped a number of our clients expand abroad and secure international protection for their creative activities in the form of patents, trademarks, industrial designs or copyrights.

We file national (Czech and Slovak) and European patents, trademarks and industrial designs applications and we are able to secure registration and subsequent protection in any country in the world. We represent clients before national authorities and courts and we will also represent clients before the Unified Patent Court.

For more information about our patent practice, please visit https://hppatents.com/.

Author: Lívia Djukić

Co-author: Kateřina Nešpůrková

AFTER ALMOST 5 MONTHS OF DELIBERATIONS, THE CHAMBER OF DEPUTIES PASSED THE WHISTLEBLOWER PROTECTION BILL. IN WHAT VERSION WILL THE SENATE DEAL WITH IT NOW, AND WHEN CAN WE EXPECT THE ACT TO TAKE EFFECT?

If the obliged entities (all employers with more than 50 employees, public institutions, and other selected entities) have not yet done so, they will soon have to implement an internal reporting system that will allow employees, business partners and other entities to report unlawful conduct within the organisation or harm to public interests. Even organisations that have reporting systems in place, e.g. under the existing AML regulations, will need to adapt them to the newly adopted legal requirements.

The obliged entities will need to consistently protect whistleblowers from retaliation and disclosure of their identity. They will also be obliged to designate a whistleblowing officer who will be responsible for receiving and addressing reports, to comply with the legal deadlines for verifying reports and communicating with the whistleblower, to protect the whistleblower’s identity, and to keep records of reports received.

The obliged entities will be exposed to fines up to CZK 1 million for violation of their obligations. Whistleblowing officers may be fined up to CZK 100,000. In addition, the whistleblower may claim compensation for non-pecuniary damage from the wrongdoing organisation, with the burden of proof being on the obliged entity in the potentially ensuing dispute.

Only employers with up to 249 employees will be allowed to share their internal reporting system with another company. All other employers will need to introduce their own internal reporting system, regardless of whether they are part of a group or not – the use of a group-wide reporting system is not justified under Czech law.

We have summarised the details of the forthcoming legislation for you in our previous article.

From the beginning, the legislative process in the Chamber of Deputies was accompanied by two main topics: the obligation to accept anonymous reports, and the protection of whistleblowers who report suspected offences.

On Friday, 21 April 2023, an amendment was approved in the third reading, according to which protection will be provided not only to a whistleblower who reports a suspected crime or violation of another regulation in areas defined by law, but also to a whistleblower who reports a suspected misdemeanour for which the perpetrator faces a fine of at least CZK 100,000. Misdemeanours are regulated in the Czech Republic by numerous regulations governing the various segments of public administration (about 250 legal regulations), so it will be interesting to see how whistleblowers will be able to deal with the legal qualification of the reported facts in order to find out whether or not it is a report that will trigger their protection.

Conversely, an amendment under which public entities and employers would be required to accept and investigate anonymous reports was rejected. On the other hand, receiving anonymous reports is not prohibited and, therefore, every obliged entity will be free to decide whether or not to address anonymous reports.

In mid-March, the European Commission announced that it would take legal action against the Czech Republic and other Member States that have not yet implemented the Whistleblower Protection Directive into their legal systems. At the same time, it has asked for a fine to be levied which would accrue until the European regulation is transposed – the amount of the fine is EUR 4,900 per day, calculated from the first day of delay, i.e. from 18 December 2021. Therefore, it can be expected that the legislative process in the Senate will be carried out quickly and efficiently so that the law enters into effect as soon as possible.

Under the current bill, obliged entities would have approximately one month after the adoption of the law to implement an internal notification system, designate a qualified whistleblowing officer, publish all mandatory information, and ensure compliance with their other legal obligations.

Based on our experience, the implementation of an internal whistleblowing system takes several weeks – it is indeed necessary to set up technologies and processes for a safe reporting, prepare and approve related internal documentation, make additions to the website and, last but not least, train the whistleblowing officers as well as potential whistleblowers. Therefore, we recommend that you do not leave the implementation for the last moment.

