Authors: Štěpán Štarha, Ján Kapec

Currently, the topic discussed in Slovakia is the efficiency of the procurement of legal services by the State. We learn from the media about budget savings associated with termination of unfavourable contracts, and at first glance it seems that only the lowest price offered by a legal service provider is the right evaluation criterion. However, when a person has a serious health problem, he/she is usually not looking for the doctor who will perform the cheapest operation, but the one who will do it best. We will explain why the same should apply when selecting legal services.

Did you know that the EU outsources legal services with a weight of only 30% price and 70% quality? In Slovakia, it is the opposite.

The Slovak Prime Minister has himself criticized in the media the use of external law firms by the State due to allegedly overpriced prices. At the same time, he has announced a plan to establish a “state law firm with the best lawyers”, which should represent state authorities in possible disputes. It is certainly true that the lowest price criterion is appropriate for supplies of generically and qualitatively interchangeable goods, in which a comparable quality of performance from individual suppliers (e.g. utilities, food, etc.) can be expected when specifying corresponding parameters. However, the question is whether it is also possible to procure in this way legal or consultancy services that the public sector procures from its external advisors, as their complexity goes beyond the normal agenda of in-house specialists.

If a client from the private sector decides on the selection of professional advisers, he is interested not only in the price of the services offered, but also in the method they are provided, the advisor’s references, the team composition, and the advisor’s specific knowledge and expertise. The client’s interest is primarily to achieve a 100% result in terms of the scope and quality of the service, while excluding or minimizing any future risks. This is clearly true of matters of great importance to the contracting authority, in which any possibility of failure must be minimized or ruled out (disputes over extremely high amounts and values or highly specialised activities). If the output of the ordered service is to be a professional legal assessment or recommendation in such a fundamental matter, it is quite clear what is the difference between the assessment or recommendation prepared by an average expert compared to that of a respected specialist.

In the end, paradoxically, the lowest hourly rate does not even have to mean the lowest total price that the client will pay for the service provided. If a lawyer is not a specialist in a specific legal area, then due to limited experience in dealing with a given type of cases, he/she is usually less efficient and the work itself will take him more time compared to a specialist. Therefore, the client can subsequently pay the same or even higher price for the legal service provided than in the case of another provider which, although it originally offered a higher hourly rate, will spend significantly less time addressing the matter. Therefore, in our opinion, it is not right to organise a tender for professional legal (or, in general, also consulting) services exclusively with a single criterion that is the lowest price.

The level of the price of professional services depends to a large extent on the costs of professionals working for a respective firm; the better employees such a firm hires, the higher the costs of their remuneration, which is also reflected in the price of the service. Therefore, it is desirable to select a legal counsel using a combination of a wider range of criteria, where the assessment of the quality of the service offered has much greater weight.

Only this solution will lead to the selection of the most cost-efficient solution. At the same time, such a solution will make it possible to eliminate the risk of selecting an insufficiently qualified or technically, economically, personally or otherwise equipped counsel for a given public contract.

Public contracts on the principle of the prevailing qualitative criteria (over the lowest price) are also awarded by European institutions, including the European Commission. The EU awards public contracts for legal services with a weight of only 30% price and 70% quality – in the Slovak Republic it is the opposite, while mostly 70-80% of the evaluation is the price and the maximum (if at all) remaining 30-20% is the quality.

The client needs a lawyer who will win the dispute at the end of the day, save costs or otherwise help him/her effectively when he/she has problems. If a person has a serious health problem, he/she is usually not looking for the doctor who will perform the cheapest operation, but the one who will do it best. Similarly, a prudent businessman primarily approaches experienced and capable professionals to ensure success in his/her matter and not to risk losses or reputational risks.

Top lawyers have a quality education and spend a lot of time on demanding transactions and cases. At the same time, the experience, knowledge and references of top lawyers are the “variable” that will help the client achieve a 100% result in terms of the scope and quality of the service, as well as time efficiency of its provision, while minimizing any future risks.

Unfortunately, a brilliant brain is not a measurable value that you simply put in the tender documentation. However, in law practice, it is the most important factor, together with loyalty to the client, encyclopaedic knowledge of the law, and the willingness to work hard, especially in cases where lawyers work for the State or the public sector.

Dear Clients and Business Friends,

Because in our view, the legal profession is not only about law, but also about communication, supporting awareness, inspiring each other and sharing useful know-how, we bring you the second issue of our H&P Magazine, this time an extended version. You will find a number of thematic articles, interviews and analyses related to current societal topics, as well as interesting tips and presentations of some of our practice areas and our other activities.

Let me also share with you this year’s extraordinary success of HAVEL & PARTNERS for which we are immensely grateful, especially in this difficult year. In early November, with four awards including the main award for domestic law firm, we became the absolute winner in the Law Firm of the Year in the Czech Republic competition, which is organised under the auspices of the Czech Bar Association and the Ministry of Justice of the Czech Republic. Our firm has also won three awards and achieved a historical success in the same competition in Slovakia, as well as winning the most popular law firm among clients category in both countries. HAVEL & PARTNERS has also won the most prestigious global award, Chambers Europe Awards 2020, for the best law firm on the Czech market. In addition to this, we have consistently been ranked the most sought-after employer and the most prestigious brand in the field of legal services.

At this point, I would like to thank all my colleagues for their enormous dedication and paramount quality of their work, and also you, our clients and business partners for entrusting us with both your business affairs and purely private matters, inspiring and motivating us to constantly move forward.

I wish you not only useful and inspiring reading, but above all good health and a great deal of optimism.

