Authors: Marek Lošan, Natalija Traurigová

The European Union has adopted measures in the form of sanctions against the Russian Federation in connection with developments in Ukraine since March 2014. In recent days these measures have been hastily supplemented by massive restrictions that are likely to change and evolve.

As of the morning of 28 February 2022, the following measures exist:

export and import ban on given goods

more restrictions on trade and investments

prohibition on supplying specified services

On 24 February 2022, another sanctions package was agreed and, in addition to the measures already adopted, further measures can be expected to be taken in the following sectors:

The situation is changing every day, and besides the measures already taken, other measures have been extensively discussed, in particular:

Please do not hesitate to contact us if you need assistance or have questions regarding a particular matter.

Authors: Robert Nešpůrek, Pavel Amler, Tomáš Chmelka

At the beginning of summer 2021, the European Commission published a proposal to revise the eIDAS[1] Regulation, nicknamed eIDAS 2.0, in which the European Commission proposes significant changes to the Regulation, in particular in the field of electronic identification, by introducing a so-called European Digital Identity wallet (the “Wallet”).

The Wallet should take the form of an app for mobile phones and other devices and should be based on a national electronic identity. The Wallet should be issued by individual Member States or by an authorised or recognised private entity. Hence, the Wallet will not create a new electronic identity but will ensure cross-border recognition of individual national electronic identities.

In addition to basic personal identification data, the Wallet should also contain other attributes (e.g. driver’s licence, diploma, licence, certificate, professional qualification, or birth certificate). The inclusion of other attributes will not be mandatory, but each citizen, as the holder of their own Wallet, will be able to individually choose which attributes to upload to the Wallet and when and how to use them. The sharing of personal data and attributes should be transparent, traceable and, with the right technical solution, GDPR[2] compliant.

It should also be possible to use the Wallet as a means of creating a qualified electronic signature or a qualified electronic seal, which could bring a new impetus to their wider use in Czech society (they have the same effects as a handwritten signature on paper).

Each EU Member State will have to issue the Wallet to its citizens within 12 months from the date the approved eIDAS 2.0 proposal enters into force. A conservative estimate is that eIDAS 2.0 could be approved by the end of 2022. Even if the legislative process takes longer, we might see the first digital and hopefully truly usable Wallets across EU Member States by 2024 at the latest.

Global internet companies in France have recently received significant fines for non-compliance with rules on user consent to the use of cookies (including, for example, the US company Meta, which operates the social network Facebook). However, similar practices are also standard on the Czech Internet, and so these decisions should be taken into account.

The basic requirement for valid consent to the use of cookies is that it can be freely given or denied, both in the same easy way (i.e. the user must not be forced into either option, directly or indirectly). In a situation where one of the options is significantly easier (one-click so to speak) and the other burdens the user with the need to click through several windows or scroll through a long text, or encourages the user to individually reject each of the many marketing cookies, one can rightfully question the free and equally easy refusal of consent.

On the Czech Internet, this way of obtaining consent has become a standard and even among the professional public there are voices that are willing to promote such a cookie banner as a model case of consent. However, supervisory authorities in Europe are of a different opinion and, given the coordination of European supervisory authorities in the area of data protection, it can be expected that the Czech Personal Data Protection Authority will follow this trend. For this reason, we recommend verifying that the cookie banner you are using does indeed meet the requirements for valid user consent – otherwise, you risk being subject to (unnecessary) sanctions.

Cyber-attacks targeting software application vulnerabilities have been encountered almost on a daily basis lately. The European Union is aware of these events and has decided to fight them, at least in part.

Based on the adopted EU Cybersecurity[3] Act, the European Cybersecurity Certification Framework should soon come into force, the primary objective of which is to guarantee a higher standard of cyber protection and security, both for the products, services and processes offered and for the end user.

The framework also establishes a single system for the certification of cybersecurity products, services and processes. The liaison point of this framework will be the European Union Agency for Cybersecurity (ENISA), which will significantly strengthen its mandate and become the EU’s permanent cybersecurity agency. ENISA will also coordinate the actions of Member States, EU institutions and other stakeholders in the field of cybersecurity.

The European cybersecurity certification system envisages several levels of assurance – “basic”, “significant” or “high”. The level of certification always depends on the level of risk in terms of the likelihood and impact of a security incident associated with the intended use of the product, service or process. Accreditation will be issued for a maximum period of five years and may be renewed under the same conditions. Certification will be voluntary unless otherwise specified by mandatory regulation.

On the basis of the related amendment to the Czech Cybersecurity Act, the NÚKIB[4] is to be designated as the national cybersecurity certification body. The NÚKIB will thus have an expanded scope of powers and will oversee and enforce compliance with the rules included in European cybersecurity certification systems, authorise or empower conformity assessment bodies to issue certifications where appropriate, and address complaints filed by natural or legal persons in connection with European cybersecurity certificates.