The law allows outsourcing the implementation and management of the internal reporting system, as well as the performance of the role of the whistleblowing officer, to a third party. In cooperation with our affiliated company, FairData Professionals a.s., we help our clients implement a comprehensive whistleblowing solution FairWhistle, and we also manage ethics hotlines for a number of clients and perform the role of whistleblowing officer. If we can help you too, we would be happy to hear from you.

We will also share with you our experience and practical tips on how to set up a working internal reporting system, or how to address reports, in our WHISTLEBLOWING AND INTERNAL INVESTIGATION – PRACTICALLY AND EFFICIENTLY (ONLINE) seminar, where we will explain, among other things, the basics of internal investigation.

To sign up, click HERE.

Author: Kateřina Nešpůrková

Co-author: Martin Peckl

Fires in factories, collapsed mines, substandard working conditions, child labour, poisoned rivers, oceans overwhelmed with garbage.[1] This and many other undesirable phenomena are brought about by globalisation. Big companies are looking for the cheapest supplier around the world. The consequences are dramatic: we live in a world where the biggest shoe manufacturers do not actually make shoes, they just design and sell them. Similarly, the largest PC manufacturers do not manufacture their products themselves, but merely assemble them from components made elsewhere. Production has moved to countries with cheap labour and raw materials, with inadequate legal protection for workers or the environment, and with high levels of crime and corruption.

There is growing social pressure for companies in the developed parts of the world to take responsibility for what happens in their supply chains. These are networks of individuals and companies that start with the acquisition of raw materials and end with the creation of the final product and its delivery to the consumer. Initially, it was international organisations such as the United Nations (UN), the Organisation for Economic Co-operation and Development (OECD), and the International Labour Organisation (ILO), and later some countries, that formulated recommendations and standards on how companies should manage risks related to human rights and environmental protection within their own groups and supply chains. However, only some corporations have adopted these recommendations and standards into their practice. Those that have acted responsibly and invested in their corporate social responsibility (CSR) are calling for the introduction of equal conditions for all market players (levelling the playing field).