On behalf of the entire firm

Managing Partner

Authors: Václav Audes, Jan Diblík, Kateřina Slavíková

The coronavirus pandemic has stirred up debates about the need for healthcare in the Czech Republic to be modernised so that it can operate remotely without direct contact with the patient. Telemedicine, as the remote provision of healthcare is called, would reduce unnecessary travel to healthcare appointments or prolonged periods spent in waiting rooms. The concept of telemedicine is neither known to nor defined by Czech legislation yet. The first step for enshrining it in Czech law will be, to a certain extent, the amendment of the Health Services Act as well as the pending Healthcare Electronization Act.

Telemedicine could make healthcare in the Czech Republic much more affordable for patients (not just during a pandemic).

Telemedicine is based on modern technology that makes it possible to provide comprehensive care to patients from an initial consultation and diagnosis through monitoring and treatment to prescription and delivery of medicinal products or electronic issuance of a sick certificate. All by means of remote communication and data transmission. This can easily make quality and cost-effective healthcare services available to patients, regardless of where they are physically located. Thanks to the availability of such services, patients will not neglect their problems, thus avoiding hospitalisation and unnecessary visits to the emergency room. This could also result in significant savings.

Moreover, healthcare electronization will enable the collection of vast amounts of data that experts can analyse and use for research. Case modelling and the use of artificial intelligence can help detect diseases early, increasing the chances of patients’ recovery.

Last but not least, telemedicine can make an important contribution to reducing the risk of coronavirus or other infections. Indeed, it would reduce the prolonged stays in waiting rooms, or unnecessary multiple healthcare appointments, before the patient can reach a specialist who could actually solve their problems.

But the Czech legal system does not yet know and define the concept of telemedicine. The sector is thus covered by legislation from many sectors, which was developed long before telemedicine, and is therefore not very up-to-date. Under the legislation, a healthcare service provider is responsible for providing healthcare services to the patient lege artis, i.e. in line with current medical science. This is true even in the case of healthcare provided remotely by physicians. But discussions are held on whether they will meet this standard if they do not see the patient at all and do not physically check the patient.

In the meantime, services are being developed on the market that get ahead of such discussions and implement telemedicine practices outright. The most immediate chance to enshrine telemedicine in Czech law is the Ministry of Health’s amendment to the Healthcare Services Act, now being drafted by the Ministry of Health, which should allow the provision of consulting services or clinical pharmaceutical care at a distance.

Some component concepts of telemedicine are already regulated by Czech law, and some are used in practice, including e-certificates and e-prescriptions. But other attempts in the field of healthcare Electronization continue to hit their limits. For example, under the Health Services Act and the Medical Documentation Order, it is now already possible for a health service provider to keep records exclusively electronically.

However, electronic systems often fail to meet the requisite criteria, and practitioners still keep patient records in paper files. A patient’s remote access to their medical records is not covered in detail under the current legislation either, therefore in practice doctors still issue paper extracts from electronically kept documents to patients. But the amendment to the Healthcare Services Act should also enable remote access to medical documentation; it will then be up to individual physicians to cope with the technology.

The European Union also plans that its citizens should have electronic access to medical documentation. But questions regarding patient identity verification and documentation security as well as communication with patients will need to be answered before its launch.

In addition to the Healthcare Services Act, the Healthcare Electronization Act could also solve some of the above-mentioned problems in the future. It provides for a new patient identifier, which should replace birth numbers entirely. It also introduces a new integrated data interface to enable secure data sharing among all participants. The new system should also interlink the existing ones such as e-Certificates and drug records.

According to initial plans, the new interface was scheduled to be put into operation from 2022. But it is now already clear that the project will be delayed. In fact, the drafting of the law gets constantly protracted. According to former Health Minister Adam Vojtech, the Parliament was to decide on the bill by the end of this parliamentary term in autumn 2021. But given the recent developments regarding the position of the minister of health, the bill can be expected to undergo significant changes, which is why it is unclear when the law might actually come into force.

Furthermore, an important issue to keep in mind when modernizing the healthcare sector is trust. Doctors or patients will not feel safe if they do not trust the new healthcare system. It is therefore crucial that the new legal regulation convinces all parties that telemedicine is trustworthy. This is by far the most important factor for the remote provision of healthcare.

There is probably nothing that can stop the development of telemedicine now. If properly conceived and professionally executed, it poses another natural progression stage in the provision of services in general, specifically healthcare services in this case. As we have already indicated, its potential is enormous. Combined with the processing of so-called big data or artificial intelligence, or machine processing of selected input data, it is a powerful tool that has the potential to substantially increase the standard of living not only in developed countries, but perhaps even more so in developing countries.

We believe that the evolution of telemedicine is in its infancy, with its true potential to be still discovered. Let us hope that Czech users – patients as well as the developers and providers of telemedicine services – will not fall behind in seizing this potential.

In the ranking of the TOP 10 largest law firms, which the daily SME and The Slovak Spectator compile according to combined objective criteria, HAVEL & PARTNERS is the largest Czech law firm, the fourth largest regional law firm and overall the seventh largest law firm operating on the Slovak market. At the same time, HAVEL & PARTNERS has become one of the largest law firms providing legal advice on mergers and acquisitions, as well as banking and finance.

In another ranking, which reflects the number of cases for which the legal fee included more than EUR 20,000, HAVEL & PARTNERS ranked fourth overall, even third at a regional level. “We highly appreciate our ranking in the leading positions and we are pleased that we are constantly rising in all rankings, despite the coronavirus crisis. We want to further strengthen our position as the largest and most successful Czech-Slovak law firm, which is the first choice for Czech companies operating in Slovakia and Slovak companies operating in the Czech Republic. In this regard, we have extraordinary experience, business contacts and unique know-how,” said Jaroslav Havel, the firm’s founder and managing partner.