Certificates issued within these systems will be valid in all EU countries, creating a single system that will make it easier for end users to gain confidence in the security of these technologies. In turn, it will make it easier for companies to do business across borders and ensure certification across the Union. We therefore certainly recommend following this development and, at the very least, considering implementing this certification as soon as possible.

Our law firm HAVEL & PARTNERS, together with Artinii, has introduced a new innovative blockchain project called Certoo. This service is, in short, a “digital notary” and essentially allows users to obtain secure and unquestionable proof of authorship of documents or data.

With this service, the user can prove his/her authorship with a certificate that contains all the information relevant to prove authorship/ownership. This information is protected from subsequent modifications thanks to the blockchain technology used. The Certoo service thus brings a new standard in the field of intellectual property protection.

Certoo is a very user-friendly and intuitive online tool that can be used by all categories of users. In the first step, the user uploads a file with a work of any nature, which is assigned a unique hash (de facto a digital fingerprint of the uploaded file). This hash is then integrated into the Litecoin network blockchain (a public and transparent blockchain), whereupon the user (author) receives his/her unique certificate to prove his/her authorship/ownership.

Each user also gets access to their own private online storage. In this environment, they can upload additional projects and administer them as needed. This ensures that they always have access to the original file to prove that the user had possession of the file at a specific date and time, which can prove their authorship/ownership in the event of a dispute. Superior security and encryption of the stored data is a matter of course.

[1] Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and trust services for electronic transactions in the internal market.

[2] Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data, and repealing Directive 95/46/EC (General Data Protection Regulation).

[3] Regulation (EU) 2019/881 of the European Parliament and of the Council of 17 April 2019 on ENISA (the European Union Agency for Cybersecurity) and on information and communications technology cybersecurity certification and repealing Regulation (EU) No 526/2013.

[4] National Cyber and Information Security Agency.

When a supplier or manufacturer charges different wholesale prices for the same product depending on whether the product is intended to be sold online or offline, or whether the buyer will sell it to a retailer or directly to end-customers, dual pricing is practiced.

A dual pricing practice does not always qualify as a restriction of competition, although it is a valid presumption that this is the case where sales via the internet are disadvantaged. The underlying rationale for such presumption is that the European Commission has considered that the internet is a powerful tool that allows distributors to reach a larger number, as well as greater variety, of customers whereby restrictions affecting a distributor’s online sales are generally seen as resale restrictions.

Under the current VBER regime, a dual pricing practice disadvantaging online sales is considered to be a passive sales restriction as online sales are considered in principle to qualify as passive sales. Pursuant to Article 4(b)(i) VBER, a supplier may restrict some types of active sales by a distributor, but it is prohibited to restrict any passive sales.

Active sales refer to sales activities whereby customers are actively approached individually, for example, by direct mail, e-mails or visits, or whereby a specific customer group or customers in a specific territory are targeted by the distributor. Passive sales refer to a response to unsolicited requests from individual customers and general advertising.

In the current Vertical Guidelines, the European Commission states that an agreement that stipulates that the distributor shall pay a higher price for products intended to be resold online than for products intended to be resold offline amounts to a hardcore restriction. This means that the European Commission considers that such behaviour is so harmful to competition that it should be considered a by object restriction and therefore is forbidden.

Even though a supplier may not limit the online sales of its buyers, under the current Vertical Guidelines, it is allowed to agree to pay the buyer a fixed sum to support the buyer’s offline or online sales efforts.

However, there are certain circumstances when a dual pricing practice may be individually exempted under Article 101(3) TFEU. This may be the case, for example, when selling a product online leads to substantially higher costs for the supplier/manufacturer than selling a product offline. The current Vertical Guidelines provide a practical example. A supplier/manufacturer of household appliances sells products to a retailer that sells the products both online and in physical stores. When the item is purchased by an end-customer in a physical store, but not when purchased online, installation of the product is included. It is possible that online sales lead to more customer complaints and/or customers making claims under the product’s warranty from the supplier/manufacturer because the product does not function as well without a qualified person installing it. A dual pricing practice in this scenario, whereby the cost charged to the distributor for a product intended to be sold online may be higher than the price of a product intended to be sold offline, is motivated by the higher costs for the supplier generated from the online sales channel. As such, the dual pricing practice does not aim to limit or discourage online sales and may then be considered to fulfil the conditions for an exemption under Article 101(3) TFEU.

Ultimately, the European Commission will assess whether the restriction is likely to limit internet sales and hinder the distributor from reaching more and different customers.

