Authors: David Krch, Vlaďka Laštůvková

Recently, a debate has been sparked in the pharmaceutical industry on the correct setting of distribution models in terms of VAT. It was triggered by the decision of the Municipal Court in Prague that upheld the opinion of the tax administration in the case at hand according to which the Czech distributor should have also recorded in its tax base the payment for marketing services paid by a foreign supplier of medicinal products because, the tax authority asserts, this income constituted a payment by a third person for the sale of medicinal products in the Czech Republic. Hence, income from marketing services invoiced abroad should be subject to the Czech VAT. The correctness of this opinion is yet to be decided upon by the Supreme Administrative Court.

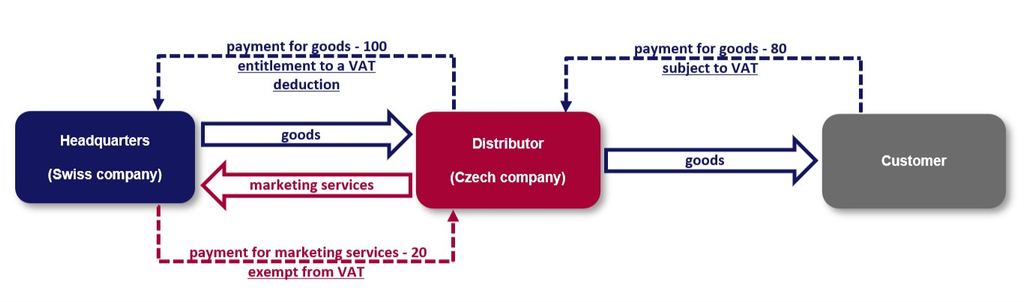

A Czech pharmaceutical company as a distributor of medicinal products (the “Distributor”) was purchasing medicines as a member of a group from a European warehouse seated in Switzerland (the “Headquarters”), which it supplied to other entities on the Czech market (wholesalers and pharmacies). However, due to price regulation in the Czech Republic, the Distributor was selling the medicinal products at a lower price than the price it purchased them for from the Headquarters.

At the same time, the Distributor was receiving payments for marketing services from the Headquarters, which ensured that the Distributor was profitable from the perspective of transfer prices, despite selling the medicinal products at a loss. The Distributor reported the marketing services as a provision of services with the place of supply outside of the Czech Republic; therefore, the income from such supply was exempt from VAT in the Czech Republic (with the entitlement to a tax deduction).

In the above model, as a result, the Distributor recorded lower tax liability. The tax administrator assessed this difference as additional tax to the Distributor equalling the VAT that would have been paid (save for relevant sanctions) if the marketing services supply had been subject to the Czech VAT.

The court ruled that the marketing services constituted partial supply that was part of the distribution and should have been considered, from the VAT perspective, a secondary activity used for the purpose of obtaining benefit from the main activity (i.e. the distribution of medicinal products) under the most favourable terms. Therefore, both activities should have been subject to the same VAT regime and the Distributor should have been paying VAT from the income from the marketing services in the Czech Republic just like from the income from the sale of medicinal products.

In this regard, the court upheld the decision of the tax administrator to the effect that “a customer purchasing medicinal products from the claimant is the recipient of a single indivisible supply (distribution and marketing),”adding that the provision of marketing services alone without any link to the distribution of medicines would not make any sense, “as the aim of such marketing is certainly to increase the customer awareness of medicines distributed by the claimant, and, as a result to increase the marketability of these medicines” to end customers in the Czech Republic.

At the same time, the court agreed with the tax administrator’s opinion to the effect that for the Headquarters, marketing was a secondary benefit. To support its opinion, the court asserted, among other things, that the Distributor was the owner of the medicines when the marketing services were provided and as such was the holder of the registration of the medicinal products. The Headquarters was thus neither a manufacturer of the products nor the holder of the distribution licence in the Czech Republic, and therefore could not be the recipient of the marketing services on the Czech market.

Given the above[1] the court concluded that the supply for marketing services was in fact “a payment received from a third person” for the sale of medicines when the Headquarters paid the costs for the marketing activities on behalf of the Distributor as the Distributor could not charge them to its customers as part of the price for medicine due to the price regulation in the Czech Republic. The court substantiated the fact that the marketing costs were already part of the price paid for the distribution of medicines by claiming that the Distributor was unable to distinguish distribution costs from marketing costs in its books.

In connection with the court reasoning, it needs to be added that during a previous income tax inspection, the Distributor declared to the tax administrator that marketing services were part of the services comprising the distribution of medicine and did not constitute a separate supply. That contributed to the fact that the Distributor was profitable in terms of transfer pricing despite the sale of medicine at a loss; had there been two supplies, a higher profit margin would have had to be applied to the marketing services. However, during a VAT inspection, the Distributor argued that it was performing two separate supplies – distribution and marketing which, as the court claimed, the Distributor failed to prove.

Even though we will have to wait for the clarification of the correct setting of the distribution model described above until the Supreme Administrative Court rules on the case or until the Court of Justice of the EU makes a statement in its preliminary ruling, it is already clear that it is necessary to proceed in a prudent manner during tax inspections at all times, and that any statement to the tax administrator must be assessed in a comprehensive manner since what may seem appropriate in certain proceedings may cause major problems in other proceedings.

If the Supreme Administrative Court eventually upholds the findings of the Municipal Court in Prague, the business models based on similar principles would have to be revisited as a result and companies applying this model could face a higher risk of additional assessment of VAT. What is more, these findings do not only concern pharmaceutical companies but all entities using a similar model, particularly in areas where prices are capped.

To conclude, it is worth mentioning that the Supreme Administrative Court should deal with the arguments presented by the Municipal Court and clarify whether a payment from the Headquarters in favour of the Distributor could truly be considered a payment received from a third person in connection with the supply of medicinal products to customers. What seems crucial for the resolution of this dispute is the factual knowledge of the pharmaceutical environment.

[1] Besides the above, the court also assessed the possibility of the Distributor and the Headquarters to make a services contract and real possibilities of the Distributor to influence the scope of promotion of the distributed medicinal products.