With this ranking, HAVEL & PARTNERS confirms not only its status as the most successful law firm with the most comprehensive services in the Czech Republic and Slovakia, but also the most successful year in its history. In addition to the above positions, it also had a historic success in the Law Firm of the Year 2020 competition in Slovakia, where it won the Best Client Services award as well as the Mergers and Acquisitions and Energy and Energy Projects categories. In the Czech Republic, it once again became the absolute winner of the Law Firm of the Year 2020 competition and also won the most prestigious global Chambers Europe Awards for the best law firm on the Czech market.

The TOP 10 ranking, the results of which were published on 23 November 2020 online on the website www.sme.spectator.sk, is a ranking of the largest law firms in Slovakia. Since 2015, it has been compiled by the SME daily in cooperation with the English newspaper The Slovak Spectator. The methodology and complete results are available HERE.

Authors: David Krch, Jaroslav Šuchman, Martina Sumerauerová

Thanks to the development of IT technology, the possibilities of digitising accounting and tax documents have increased significantly over the last few years. Until a few years ago, only some of our clients worked with digitised documents, now we hardly know anyone who does not use this option in some form, as the digitisation of documents brings many benefits, including significant savings in document archiving costs. As a result, as part of the introduction of new digitisation systems, clients have often asked us recently whether it is possible to digitise accounting and tax documents in order to comply with existing legislation.

The digitisation of ordinary (paper) accounting documents is not regulated in accounting and tax legislation in a way that reflects the current technological possibilities. Our legislation is very outdated in this respect and does not lay down clear rules for the procedure and method of digitisation.

The statutory rules are set out in particular in the Accounting Act and the VAT Act. Conversely, no statutory requirements are specifically regulated by the Income Tax Act. Overall, the available legal requirements can be summarised by stating that archiving original paper documents in electronic form is only possible with the appropriate setting ofinternal document scanning processes.

It should therefore be stressed that simply scanning the invoice received from the supplier without sufficient technological and procedural security is not sufficient and runs the risk that the document thus archived will not be accepted by the tax authorities.

Therefore, based on our consultations with the tax administration authorities regarding this subject to date, please note that even a well-designed internal processes system does not completely eliminate the risk that the tax administration authorities will proceed in a strictly formalistic manner and also require for documents submitted in the electronic version identical documents in (the original) paper form as a condition of tax eligibility for income tax purposes or a condition for claiming an input VAT deduction.

While we have not yet encountered such a purely formalistic approach by the tax administration authorities in our clients’ practice, we caution clients that such a situation cannot be completely ruled out.

In most cases tax documents contain or may contain personal data of individuals, therefore, the personal data protection regulatory rules should also be taken into account when processing such data and the requirements arising from those rules should be complied with.

We are happy to help you with the appropriate setting of electronic document archiving processes in tax and accounting as well as personal data protection and to provide you with detailed information.

Authors: Dušan Sedláček, Jan Králíček

Initially, Act No. 191/2020 Coll., also known as Lex Covid Justice, responded to the crisis caused by the SARS CoV-2 virus. The Act caused a number of significant changes in the field of insolvency law. We published a basic overview of information on this law in our article of 1 April 2020, which is available at this link. A new Act called Lex Covid Justice II which was presently approved, follows to previous legislation and renews a number of previously available measures aimed to relieve businesses in financial distress. On 10 November 2020, the Chamber of Deputies of the Parliament approved the draft Act after its return by the Senate in the original wording. Therefore, the signing by the President and the entry into force of the Act can be expected in the upcoming days.

From the variety of measures, we draw attention in particular to the renewal of extraordinary moratorium, i.e. debtor´s protection against creditors declared by the insolvency court on the basis of the mere debtor´s form request, without factual review. According to the explanatory memorandum, this measure has allegedly proved itself. The low number of previously announced extraordinary moratoriums is supposed to indicate that this institute was not overused.

However, a significant increase of extraordinary moratoriums can now be expected, especially within the sectors most affected by the loss of demand. An extension of previously granted extraordinary moratoriums can also be expected, as creditors’ consent will not be required (see below). As before, the debtor´s obligation to file an insolvency petition is suspended if the insolvency situation is caused due to COVID-19 and government emergency measures.

An early identification of the problem is crucial for creditors. Debtors, on the other hand, should not delay filing an insolvency petition even if the deferral is theoretically applicable in their situation. Even in such a case, the management of the debtor is obliged to proceed with due managerial care. Therefore, if the negative financial situation is not only temporary and there is no prospect of its improvement, all that remains is to resort to insolvency proceedings.

Under the original legislation, debtors who got into problems in connection with the COVID-19 and were not declared insolvent before the announcement of emergency measures (i.e. 12 March 2020) could file a petition for judicial protection against creditors in the form of a so-called ‘extraordinary moratorium’. Petitions could be filed until 31 August 2020.

Lex Covid Justice II aims to renew this measure, the deadline for submitting a proposal for an extraordinary moratorium is extended until 30 June 2021. As before, this option will be open to debtors who have experienced temporary problems in connection with COVID-19 and were not declared insolvent before 5 October 2020. Protection under the extraordinary moratorium consists in the fact that during its duration it is not possible to decide on the debtor’s bankruptcy and it is also not possible to carry out execution on his property.