The draft VBER contains the same provision for sales restrictions meaning that some types of active sales may be restricted, but passive sales may not.

However, the current proposals of the Vertical Guidelines provide an interesting difference in approach with respect to dual pricing, as the European Commission states that dual pricing arrangements may benefit from the safe harbour of the VBER in certain circumstances. This requires that the dual pricing practice aims to incentivize or reward the appropriate level of investments respectively made online or offline. In other words, a product intended to be sold offline can be offered at a lower price to the distributor than a product intended to be sold online, provided that the difference in price reflects the difference in investments and/or costs incurred. For example, a supplier who wishes to reward the buyer for its efforts in offline sales may offer the supplier a lower price for the products intended to be sold offline.

According to the European Commission’s proposals, dual pricing will no longer necessarily be considered a hardcore restriction. It is further stated, in the current proposals of the Vertical Guidelines, that the difference in price should relate to the differences in the cost incurred in each channel by the distributor at retail level. If the wholesale price difference instead prevents the use of the internet for online sales, the dual pricing practice will still be considered a hardcore restriction by the European Commission.

The difference in approach introduced in the current proposals will provide more legal certainty for suppliers in relation to the fact that dual pricing may benefit from the safe harbour of the VBER, at least in certain circumstances.

The new approach that dual pricing is not necessarily a hardcore restriction if the price difference can be attributed to cost-differences between sales channels provides much welcomed flexibility for suppliers.

The difference in approach also helps to fulfil the aim of ensuring the effective use of the internet as a sales channel, more efficiently and in a targeted manner, while allowing suppliers greater contractual freedom. The new approach raises the interesting question of whether a pricing advantage for the online channel at the expense of the offline channel would be admissible and to what extent it would not constitute a restrictive dual pricing practice. In other words, can offline sales channels be put at a disadvantage without falling foul of the competition rules at all? Based on the reasoning in the proposal for the Vertical Guidelines (and in particular the fact that internet sales qualify in principle as passive sales), it certainly appears so, and we understand that this is in line with the European Commission’s views on this topic.

The “DLC countdown” newsletters are offered to you by HAVEL & PARTNERS.

If you need more information or our assistance with setting up the distribution system, please contact Robert Neruda or Štěpán Štarha, who are the firm’s partners responsible for this area.

WANT TO KNOW MORE? STAY TUNED…

Counting down towards 1 June 2022, we aim to provide you with regular updates and the necessary legal knowhow in order to fully prepare your business for the future. Please also check out the Distribution Law Center platform (www.distributionlawcenter.com) and our LinkedIn page for much more information on the laws governing vertical agreements, covering both competition and commercial law. 27 specialized teams from all over the EEA are working hard to turn the platform into your favourite source of guidance and information.

Authors: David Krch, Václav Audes, Vlaďka Laštůvková

We would like to take this opportunity to inform you about conclusions made by the Coordination Committee[1] regarding tax implications of paybacks provided to health insurance companies based on risk sharing.

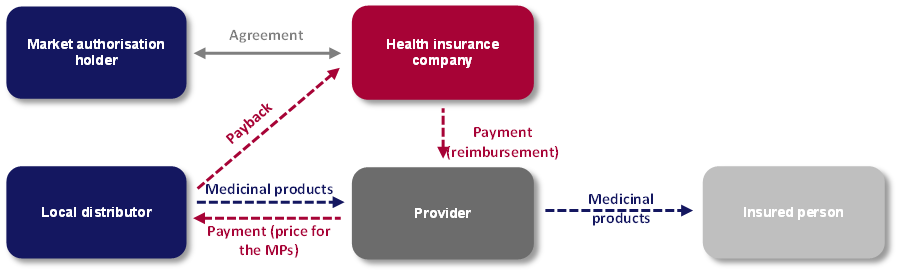

At the end of last year, the Coordination Committee addressed adjustments of the VAT assessment base (and VAT) in cases of paybacks provided to health insurance companies that have entered into the agreement to limit the risks / costs related to the reimbursement of medicinal products (risk-sharing) with the market authorisation holder (MAH), but it is the local distributor that provides the paybacks to the health insurance company (the minutes use a term “bonus” to refer to the payback and the word “importer” to denote the local distributor, usually belonging to the same group as the MAH). This is a standard risk-sharing model as you can see below:

In conclusions of the Coordination Committee, the General Financial Directorate confirmed in the given case that the local distributor may reduce its VAT assessment base (and VAT) by virtue of the payback to the health insurance company under Section 42 of the VAT Act if:

The full wording of the relevant section of the minutes of the Coordination Committee’s meeting is available (in Czech) here.

In case of any questions, please do not hesitate to contact us. We are ready to provide you with more information and assess the setup of adjustments of your VAT assessment base (and VAT) in light of the above.