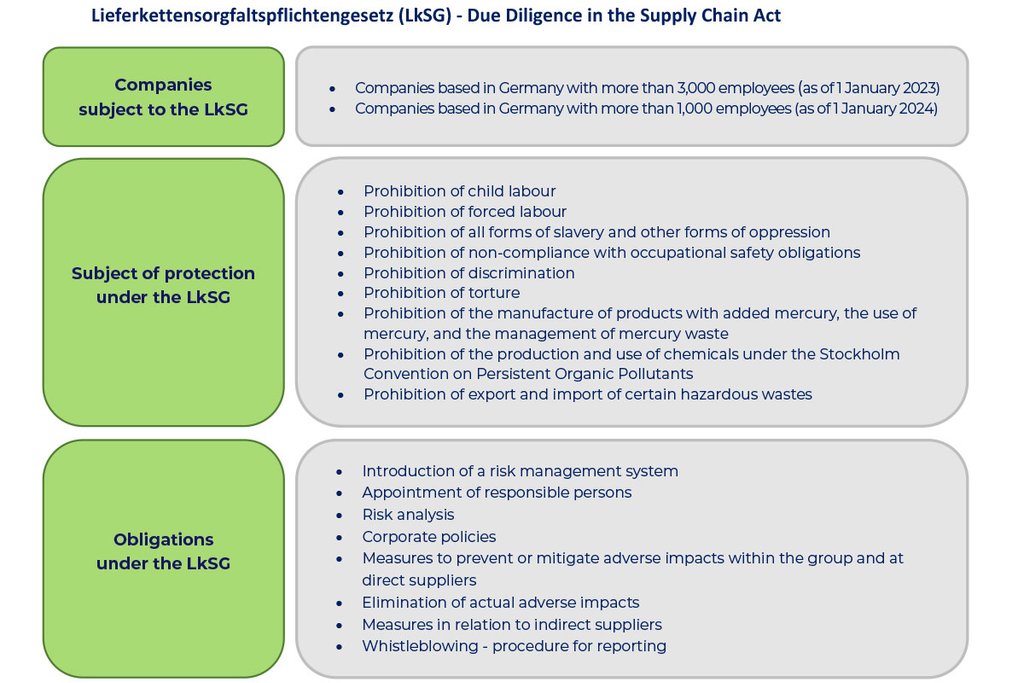

These calls have been answered. At the level of some countries (the United Kingdom, France, the Netherlands …), binding legislation has been gradually adopted establishing the legal responsibility of corporations to manage human rights and/or environmental risks in their supply chains. With effect from 1 January this year, Germany, which is the most important trading partner for Czech companies, adopted binding regulations in this area. The Lieferkettengesetz (LkSG), as the German law is called for short, is considered a pilot project in the EU to test the new rules.

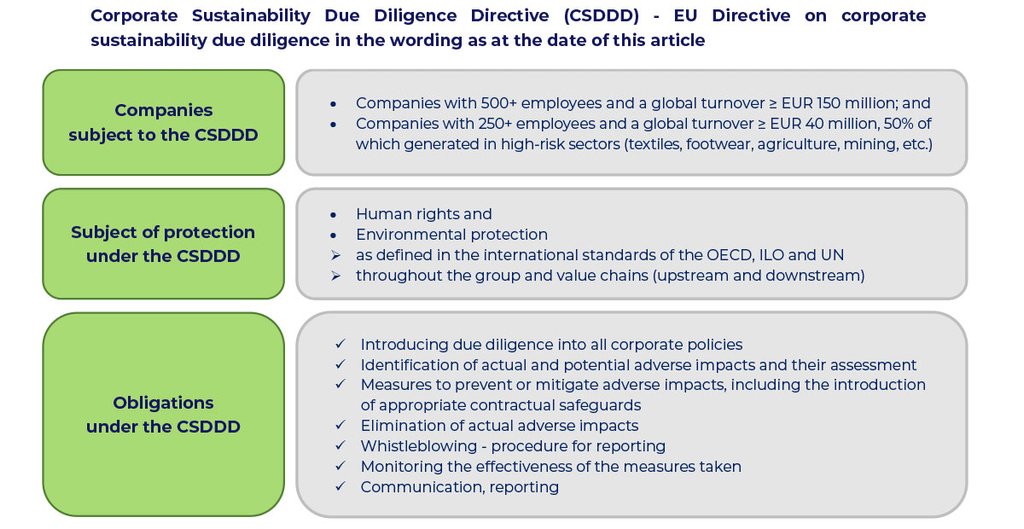

The draft EU Corporate Sustainability Due Diligence Directive (CSDDD) is based on similar principles to the LkSG at EU level. It is currently in the EU legislative process. The Directive is expected to take effect from 2026 at the earliest.

This (forthcoming) new piece of legislation builds on requirements already formulated by international institutions. When defining protected human rights (e.g. prohibition of child labour, all forms of forced labour, prohibition of violations of occupational health and safety, etc.) and protected environmental parameters (e.g. prohibition of the production of products with added mercury, prohibition of import and export of hazardous waste, etc.), reference is often made directly to established international conventions.

Large corporations will have to monitor the fulfilment of key values – protection of human rights and of the environment – throughout their supply chains according to established due diligence benchmarks and by implementing prescribed measures. The LkSG calls for both a preventive approach and the correction of identified negative impacts. German companies face heavy fines if they fail to comply – up to EUR 800,000 or 2% of their average annual worldwide turnover. In addition, they also risk being banned from participating in German public procurement for up to three years.

The CSDDD, too, foresees that Member States will be obliged to introduce sanctions when transposing the Directive, fines will have to be based on the corporation’s turnover, decisions will always be made public. Beyond the framework of the German LkSG, however, the CSDDD is also working with introducing civil liability for damage to protected values caused by a breach of the due diligence within the group or by a direct partner. In effect, this would mean that large corporations could be held liable for damage they did not directly cause, but to which they may have contributed by their inaction.

As it stands, the obligations under the German Lieferkettengesetz directly affect German companies with more than 3,000 employees in a group. From 1 January 2024, this threshold will be reduced to 1,000 employees. The contemplated European CSDDD is even more ambitious (in some high-risk sectors – typically mining of minerals or garment and footwear manufacturing – companies with at least 250 employees will be directly affected) and it should affect around 13,000 European companies in total and a further 4,000 non-European companies with a defined turnover generated in the EU.