Debtors who have been granted protection under the previous legislation will not be able to apply for a new extraordinary moratorium. So far, a total of 61 extraordinary moratoriums have been declared. This limitation is intended to prevent the potential chaining of extraordinary moratoriums.

However, for these debtors, its extension is still possible. Due to the risk that debtors will not be able to obtain the creditors´ consent to extend the existing extraordinary moratoriums, the new legislation stipulates that the creditors´ consent to extend previously declared extraordinary moratoriums (i.e. in relation to petitions filed before 31 August 2020) is no longer required. This change was at first rejected by the Senate. However, the Chamber of Deputies approved the original draft Act including the change that allows the extension of existing extraordinary moratoriums without the consent of creditors and thus retroactively changes the rules of this measure.

The new extraordinary moratoriums will be limited again to 3 months, with the possibility of extension for another 3 months. The extension will require the consent of the majority of the debtor’s creditors, calculated according to the amount of their claims.

The original Lex Covid Justice brought a change in relation to the basic obligation of the debtor’s management to file an insolvency petition without delay, which was suspended until 31 December 2020 – in case the debtor found himself in crisis due to COVID-19 and government emergency measures.Due to the pandemic, a higher risk of poor payment morale of business partners is expected, therefore overdue liabilities may be piling up. The original Lex Covid Justice was intended to prevent otherwise viable businesses from filing insolvency petitions prematurely. Lex Covid Justice II is now extending this period, in which the debtor’s obligation to file for insolvency is suspended, until 30 June 2021.

The measure by which creditors were restricted in filing creditor insolvency petitions from 17 April 2020 to 31 August 2020 is no longer renewed. Consequently, the creditor’s right to file insolvency petition is not affected by the new regulation.

In the area of debt relief and reorganisations, Lex Covid Justice II extends the grounds for preservation of approved debt relief even where there are grounds for its cancellation and extends the possibility to suspend the implementation of the reorganisation plan without the threat of turning reorganisation into bankruptcy liquidation.

Under the original Lex Covid Justice, the court enforcement of a decision (and enforcement by bailiffs) could not be carried out by the sale of movable property or the sale of immovable property where the obliged person had his/her permanent residence (with the exception of, for example, maintenance claims).

The government’s Lex Covid Justice II draft provided for the extension of this measure only for movable property. Due to an amendment submitted in the Chamber of Deputies, it was eventually approved that the prohibition of enforcement shall apply to both movable and immovable property until 31 January 2021. Regarding immovable property, the prohibition again applies only to immovable property where the debtor has a permanent residence.

HAVEL & PARTNERS has continued its success at the Chambers Europe Awards 2020 for the Best Law Firm on the Czech market and became the absolute winner in the Law Firm of the Year 2020 awards in the Czech Republic. In the 13th year of the competition, the firm has won four awards: the main prize for the Czech law firm and for the Best Client Service, and at the same time, was ranked first in Mergers and Acquisitions and Competition Law. These are the firm’s best results in its history. This year, HAVEL & PARTNERS also achieved excellent results at the Slovak Law Firm of the Year awards, having won 3 awards, including the Best Client Service award. The results of these prestigious awards, regularly organised by EPRAVO.CZ under the auspices of the Czech Bar Association and the Ministry of Justice of the Czech Republic, were announced online on 3 November 2020.

HAVEL & PARTNERS has been awarded the best Czech law firm for the fourth time in the last six years. At the same time, it retained the award for Best Client Service, which it also received in Slovakia this year. With a total of four awards, HAVEL & PARTNERS became the absolute winner of the 13th year of the Law Firm of the Year awards in the Czech Republic. “This year has been extremely difficult for the entire world. All the more we value our victory in the most prestigious global and domestic awards. It is primarily an appreciation of the top expertise, loyalty and maximum commitment of all our colleagues and their ability to cope with all the adverse circumstances brought by the COVID-19 pandemic. This is what I want to thank them for. To our clients, this is a confirmation that they work with the best law firm in the market that is a leader not only in times of prosperity but also in times of crisis and that can effectively help them deal with its consequences,” said the firm’s founder and managing partner Jaroslav Havel. “I would also like to thank our clients, because it was their references that allowed us to become the law firm most popular with clients in the Czech Republic and Slovakia. I actually want to thank our clients too, for entrusting us with their business and purely private matters and motivating us to continue moving forward,” added Mr Havel. He views this year’s success as the best possible entry into 2021, in which the firm will celebrate its 20th anniversary.

For the second time in a row, HAVEL & PARTNERS took home the first place award for Mergers and Acquisitions, which have been the firm’s flagship since its foundation in 2001 and in which it has been the market leader for more than 10 years in the Czech Republic as well as in Slovakia and throughout Central Europe. “The past period has been very successful for our firm in terms of transaction advice. We conducted the largest number of transactions and became the winner of the Law Firm of the Year in the Czech Republic awards for the second time in a row. This year, we were even recognised by the same award in Slovakia. My thanks go to the team of more than eighty colleagues, because it is their excellent knowledge, unique know-how, as well as their human and proactive approach that have allowed us to carry out more than 700 transactions with a value exceeding 700 billion Czech crowns in the last 15 years,” commented Jan Koval, a partner participating in the management of the largest transaction team on the market, of the victory. In terms of the number of successfully completed transactions, since 2009 the firm has been regularly ranked at the top of the recognised international rankings EMIS DealWatch and Mergermarket in the ranking for the entire region of Central and Eastern Europe.