[1] The Coordination Committee is a joint meeting of the Chamber of Tax Advisers and the General Financial Directorate. The minutes of such a meeting are a kind of a guideline for the tax authority.

HAVEL & PARTNERS has won the TOP Employers poll, and for the eighth time in a row became the most sought-after employer among law firms in the Czech Republic. The poll, which is organised annually by the Association of Students and Graduates, is voted for by students of Czech universities. They evaluate companies according to criteria such as working environment, social responsibility, professional background or prospects for future high income, and thus vote for the most attractive employers in each field.

“It’s great that we remain the first choice for law students on the job market,” said managing partner Jaroslav Havel. “Finding talented and driven students and graduates is absolutely crucial for us. We are aware that a successful firm is primarily made up of people who enjoy working for it and have the opportunity to develop within it. That is why our role is far from over with recruitment; not only do we offer students the stable background of the largest independent law firm on the Central European market, but we also enable them to grow professionally.”

HAVEL & PARTNERS currently has 290 lawyers and tax advisors. It provides comprehensive legal and tax services in all areas of law and business to a total of 2,500 clients, including the most important Czech and foreign companies and successful entrepreneurs. Students and graduates of law faculties thus have the opportunity to participate in top-class counselling where they actually meet the most demanding clients. At the same time, they have the opportunity to get hands on experience in the fields the new generation of legal professionals find attractive for the future such as digitalization, technology, ESG, private equity and venture capital.

“I would like to thank the students for their vote in the TOP Employers poll. I am pleased that they see us as a stable, strong and trustworthy firm that can offer them an exceptional opportunity to enter the world of legal counselling and start their further career development,” commented Daniel Soukup, HR Director of HAVEL & PARTNERS, on the first place won in the poll. “From the very beginning, young promising professionals have the chance to benefit from the firm’s unique know-how built up over the years and the guidance of more experienced colleagues, and they often soon find themselves on extremely interesting cases,” he added.

Certain types of vertical restraints are particularly likely to hinder competition and harm consumers. These hardcore restrictions will not benefit from the safe harbour provided in the VBER and will often amount to an infringement of Article 101 TFEU. Resale price maintenance (“RPM”) constitutes a prime example of such hardcore or black-listed restrictions.

RPM refers to vertical price fixing: a situation where, as a result of a vertical agreement, the buyer’s ability to set its resale price is restricted. A clear-cut example of RPM would be an agreement between a manufacturer and a distributor requiring the distributor to sell the supplier’s products at a fixed price or at a price above a certain minimum level. The most clear-cut application of RPM is the direct imposition of resale prices (or maximum discount levels or fixed distribution margins) by means of a contractual provision. However, RPM can be implemented also through indirect measures such as benefits to the distributor for complying with a given price level (or penalties for failing to do so).

RPM must be distinguished from the permissible practice of imposing maximum and recommended resale prices. Such practices may benefit from the VBER (subject to the 30% market share threshold), provided that in practice they do not amount to fixed or minimum resale prices (as result of pressure from or incentives offered by the supplier).

Vertical price fixing constitutes one of the most serious infringements of competition law and it is deemed unlikely to generate significant efficiencies to qualify for an exemption under Article 101(3) TFEU. What is more, the prohibition of RPM is vigorously enforced by national competition authorities in the EU and, recently, also by the European Commission.

Under the current VBER, RPM constitutes one of the hardcore restrictions described in Article 4(a). As such, it cannot benefit from the block exemption and will have to be assessed individually under Article 101 TFEU. That said, the current Vertical Guidelines explicitly state that RPM, as a hardcore restriction, is presumed (i) to fall within the scope of Article 101(1) TFEU (definition of anticompetitive agreement) and (ii) not to satisfy the conditions of Article 101(3) TFEU (efficiency defence).

This presumption of RPM’s anticompetitive nature results from the fact that such arrangements restrict competition in a number of ways: they may lead to price increases, collusion between both suppliers and distributors, foreclosure of smaller rivals of suppliers and reduction of innovation at distribution level.

Despite that, the European Commission recognizes that in some circumstances, RPM may be necessary to achieve certain efficiencies, in which case the agreement will be exempted under Article 101(3) TFEU. Both the current and the (draft of the) future Vertical Guidelines give three examples of such cases: (i) the launch of a new product; (ii) short-term promotion and (iii) additional pre-sales services provided by retailers.

The key principles regarding RPM are likely to remain unchanged under the new VBER. The wording of Article 4(a) VBER, providing that RPM cannot benefit from the block exemption regime, will not change. This is reflected in the current proposals of the Vertical Guidelines, which are largely based on the current Vertical Guidelines. In the proposed document, the Commission indicates that RPM is likely to fall within Article 101(1) TFEU and not to satisfy Article 101(3) TFEU, albeit without clearly referring to this observation as a presumption.