Indirectly, however, this regulation will also affect a much wider range of other, often much smaller companies, including Czech ones, if they are part of the supplier-customer network of large corporations regulated by the German LkSG or, in the future, the CSDDD. The introduction of the legal due diligence in value chains will therefore be felt indirectly by many of you due to its cascading effect.

The new legislation compels large corporations to implement a risk management system designed to identify, prevent and eliminate risks related to human rights and the environment both on their own part and within their global supply chains. They will be obliged to carry out risk analysis of all their business processes and take preventive measures, which will also be reflected in the management of relationships with contractors. The requirement for effective human rights and environmental risk management will become more important when selecting contractors. Selected suppliers will have to contractually commit to the rules defined by the regulated entities (Code of Conduct) and reflect those rules further in their own supply chain.

Large companies are motivated to work with their chain. The LkSG specifically mentions the training of responsible persons. The contractual partners must contractually agree to allow an audit of compliance with the relevant rules to be performed either by the corporation or by an independent third party. The CSDDD allows for the cost of compliance verification at small and medium-sized enterprises (SMEs) to be passed on to the obligated companies. The whole system should be updated regularly, at least once a year.

All measures implemented in respect of due care under the LkSG and/or CSDDD will need to be reported and published. The CSDDD explicitly stipulates that this report will be part of the sustainability report; the details for this report are set out in the EU Corporate Sustainability Reporting Directive (CSRD) approved at EU level at the end of November last year.

It is clear that those responsible for risk management in companies affected – whether directly or indirectly – by the new legislation will have to revise their contractual relationships with partners, related codes of conduct and, in particular, the clauses addressing partner liability in the event of a breach of the rules.

In the transaction market, ESG audit is already becoming established as a separate category, which is performed in parallel with due diligence in other areas such as legal, tax and economic. We have seen extensive third-party group audits in the areas of occupational safety, labour and environmental compliance. Within their framework, contractual documentation (not only) in customer-supplier relationships will be newly examined in terms of ESG clauses, which change the current practice of generally formulated supplier codes. ESG clauses move from appendices (or sometimes just a web link) into the body of the contract. They tend to be much more specifically worded as they should be based on a previous individualised audit and assessment of specific risks. They require identification of persons responsible at the level of the contractors for compliance with the rules. We have also encountered the approach that ESG clauses have been identified as an essential element of the contract, with all the consequences that this entails, including the possibility of immediate termination of the contractual relationship with the supplier in the event of a breach of those clauses. In general, it is therefore advisable to pay attention to the formality of individual acts within the supplier-customer relationship, the quality of related documentation and its proper recording – the German legislator, for example, requires the retention of relevant documentation for 7 years.

Both the German and the European regulations further require that obligated companies establish an internal reporting system that allows affected persons to report human rights risks and/or environmental risks that are related to the economic activities of the obligated company itself or its direct and indirect suppliers. The rules for receiving and addressing these concerns are the same as those for whistleblowing as defined in the EU Directive on the protection of persons who report breaches of Union law. It is clear that obligated persons will need to implement more comprehensive reporting systems that will allow them to receive reports from the entire chain and/or to use the notification systems of their partners.

In June this year, the Whistleblower Protection Act was passed in the Czech Republic, requiring all companies with more than 50 employees to introduce whistleblowing arrangements. When implementing or revising their internal whistleblowing systems, companies that are suppliers to large German corporations had to consider how to properly combine the requirements of German legislation for receiving and investigating reports of suspected violations of regulations governing human rights and environmental protection with the requirements of Czech legislation for internal whistleblowing. A number of the companies ended up with an ethics helpline with a broader personal and substantive scope than that required by local laws.