HAVEL & PARTNERS received the recognition for Competition Law for the fifth time in total and is the most successful law firm in this branch of law by a large margin. “The fifth victory out of nine years in which this category was announced confirms our exceptional position among law firms focusing on competition law. We are the only firm in the market who effectively links legal and economic competition advice. This allows us to offer our clients unique know-how for resolving complex issues relating to competition protection and regulation,” said Robert Neruda, the partner leading the competition practice group, which is comprised of more than 20 lawyers and economic experts.

HAVEL & PARTNERS has been included among highly recommended firms (top tier) in other 13 categories and among recommended firms in 2 categories. This is proof of the firm’s versatility and the quality of all of its teams. In Criminal Law, in which category HAVEL & PARTNERS does not directly participate itself, SEIFERT A PARTNERS, a law firm cooperating with HAVEL & PARTNERS on an exclusive basis in criminal law advice, was named among the best rated firms. “These excellent results are proof of our versatility and exceptional quality of all our specialised teams. I strongly believe that we will continue our achievements in the next year, which will be our firm’s anniversary year,” concluded Havel.

According to the total number of nominations and awards received in all years of the Law Firm of the Year awards, HAVEL & PARTNERS continues to be the most successful and all-encompassing legal practice in the Czech Republic and Slovakia.

Authors: Ondřej Majer, Štěpán Štarha, Lenka Ostró

By its Resolution no. 678 of 22 October 2020, the Government of the Slovak Republic ordered a curfew for the period from 24 October 2020 to 1 November 2020 between 05.00 a.m. and 01.00 a.m. of the next day, restricting access to shopping malls and stores with the exception of grocery stores, drugstores and pharmacies, while the stores were allowed to remain opened. Subsequently, by Resolution of the Government of the Slovak Republic no. 693 of 28 October 2020, the curfew was prolonged and extended from 2 November 2020 to 8 November 2020 between 05.00 a.m. and 01.00 a.m. The extended curfew does not apply citizens with a negative result of the RT-PCR test and/or the antigen test certified in the territory of the European Union for the COVID-19 disease and performed no later than 24 hours before 24 October 2020.

Below is a short summary of the obligations that apply to employees based on the curfew and how employers can protect their employees.

If the result of an employee’s RT-PCR and/or antigen test is positive, the employee must stay at home in a 10-day quarantine, and must contact their general practitioner who will issue to the employee a certificate of temporary incapacity for work due to the ordered quarantine or isolation. During such “pandemic” incapacity for work the employee receives sickness allowances from the Social Security from the first day – known as pandemic incapacity for work.

Employees who do not undergo the test are not permitted to report to work during the time period concerned and are obliged to stay at home in quarantine for at least 10 days. Pursuant to the Labour Code, this constitutes personal obstacle to work on the part of the employee.

The employee is obliged to inform the employer of such obstacle in advance and agree on working from home if the nature of the employee’s work so permits, or on taking vacation. If neither of the two options is possible, we believe that this constitutes an obstacle on the part of the employee. For the duration of such obstacle the employer is obliged to excuse the employee’s absence from work but is not obliged to pay any compensation for wages to the employee. Thus, the employee is on unpaid leave.

Following the general testing, employers have the right to ask employees to produce proof that they have a negative test for COVID-19, whether from the general testing or from any other authorised testing, or to produce a certified proof of exemption that they did not have to undergo the test. If an employee is unable to produce the result of such test or proof of exemption from the testing obligation, the employer must restrict such employee’s access to the workplace.

Employers are entitled to demand this information from employees under Decree no. 16/2020 of the Public Health Authority of the Slovak Republic of 30 October 2020.

The curfew in effect since 24 October 2020 and the increasing numbers of infected persons have paralysed many operations in various industries. Therefore, the Government has introduced a new state aid programme for the affected entrepreneurs, known as “Prvá pomoc +” (“First Aid +”). Below is a short outline of changes in the new state aid programme.

Entrepreneurs may apply for state aid under the “First Aid +” project based on its revised terms and conditions for October 2020 for the first time. As usual, all details (in Slovak) regarding the aid are available at www.pomahameludom.sk.

Apart from the changes to the terms and conditions, the Government has also extended the period of time during which employers can apply for the contribution to January through March 2021.

The employment authority will distribute amendments to previously executed agreements to existing applicants from 2 November 2020. New applicants who have not signed an agreement with the employment authority may apply for the aid in the week of 9 November 2020, until 31 January 2021.

In the first group, applications for the contribution can be again submitted by employers who had to shut down or restrict their operations on the basis of the Measure of the Public Health Authority, whereas the measure introduces the following changes:

In the third group, i.e. employers who are afflicted by the current emergency but who have not shut down their operations due to the Measure aforesaid, the rules have also been modified:

Apart from the above-described aid to legal entities – employers, the Government has also increased the financial contribution intended for independent contractors. In addition, the state will provide an SOS subsidy of EUR 300 to citizens who lost their jobs during the crisis.

Special aid in a total amount of EUR 100 million will be provided to entrepreneurs doing business in tourism. Applications may be submitted by restaurants, cafes, bistros, hotels and pensions, aquaparks and swimming pools, tour guides, botanical gardens, zoos, nature reserves, theme parks and amusement parks, museums, historical monuments and tourist attractions, and ski tow, ski lifts and cable car operations (the list of eligible beneficiaries will be specified by the Slovak Ministry of Transport and Construction).

Application for this aid is conditional on a decline in the revenues of entrepreneurs in this sector in the period from 1 April 2020 to 31 December 2021 by more than 40% as a result of the pandemic compared to 2019, and the contribution will range from 1.4% to 10% depending on the decline in revenues.