While the current proposals of the Vertical Guidelines set out the same principles and examples of RPM as their predecessor, some notable additions are included:

In the EU, RPM is presumed to infringe Article 101 TFEU, and this approach seems likely to continue under the new VBER. By contrast, in the US, vertical price fixing is no longer treated as a per se restriction of competition. Some may be disappointed that the evaluation of VBER was not seized as an opportunity to bring EU law rules on RPM closer to their American counterparts. This would allow businesses greater flexibility and could permit more extensive use of new technologies in distribution. On the other hand, legal certainty is not to be taken lightly. A strength of the new VBER is that it does not contain any major surprises in relation to RPM.

That said, it is unfortunate that the current proposals of the Vertical Guidelines fail to illuminate some important issues raised during the evaluation of the current VBER regime. Firstly, the draft Guidelines do not provide any additional (compared to the current Guidelines) explanation regarding recommended or maximum resale prices. It would be helpful to better understand when such arrangements could in fact amount to a RPM. Secondly, both businesses and consumers would benefit from greater clarity regarding the conditions for exempting RPM under Article 101(3) TFEU due to efficiencies offered. Is RPM allowed for short-term promotions only when they are organized in franchise systems, and if not, what other distribution systems are eligible? If RPM is used for the introduction of a new product, how long can it be maintained for? What kind of evidence could be used to prove efficiencies? Additional guidance would allow businesses to bring new products to the market, lower prices and offer better customer service without having to choose between budget constraints on the one hand and legal risks on the other.

The “DLC countdown” newsletters are offered to you by HAVEL & PARTNERS.

If you need more information or our assistance with setting up the distribution system, please contact Robert Neruda or Štěpán Štarha, who are the firm’s partners responsible for this area.

WANT TO KNOW MORE? STAY TUNED…

Counting down towards 1 June 2022, we aim to provide you with regular updates and the necessary legal knowhow in order to fully prepare your business for the future. Please also check out the Distribution Law Center platform (www.distributionlawcenter.com) and our LinkedIn page for much more information on the laws governing vertical agreements, covering both competition and commercial law. 27 specialized teams from all over the EEA are working hard to turn the platform into your favourite source of guidance and information.

Attorney-at-law Hana Erbsová, who has been a part of the legal-tax team at HAVEL & PARTNERS since last year, has won the prestigious competition Tax Advisor & Tax Firm of the Year. Top experts from the area of tax and tax law elected her Tax Advisor of the Year in the Tax Administration category.

“I very much appreciate the fact that Hanka is part of the HAVEL & PARTNERS team, and I sincerely congratulate her on her well-deserved victory in the competition,” said the firm’s tax partner David Krch. “She is an experienced professional who has brought know-how from the supreme tax administration authority, having worked for many years as a tax administration methodologist and department head at the General Financial Directorate. She also has experience gained at leading international consulting companies, so her reach and contribution to us and our clients is truly exceptional,” he added.

“I am delighted that also the professional public has appreciated my experience and long-term interest in tax law and that I can contribute to further strengthening the reputation of our law firm’s tax team this way,” commented Hana Erbsová, an attorney who focuses primarily on tax disputes, international taxation and tax arbitration, including comprehensive advisory support to clients in tax and subsidy audits and in proceedings before courts, including the Supreme Administrative Court. “As part of my specialisation, I constantly strive to develop myself in the most topical fields and related trends. Therefore, I also focus, for example, on the tax and legal aspects of cryptocurrencies and other virtual assets,” she added regarding her portfolio.

HAVEL & PARTNERS’ tax law practice group is continuously growing, and currently has a stable team of more than 15 attorneys and tax advisors. They have many years of experience from major international consulting companies, tax authorities and the judiciary and extensive experience in complex tax advisory services and in representing multinational corporations and the world’s most important players in a wide range of industries. “Our main goal is to effectively combine legal and tax services, thanks to which we are then able to offer our clients a high-quality and comprehensive service in one place. Thanks to the composition of our team, in addition to tax and legal services, we also provide comprehensive tax advisory services to leading global corporations, including tax return preparation services,” added David Krch.

The Tax Advisor & Tax Firm of the Year competition is the only competition of this kind in the Czech Republic, annually organised since 2010. The aim of the competition is to select the best tax advisors and experts and the most friendly tax authority branches. You can find more information about the competition here.

Vertical agreements often contain a vast number of provisions, regulating different aspects of a vertical relationship. However, the EU competition rules determine that certain provisions cannot be included in distribution agreements since they impede competition to an extent that cannot be permitted. These are the so-called “hardcore restrictions”. Hardcore restrictions can be imposed both directly and indirectly, in which case the assessment is more complex, but the outcome is the same.