Nothing in the new legislation regulating supply chains will be an easy task. Even for companies that have a team with experience in sustainability and human rights, supply chain due diligence risk management will be a brand new field. Companies that are already preparing for sustainability reporting under the CSRD will have an advantage. The CSRD, too, requires the provision of aggregated sustainability data across the value chain. It is obvious that in performing risk analysis across the entire value chain, implementing preventive and corrective measures, updating them, managing complaints across the chain, etc. it will be appropriate to involve not only a competent team, but also software that enables efficient data processing.

At HAVEL & PARTNERS, we monitor ESG and sustainability trends across the relevant legal practice areas and are here to help you apply them in practice.

[1] 2012 – Fire at Ali Enterprises textile factory in Karachi, Pakistan, killing 258 people

2012 – Fire at the Tazreen garment factory in Dhaka, Bangladesh, with 117 people dead and more than 200 injured

2013 – Rana Plaza building collapses in Dhaka, Bangladesh, leaving at least 1,132 people dead and more than 2,500 injured

2019 – Collapse of a copper and cobalt mine in Kolwezi, Democratic Republic of Congo, killing at least 36 people

Author: Lívia Djukić

Co-author: Kateřina Nešpůrková

After almost a decade of debates, the EU Directive on improving the gender balance among directors of listed companies has been approved on European soil. The Directive, known abroad as the “Women on Boards Directive”, is another of a number of upcoming compliance obligations with an overlap into the ESG topic, which also resonates with the topic of gender equality and equal pay.

The Directive aims to increase the number of women as under-represented sexin director positions of companies. According to the European Union, a higher number of women involved in direct decision-making is not only to ensure equal opportunities and pay for men and women, but also to improve corporate governance, attract more female talent to companies, and thus increase the competitiveness and growth of the European economy.

The Directive applies to companies having registered office in an EU Member State, whose shares are admitted to trading on a regulated market in one or more EU Member States, i.e., European listed companies. It does not apply to micro, small and medium-sized enterprises.

The Directive requires Member States to ensure that listed companies are subject to one of the following objectives:

Each listed company will therefore have to comply with the legislation of the Member State in which it has its registered office, and the specific requirements will depend on how that Member State implements the Directive.

A means to achieve gender balance will be to increase transparency in the selection processes for director positions. In advance of the selection process, listed companies will be required to establish clear, neutrally formulated, non-discriminatory and unambiguous selection criteria (the “qualification criteria”), which will be applied throughout the selection process and on the basis of which the best qualified candidate, irrespective of gender, will be selected in an objective manner.

The Directive explicitly states that when choosing between equally qualified candidates of different genders, priority should be given to the candidate of the underrepresented (usually female) sex. Of course, this rule is not absolute – companies will be able to decide in exceptional cases in favour of a candidate of the adequately represented (usually male) sex.

If the unsuccessful candidate requests it, companies will have to inform him/her of:

The burden of proof in any dispute lies with the listed company, which will be obliged to prove that there were specific objective reasons in a particular selection process for which it exceptionally preferred a candidate of the adequately represented sex. It will therefore be in the companies’ interest to document the entire selection process in detail so that they have a quality defence file at hand in the event of a dispute.

Listed companies will also be required to:

The Directive states that appropriate penalties may include fines or the possibility for a court to annul a decision concerning the selection of directors or to declare it null and void(if such decision has been made in breach of the Directive). Listed companies may only be held liable for acts or omissions which can be attributed to them in accordance with the law of the relevant Member State. The decision on the type and amount of penalties is therefore fully in the competence of individual Member States.

Member States must transpose the Directive by 28 December 2024 at the latest. Companies will be required to ensure that they comply with their obligations by 30 June 2026 at the latest.

The European Union is imposing more and more regulatory requirements on companies in the area of corporate social responsibility, which should gradually lead to the fulfilment of individual sustainability objectives. It is apparent that companies that want to meet all these criteria and maintain their competitiveness must include gender equality strategy (including equal pay requirements) in their internal policies and decision-making processes, not only at the HR management level. Multidisciplinary ESG team of HAVEL & PARTNERS follows all these new trends in the area of sustainability and will continue to keep you informed as a good guide on your path towards sustainability. If you need to get more information about individual ESG areas and their potential impact on your business, we will be happy to provide you with a comprehensive tailored service.