Although the persisting crisis in the market is unbearable for many entrepreneurs, the increased state aid as well as the modified active measures adopted in the labour market may have some positive effects, even though those effects will manifest themselves later. However, the results may to a certain extent be distorted by measures towards gradual alleviation of the restrictions, or by a strict lockdown. Of course, we will continue monitoring the developments and will keep you updated on any new adopted measures.

Authors: David Krch, Vlaďka Laštůvková

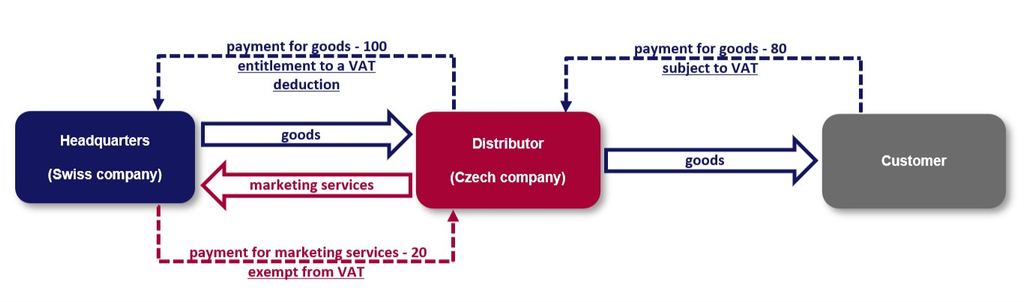

Recently, a debate has been sparked in the pharmaceutical industry on the correct setting of distribution models in terms of VAT. It was triggered by the decision of the Municipal Court in Prague that upheld the opinion of the tax administration in the case at hand according to which the Czech distributor should have also recorded in its tax base the payment for marketing services paid by a foreign supplier of medicinal products because, the tax authority asserts, this income constituted a payment by a third person for the sale of medicinal products in the Czech Republic. Hence, income from marketing services invoiced abroad should be subject to the Czech VAT. The correctness of this opinion is yet to be decided upon by the Supreme Administrative Court.

A Czech pharmaceutical company as a distributor of medicinal products (the “Distributor”) was purchasing medicines as a member of a group from a European warehouse seated in Switzerland (the “Headquarters”), which it supplied to other entities on the Czech market (wholesalers and pharmacies). However, due to price regulation in the Czech Republic, the Distributor was selling the medicinal products at a lower price than the price it purchased them for from the Headquarters.

At the same time, the Distributor was receiving payments for marketing services from the Headquarters, which ensured that the Distributor was profitable from the perspective of transfer prices, despite selling the medicinal products at a loss. The Distributor reported the marketing services as a provision of services with the place of supply outside of the Czech Republic; therefore, the income from such supply was exempt from VAT in the Czech Republic (with the entitlement to a tax deduction).

In the above model, as a result, the Distributor recorded lower tax liability. The tax administrator assessed this difference as additional tax to the Distributor equalling the VAT that would have been paid (save for relevant sanctions) if the marketing services supply had been subject to the Czech VAT.

The court ruled that the marketing services constituted partial supply that was part of the distribution and should have been considered, from the VAT perspective, a secondary activity used for the purpose of obtaining benefit from the main activity (i.e. the distribution of medicinal products) under the most favourable terms. Therefore, both activities should have been subject to the same VAT regime and the Distributor should have been paying VAT from the income from the marketing services in the Czech Republic just like from the income from the sale of medicinal products.

In this regard, the court upheld the decision of the tax administrator to the effect that “a customer purchasing medicinal products from the claimant is the recipient of a single indivisible supply (distribution and marketing),”adding that the provision of marketing services alone without any link to the distribution of medicines would not make any sense, “as the aim of such marketing is certainly to increase the customer awareness of medicines distributed by the claimant, and, as a result to increase the marketability of these medicines” to end customers in the Czech Republic.

At the same time, the court agreed with the tax administrator’s opinion to the effect that for the Headquarters, marketing was a secondary benefit. To support its opinion, the court asserted, among other things, that the Distributor was the owner of the medicines when the marketing services were provided and as such was the holder of the registration of the medicinal products. The Headquarters was thus neither a manufacturer of the products nor the holder of the distribution licence in the Czech Republic, and therefore could not be the recipient of the marketing services on the Czech market.

Given the above[1] the court concluded that the supply for marketing services was in fact “a payment received from a third person” for the sale of medicines when the Headquarters paid the costs for the marketing activities on behalf of the Distributor as the Distributor could not charge them to its customers as part of the price for medicine due to the price regulation in the Czech Republic. The court substantiated the fact that the marketing costs were already part of the price paid for the distribution of medicines by claiming that the Distributor was unable to distinguish distribution costs from marketing costs in its books.

In connection with the court reasoning, it needs to be added that during a previous income tax inspection, the Distributor declared to the tax administrator that marketing services were part of the services comprising the distribution of medicine and did not constitute a separate supply. That contributed to the fact that the Distributor was profitable in terms of transfer pricing despite the sale of medicine at a loss; had there been two supplies, a higher profit margin would have had to be applied to the marketing services. However, during a VAT inspection, the Distributor argued that it was performing two separate supplies – distribution and marketing which, as the court claimed, the Distributor failed to prove.

Even though we will have to wait for the clarification of the correct setting of the distribution model described above until the Supreme Administrative Court rules on the case or until the Court of Justice of the EU makes a statement in its preliminary ruling, it is already clear that it is necessary to proceed in a prudent manner during tax inspections at all times, and that any statement to the tax administrator must be assessed in a comprehensive manner since what may seem appropriate in certain proceedings may cause major problems in other proceedings.