Including a hardcore restriction in a vertical agreement has as a consequence that the block exemption is no longer applicable to that agreement as a whole. In this case, the agreement might still benefit from an individual exemption under Article 101(3) TFEU but, for hardcore restrictions, there is a rebuttable presumption that they do not meet the conditions set out in this article. Consequently, obtaining an individual exemption is particularly challenging and only occurs in exceptional circumstances. It is therefore extremely important for practitioners to have a clear understanding of what these hardcore restrictions are, so that they can avoid them when drafting vertical agreements.

Under the current VBER regime, five types of restrictions are considered hardcore restrictions that render the block exemption inapplicable. They are listed in Article 4 of the current VBER.

Firstly, Article 4(a) VBER prohibits the restriction of the buyer’s ability to determine its own sale price, so-called “resale price maintenance” (“RPM”). This entails both the imposition of a fixed or minimum resale price and upholding a fixed or minimum margin.

Secondly, Article 4(b) VBER prohibits territorial or customer restrictions (with certain exceptions). Because the internet allows a distributor to reach a greater number and variety of customers than through the more traditional sales methods, the European Commission considers a number of restrictions on the use of the internet sales restrictions, and in certain cases even hardcore restrictions (see, paragraph 52 Vertical Guidelines). One example of such a hardcore restriction is dual pricing, an agreement that the distributor shall pay a higher price for products intended to be resold online compared to products intended to be resold offline.

Thirdly, Article 4(c) VBER prohibits the restriction of active or passive sales to end users by members of a selective distribution system. Again, with regard to internet sales, the European Commission has stated (see, paragraph 56 Vertical Guidelines) that any obligation which dissuades members of a selective distribution system from using the internet by imposing criteria for online sales which are not overall equivalent to the criteria imposed for offline sales are hardcore restrictions.

Fourthly, Article 4(d) VBER prohibits the restriction of cross-supplies between distributors within a selective distribution system.

Lastly, Article 4(e) VBER prohibits the restriction of the supplier’s ability to sell components as spare parts to end-users or repairers or other service providers not entrusted by the buyer with the repair or servicing of its goods.

First and foremost, the current proposals for the new VBER and Vertical Guidelines contain certain changes to the regime, but from a general perspective the list of hardcore restrictions in Article 4 remains largely unchanged.

Article 4(a) draft VBER is maintained. Thus, the basic rules on RPM will continue to apply. Nevertheless, the proposals for the new Vertical Guidelines do introduce changes with regard to price monitoring, fulfillment contracts and minimum advertised price policies. Make sure to read DLC countdown no. 9 if you want to know what will likely change under the new VBER regime.

With online sales becoming increasingly important, the European Commission continues to pay attention to the online environment and is making certain changes to the current regime to render this distribution channel even more accessible. The current proposals for the new Vertical Guidelines provide an interesting change in approach with respect to dual pricing, as the European Commission states that dual pricing arrangements may benefit from the safe harbour of the VBER in certain circumstances. Do not miss DLC countdown no. 10 if you want to know more. Also with regard to the equivalence principle, the European Commission seems to be moving in a new direction by focusing on the actual restriction of the use of the internet. In the current proposals for the Vertical Guidelines, the equivalence test for hybrid distribution scenarios is abandoned. DLC countdown no. 11 will discuss this topic in more detail.

The conditions for the imposition of territorial or customer restrictions in an exclusive distribution agreement (see, Article 4(b)(i) draft VBER) underwent an upgrade to make this exception more appealing and easier to apply in practice. The changes entail the possibility of shared exclusivity, the possible abolition of the parallel imposition requirement and the ability to pass on the active sales restrictions on the customers of the buyer. All of this is very technical and the exact changes will be outlined in DLC countdowns no. 12, 13 and 14. Have a look at these DLC countdowns if the topic is of interest to you.

A clear split can be made between two sets of topics, notably those where the existing regime will remain largely in place and those where the new rules are likely to bring changes.

The most important topics included in the first category are RPM and selective distribution.

The second category includes the regime applicable to online sales and the protection of exclusive distributors against active selling.

The degree of legal certainty created by the proposed new rules is not so clear. This is in part attributable to the fact that the description of certain hardcore restrictions in the draft Regulation is not always fully consistent with the language of the draft Guidelines. As you will see, the devil is often in the detail. DLC countdowns no. 9 – 14 will discuss the practical consequences of the likely changes in more detail and outline the areas of uncertainty.

The “DLC countdown” newsletters are offered to you by HAVEL & PARTNERS.

