Authors: David Krch, Václav Audes, Vlaďka Laštůvková

We would like to take this opportunity to inform you about conclusions made by the Coordination Committee[1] regarding tax implications of paybacks provided to health insurance companies based on risk sharing.

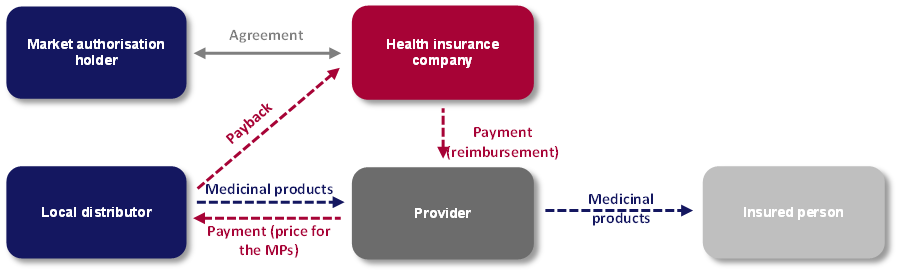

At the end of last year, the Coordination Committee addressed adjustments of the VAT assessment base (and VAT) in cases of paybacks provided to health insurance companies that have entered into the agreement to limit the risks / costs related to the reimbursement of medicinal products (risk-sharing) with the market authorisation holder (MAH), but it is the local distributor that provides the paybacks to the health insurance company (the minutes use a term “bonus” to refer to the payback and the word “importer” to denote the local distributor, usually belonging to the same group as the MAH). This is a standard risk-sharing model as you can see below:

In conclusions of the Coordination Committee, the General Financial Directorate confirmed in the given case that the local distributor may reduce its VAT assessment base (and VAT) by virtue of the payback to the health insurance company under Section 42 of the VAT Act if:

The full wording of the relevant section of the minutes of the Coordination Committee’s meeting is available (in Czech) here.

In case of any questions, please do not hesitate to contact us. We are ready to provide you with more information and assess the setup of adjustments of your VAT assessment base (and VAT) in light of the above.

[1] The Coordination Committee is a joint meeting of the Chamber of Tax Advisers and the General Financial Directorate. The minutes of such a meeting are a kind of a guideline for the tax authority.