If the Supreme Administrative Court eventually upholds the findings of the Municipal Court in Prague, the business models based on similar principles would have to be revisited as a result and companies applying this model could face a higher risk of additional assessment of VAT. What is more, these findings do not only concern pharmaceutical companies but all entities using a similar model, particularly in areas where prices are capped.

To conclude, it is worth mentioning that the Supreme Administrative Court should deal with the arguments presented by the Municipal Court and clarify whether a payment from the Headquarters in favour of the Distributor could truly be considered a payment received from a third person in connection with the supply of medicinal products to customers. What seems crucial for the resolution of this dispute is the factual knowledge of the pharmaceutical environment.

[1] Besides the above, the court also assessed the possibility of the Distributor and the Headquarters to make a services contract and real possibilities of the Distributor to influence the scope of promotion of the distributed medicinal products.

Authors: Ondřej Florián, Pavlína Petráčková

Another substantial change introduced by the large amendment to the Companies Act (the “Amendment”) is the long-awaited new arrangement of the one-tier corporate governance system of a joint-stock company. In this third issue of our Guide to the Corporate World after the Amendment, we take a look at the one-tier system, which is to be profoundly changed.

Under the existing legal regulation, joint-stock companies with the one-tier system are obliged to establish two elected bodies, namely the governing director (statutární ředitel) and the management board (správní rada). It is further stipulated that the provisions of the Companies Act regarding the board of directors and the supervisory board shall be applied with necessary modification to the governing director and the management board, respectively.

As a result, the current form of the one-tier system composed of two elected bodies is not very much different from that of the two-tier governance system of a joint-stock company. Essentially, the two-tier and the one-tier systems are only different in name, the precisely defined powers of the board of directors and the supervisory board, as well as the fact that different offices may not be held by the same person, as opposed to the one-tier system (as the governing director may concurrently be a member of the management board). In addition, the aforesaid application with necessary modification in conjunction with the inexact definition of the one-tier system has continuously caused notable interpretation issues concerning the position and powers of the governing director and the management board, as it cannot be unambiguously determined which provisions regarding the two-tier system are to be applied to the one-tier system and to which specific bodies. This uncertainty may be very dangerous for (particularly different) persons holding the office of the governing director and that of a management board member.

The Amendment is about to introduce a substantial change by abolishing the office of governing director and fully replacing it with the management board. As a result, the management board will accumulate executive and supervisory powers; the board will be both a supervisory body, which will oversee the company’s activity, and a governing body, which will be vested with the company’s management.

Similar to the board of directors in the two-tier governance system of a joint-stock company or executive directors of a limited-liability company, the management board will be governed by the principles and instructions approved by the general meeting, provided that these are in accordance with legal regulations and the articles of association. However, no one will be entitled to instruct the management board as to the corporate management or the supervision of the company’s activity, except for cases of the management board expressly requesting the general meeting to do so, or if instructions are given within a concern. Instructions concerning the management or supervision of the company’s activity must be distinguished from strategic and systemic instructions, which may be given by the general meeting if they do not breach legal regulations or the company’s articles of association.

The Amendment further stipulates that persons different from management board members may not be authorised to perform the management board’s power to set out the fundamental direction of managing and supervising the company’s activity; likewise, this powermay not be distributed among management board members according to certain fields. However, as stated in the explanatory report of the Amendment, we must note that such prohibition of delegating powers only applies to the “fundamental” direction of management, which implies that the law does not prohibit the possibility to authorise a member of the management board or a person different from such a member to exercise “ordinary” management.

The management board is to have three members, unless otherwise stipulated by the company’s articles of association – fewer or more members may be provided in this way. The Amendment further removes the explicit regulation of the management board chair, which might imply that a chair of the management board of a one-tier governance joint-stock company is vested with certain powers independent of the management board. However, this does not mean that a management board composed of several members will not elect their chair; it only means that they are to proceed in accordance with the general provisions of the Companies Act.

The Amendment also expressly lays down a rule for electing and removing management board members – this is a power vested in the general meeting. It further allows for issuing shares of stock with the right to appoint one or several members of the management board or to remove the member appointed in such way. The overall number of management board members appointed in such manner must not exceed that of the management board members appointed by the general meeting. As the Amendment does not include a legal regulation similar to the divisibility of the number of members by three applying to a supervisory board, and the fact that the management board accumulates both executive and supervisory powers, it may be inferred that the provisions regarding employee participation, which have been frequently discussed under the current regulation of the management board,are unlikely to apply to the management board.

Finally, the Amendment clearly stipulates that with regard to the mixed nature of a management board member’s office, such person will be subject to the provisions concerning a supervisory body member’s conflict of interest. It further unifies the non-compete regulation, provisions regarding the termination of office and election of a new member, co-opting possibilities, elections of replacement candidates or rules for decision-making under the legal regulation of a board of directors.

All changes regarding the new concept of the one-tier governance system of a joint-stock company become effective as of 1 January 2021. However, the Amendment includes numerous transitional provisions in this respect, namely:

With regard to the changes outlined above, we recommend that all joint-stock companies with a one-tier governance system should gradually start making themselves familiar with the wording of the Amendment and making preparations to introduce the necessary steps required in this respect.

It will be inevitable that such companies’ articles of association will need to be reviewed and amended so that their new wording corresponds to the amended wording of the Companies Act, at least to the extent specified by its peremptory provisions. This change may also be made now with deferred effect or without undue delay after the Amendment becomes effective, but no later than within the time limits set forth by the transitional provisions addressed above.