If you need more information or our assistance with setting up the distribution system, please contact Robert Neruda or Štěpán Štarha, who are the firm’s partners responsible for this area.

WANT TO KNOW MORE? STAY TUNED…

Counting down towards 1 June 2022, we aim to provide you with regular updates and the necessary legal knowhow in order to fully prepare your business for the future. Please also check out the Distribution Law Center platform (www.distributionlawcenter.com) and our LinkedIn page for much more information on the laws governing vertical agreements, covering both competition and commercial law. 27 specialized teams from all over the EEA are working hard to turn the platform into your favourite source of guidance and information.

Authors: Josef Žaloudek, Kristýna Šlehoferová

The Court of Justice of the European Union delivers approximately 40 to 50 judgments a year on VAT and its rules. The interpretation given by the CJEU in these judgments is effectively binding on EU Member States and should be followed immediately by local tax administrations. This makes knowledge of the judgments one of the most essential elements for the correct application of VAT rules, making VAT effectively the most interpreted (and in some ways the most changed) tax. To illustrate the importance of these judgments, below are examples of three CJEU judgments for 2021 and their impact on the operation of VAT.

In this judgment, the CJEU addressed a situation in which a Belgian company applied for a VAT refund in Hungary. However, on the application, it understated the amount of VAT for a part of the supplies received. Although being aware of this fact, the Hungarian tax administration did not notify the company accordingly and refunded VAT only on the lower amount stated in the VAT refund application. The company did not accept this fact. In its judgment, the CJEU admitted that the company was right, stating that the tax administration should always notify the taxable person of this fact in order to give them an opportunity to amend the application if necessary.

In such a situation, the tax administrations of all EU Member States should always be obliged to notify taxable persons if they believe that the information has been misstated in error.

ALTI was considered a person liable for VAT not paid by its supplier FOTOMAG EOOD. In this respect, the tax administration requested not only VAT on the supply concerned but also default interest, which ALTI did not accept. However, the CJEU held that EU VAT legislation does not preclude such a procedure if the liability for default interest is sufficiently justified by the Member State concerned with regard to the principles of legal certainty and proportionality and is enshrined in its law.

As a result, EU VAT laws in general allow individual Member States to introduce liability for related default interest. In the Czech Republic, the current legislation on liability for tax and its interpretation is narrower and applies only to unpaid VAT on a given supply. However, it cannot be ruled out that in the future there will be a change in the interpretation or the law directly that will allow liability for default interest as well.

In this judgment, the CJEU ruled that swimming tuition cannot be considered educational services exempt from VAT. Although it is of great public importance, swimming tuition constitutes specialised lessons that do not in themselves constitute the transmission of knowledge and skills relating to a large and varied set of fields and the extending and development thereof.

Swimming tuition with characteristics such as those in this judgment should not fall under the scope of educational services exempt from VAT.

HAVEL & PARTNERS, the largest independent law firm in Central Europe, reported record financial results for last year again. The firm’s total turnover grew by 7% year-on-year, with the second half of the year being more successful, when revenue growth reached almost 20%. Sales of legal and tax services amounted to EUR 951 million. The Czech branches of the firm announced year-on-year growth of nearly 7%, while the Slovak branch grew by 7.4% and profitability increased accordingly. In terms of the entire group, which also comprises the debt collection agency Cash Collectors and specialised tax advisory services, the turnover exceeded CZK 1.1 billion.

“Last year we once again confirmed our strong and extremely stable position in the Czech and Slovak legal market,” commented Jaroslav Havel, Managing Partner, on another successful period. “The firm has been growing steadily since its establishment 20 years ago. This trend has continued despite the ongoing coronavirus crisis and turbulent economic developments. Once again, it has proved that we are well prepared for market changes; we have precise financial management, are able to respond flexibly to our clients’ needs and are constantly developing future branches, such as digitalisation and technology, legislation, regulation and ESG,” added Mr Havel. In his opinion, the firm’s success is primarily based on building a unique relationship with clients and being able to guide them through their business, which results in the creation of strategic partnerships and a major competitive advantage.

Last year’s growth was positively driven by all practice groups within the firm, with M&A, the legal and tax structuring of personal assets, and real estate projects continuing to be key areas. The restructuring and insolvency and litigation groups have also been growing, as have the teams advising on technology law and venture capital, branches of business that have seen record investments in recent years.

In addition, HAVEL & PARTNERS again complemented its excellent economic shape with a number of local and international awards last year. The firm again became the absolute winner of the Czech Law Firm of the Year awards and also retained its top position in the prestigious global Chambers Europe Awards as the best Czech law firm. “I believe that these accomplishments are primarily a reflection of the maximum commitment and teamwork of all my colleagues in the firm, the exceptional quality of our expertise and the flexibility of our internal teams. For our clients, however, they are also proof that they entrust their business and private matters to the best law firm in the market,” concluded Jaroslav Havel.

Suppliers often provide commercial know-how to their distributors which they would not want to benefit their competitors. A critical situation in that respect is obviously the period immediately following the termination of a distribution agreement. The distributor is likely to switch to a competing supplier and there is a real risk that the distributor will share the know-how with his new supplier.

In order to address this issue, distribution agreements may include a so-called post-term non-compete obligation. This obligation prevents the distributor under certain conditions from engaging in competing activities following the termination or expiry of the distribution agreement.

While in certain limited instances (e.g. when the market shares of the parties are low) it is not excluded that such a post-term non-compete obligation does not qualify as a prohibited restriction of competition, it will, in many cases, be necessary to secure an exemption to render the restriction compatible with competition law and hence enforceable. The application of a block exemption regulation is the most efficient way to secure such an exemption.

The current vertical block exemption regulation applicable to distribution agreements is Commission Regulation 330/2010 (the “VBER”). The VBER exempts post-term non-compete obligations under the following strict and cumulative conditions, notably that the restriction:

The current proposals for the future regime leave the existing rules intact.

There is no need to change the existing practice.

The conditions governing the automatic exemption of post-term non-compete restrictions remain extremely strict. This applies in particular to the condition that the restriction must be confined to the premises and land from which the distributor has operated under the distribution agreement. This implies in practice that it suffices for the distributor to change premises (even within the same shopping area or village) to render the exemption inapplicable. There is tension between the condition that the post-term non-compete obligation must be indispensable (which is a very strict standard) to protect the know-how of the supplier and the extreme geographic limitation of such obligation. The relevance of this part of the VBER and the consistency between the cumulative conditions would definitely be enhanced by extending the geographic limitation to cover the entire area where the distributor was active with the sales and marketing of the products covered by the distribution agreement.

The “DLC countdown” newsletters are offered to you by HAVEL & PARTNERS.

If you need more information or our assistance with setting up the distribution system, please contact Robert Neruda or Štěpán Štarha, who are the firm’s partners responsible for this area.

WANT TO KNOW MORE? STAY TUNED…

Counting down towards 1 June 2022, we aim to provide you with regular updates and the necessary legal knowhow in order to fully prepare your business for the future. Please also check out the Distribution Law Center platform (www.distributionlawcenter.com) and our LinkedIn page for much more information on the laws governing vertical agreements, covering both competition and commercial law. 27 specialized teams from all over the EEA are working hard to turn the platform into your favourite source of guidance and information.

In cooperation with leading Czech cybersecurity experts at AEC, HAVEL & PARTNERS, the largest Czech-Slovak law firm, has launched the CYBER DEFENSE CENTER emergency hotline for companies being threatened by a cyberattack. The telephone line is in operation around the clock, providing clients facing an emergency with service 24 hours a day, 7 days a week.

In their practice, cybersecurity and technology specialists at HAVEL & PARTNERS have increasingly had to deal with cyberattacks aimed at companies, public institutions, and start-ups. This trend is supported by a growing number of cyberattacks reported to the National Cyber and Information Security Agency. In 2020, firms, organizations, and public institutions notified the agency of a total of 468 cyberattack incidents, twice as many as the year before.

Data and information are one of the most valuable assets of each organization. Data corruption or theft may have far-reaching consequences. “Cyberattacks are digital fires. Our motto is ´Connected through Success´, and if there is anything that can jeopardize success, we are ready to assist our clients in their defense. That is why together with AEC, we have decided to establish an emergency telephone line, which companies facing a cyber threat can contact at any time,” said partner Robert Nešpůrek about the new service.

If an organization does not have its own Security Operations Center, the CYBER DEFENSE CENTER line is an easily accessible and very useful solution in the event of a security incident. AEC experts are available around the clock to provide instant assistance and explain how to proceed step by step to fend off the attack as fast as possible, and thereby to minimize any potential damage.

AEC is one of the major European security service providers with one of the strongest ICT security teams in Central Europe. Its staff includes over 50 consultants with many years of relevant experience and the highest internationally acknowledged certifications. All this ensures that clients receive service based on top expertise.

The fact that the number of cyberattacks have skyrocketed should convince everybody that data security is not to be underestimated. The most powerful defense is prevention. An experienced HAVEL & PARTNERS team of more than thirty technology and cybersecurity lawyers have provided thousands of hours of legal advisory on data protection and assessment. They have handled hundreds of data projects and mastered the best practices tried and tested in international transactions. They assist our clients in finding the best practical solutions for cyber threat prevention setups and data protection, and can help them effectively remedy the consequences of security incidents.