Our corporate team is always ready to assist you in making the necessary preparations for the planned changes.

Authors: Róbert Neruda, Lenka Gachová, Tomáš Varšo

The Antimonopoly Office of the Slovak Republic (the “AMO”) has submitted a draft of a completely new Competition Act (the “Draft”) to the inter-ministerial comment procedure (the “ICP”). You can read about the plan to submit a new Act instead of a simple amendment to the current one on our blog,[1] where we described why the AMO is going this direction. In this issue of Competition Flash, we will briefly present to you the most fundamental change in terms of content which the Draft entails.

If you currently contact a lawyer at the beginning of the planned transaction with a question whether you will have to notify the AMO, your conversation will revolve mainly around the turnovers of the participating undertakings. If you already have this experience, you know that the current turnover thresholds for the obligation to notify a transaction are relatively high (EUR 46 million and EUR 14 million for the territory of the Slovak Republic and worldwide, respectively).

However, much smaller undertakings will also probably have to be vigilant after the Draft comes into effect. The Draft brings about a new notification criterion partly independent of the turnovers of the parties involved. As proposed in the Draft, in connection with the new notification criterion, it should be necessary to notify a concentration also in the form of a request for an opinion on whether the concentration is subject to approval by the AMO.

The obligation to submit a request for an opinion should arise if two conditions are met – at least two parties to the concentration have a turnover of more than EUR 4 million in the Slovak Republic and their separate or common market share in any alternative of the relevant markets affected by the transaction (horizontal or vertically related) is at least 40%.

If you have experience with the definition of the relevant markets by competition authorities, you know that this is often a relatively time-consuming and information-demanding exercise with a high level of uncertainty about the conclusion of such an exercise. Undertakings often do not agree with the competition authority on the definition of the relevant markets. The authorities tend to define markets more narrowly, thus indicating higher market shares of the parties concerned. Thus, many undertakings will be careful to consider the narrowest possible definition of the relevant market, which will lead to a higher frequency of requests for opinions. All this can significantly slow down the transactions themselves, not only due to the demanding preparation of documents and legal uncertainty, but also due to the additional deadline for issuing an opinion, which is the same as that for the current standard assessment – 25 business days. The risk of not requesting the AMO’s opinion is high, as it is associated with a fine of up to 10% of turnover.

The new notification criteria will thus probably significantly complicate the assessment of the obligation to notify the AMO of the transaction and will lead to an increase in the number of interactions with the AMO within the acquisition activity. In other words, undertakings will have to go to the AMO more often than today, either with a notification or a request for issuing an opinion.

The Draft also contains other fundamental changes that will affect the overall powers of the AMO and the proceedings before it. These changes (e.g. modification of time limits for imposing a fine and related procedural time limits, restriction of inspection of the file by persons other than the parties to the proceedings, modifications in blacklisting, and many other significant changes) will of course be commented on as part of the ICP, in which you, as the general public, can also participate by 6 November 2020.[2]

If you are interested in the changes in the Draft and the overall developments of its adoption, you can look forward to a series of blogs called the “New Competition Act in a nutshell”, in which experts from our law firm will present to you individual changes in their broader context and impact. For regular service, just follow our blog (https://www.havelpartners.blog/) and LinkedIn of our Slovak office (https://www.linkedin.com/company/havel-partners/).

[1] P Access to the Draft as part of the ICP is available from: https://www.slov-lex.sk/legislativne-procesy/SK/LP/2020/284

[2] Available at: https://www.havelpartners.blog/blog/revolucia-slovenskeho-sutazneho-prava-v-tieni-pandemie/122

HAVEL & PARTNERS M&A practice group, the largest and most experienced of its kind in Central Europe, has been joined by Petr Dohnal, attorney-at-law, as counsel. His primary responsibility will be to advise clients on acquisitions and restructuring projects. The firm has thus further strengthened its comprehensive services to companies facing economic difficulties in connection with the current crisis.

“I am very pleased to be able to welcome an experienced attorney, Petr Dohnal, who has joined our team as part of the firm’s strategic development plan. Before joining us, Petr worked for more than 12 years as an in-house lawyer in a leading Czech investment group”, said Jaroslav Havel, one of the founders and the managing partner of the firm. “By engaging Petr we have strengthened our excellent M&A practice group as well as our unique teams for finance, restructurings and insolvencies, which we have set up in response to the recent decline of the Czech economy and the ensuing serious financial difficulties of many companies. We currently offer them our comprehensive services with a view to finding and subsequently implementing the most economically efficient and risk-effective solution to their situation,” said Jaroslav Havel.

“This practice area currently belongs among our priorities; we enlarged the relevant practice group in September, engaging two restructuring and insolvencies experts, Jan Králíček and Vojtěch Šváb, and Elena Jarolímková, a seasoned financing and insolvencies specialist in the Bratislava office. We have also grown in Moravia, in terms of both personnel and expertise. We are thus fully prepared to assist clients throughout the Czech Republic and Slovakia in the upcoming difficult time,” said Jaroslav Havel.

Petr Dohnal received his master’s degree in law from the Law Faculty of the Masaryk University in Brno, and then successfully passed the bar exam and was admitted to practice law. After graduation, he delivered legal advice on M&A, legal audits and insolvency proceedings in several law firms. Before joining HAVEL & PARTNERS, Petr worked as an in-house lawyer in the PPF investment group where he was instrumental in handling major corporate insolvency and restructuring cases, whether as a representative of creditors or as an advisor to the debtor’s management.