Dentamed, a member of the Lifco group, has acquired 100 percent shares in Medema, Brno-based vendor if consumables and equipment for dentists’ offices and dental laboratories in the Czech Republic. A dedicated HAVEL & PARTNERS team has provided comprehensive transactional advice to Dentamed on this acquisition.

The advisory team comprised Jan Koval (Partner), Tomáš Navrátil (Senior Associate), and Josef Bouchal (Associate).

By its acquisition of Medema, Dentamed has strengthened its portfolio in the dentistry business. Dentamed supplies the complete range of dental products including dental tools and instruments, both foreign- and Czech-made. Dentamed has been active in this industry since 1990.

Dentamed is a member of the Lifco international group of companies, which acquires and develops top-notch specialised undertakings, focusing on small and medium-sized enterprises with a potential for long-term growth. In 2019, the group’s portfolio comprised 164 operating companies in 30 countries.

The transaction is not subject to merger clearance by authorities.

Authors: Ondřej Florián, Gerardi Karolína

The big amendment to the Corporations Act introduces a number of changes concerning shareholders in limited liability companies, among other things. In this Part IV of our Guide to the Corporate World after the Amendment, we will focus on selected shareholder rights affected by the amendment.

The right of a shareholder to be accompanied to a general meeting has always been a topic of heated debate and there have also been attempts to address this issue in case law. The point is clear – to help shareholders to orient themselves in what are often complex legal or economic issues that have to be addressed at the general meeting. The amendment now expressly lays down the right of shareholders to take part in a general meeting accompanied by their guest, unless otherwise specified in the memorandum of association of the company concerned. The memorandum may exclude the presence of a person designated by a shareholder or modify it in some way.

For the sake of completeness, it should be added that pursuant to transitional provisions, this provision will apply to corporations established prior to the date of effect of the amendment (i.e. prior to 1 January 2021) as of 1 January 2023, unless the presence of persons other than shareholders at the general meeting is regulated in the company’s memorandum of association. A guest will have to prove they are subject to the confidentiality obligation at least to the same extent as the shareholder.

The shareholder will thus have to contractually bind the guest by a confidentiality agreement and the guest will have to submit the agreement to the company. That, however, does not apply to a guest who is an attorney-at-law, as they are by law bound to the confidentiality obligation.

Pursuant to the amendment, a protesting shareholder will no longer have to ask the general meeting to record the content of their protest in the minutes of the general meeting. A record of a protest is an essential part of the minutes of the general meeting.

This change closely relates to the fact that shareholders may seek the invalidity of a resolution of the general meeting only if they have filed a substantiated protest. A protest is viewed to have a preventive purpose; the right of the shareholder present at the general meeting is, nevertheless, somewhat restricted as the validity may only be challenged for reasons specified in the protest. In practice, unless the content of a protest is included in the minutes of the general meeting, it will be necessary to secure evidence/proof showing the protest has been filed.

To elaborate on a shareholder’s protest in more detail, it is necessary to state that pursuant to the amendment, protests must be substantiated. In other words, it will have to contain information on a defect of a specific resolution or the manner of convening or holding the general meeting as claimed by the shareholder. The amendment also regulates situations when a protest could not be filed for objective reasons. In that case, the requirement for a substantiated protest does not apply. Moreover, the need to file a protest due to the invalidity of a resolution of a general meeting may even be ruled out by the memorandum of association.

The amendment also expressly introduces a type of a share without a voting right. Furthermore, a share does not need to be associated with the right to profit or the right to the liquidation balance. The law still imposes a minimum requirement that one of the above rights must be associated with the share to the full extent.

Needless to say, there has to be at least one share associated with the voting right in the company. However, in some matters or in certain situations, shareholders holding shares without a voting right will also be entitled to vote (e.g. if all shareholders whose shares are associated with voting rights are forbidden to vote).

The company’s memorandum of association may further stipulate that a share is associated with the right to appoint and remove one or more executive directors. This is a special type of share associated specifically with this right.

The amendment significantly expands the possibility to suspend the voting rights of shareholders, i.e. to prohibit shareholders from exercising their voting rights. The memorandum of association may stipulate other important grounds in addition to the still valid reasons for the suspension. This change reflects the common situation of a shareholder who has a conflict of interest. According to the explanatory memorandum, a conflict of interest is undoubtedly an important reason for the suspension of voting rights.

The amendment also introduces a change concerning additional voting and removes the legal uncertainty hindering shareholders rights in situations when a resolution of the general meeting may subsequently fail to be adopted during additional voting under the existing legal regulation. As of 1 January, shareholders can only consent to a decision of the general meeting in cases when a consent of a shareholder is required by law; hence, it will not be possible to quash a validly adopted resolution.

The amendment introduces a new practical way of payment of a monetary contribution of up to CZK 20,000. It can be paid differently than by payment to a special bank account. When establishing a limited liability company, shareholders may pay their contribution of up to CZK 20,000 for instance to a notary as the administrator of the contribution.

The amendment also aims to increase the protection of shareholders by introducing a statutory pre-emption right of shareholders to the company’s own shares.

In view of the above, we recommend that shareholders in limited liability companies become familiar with the wording of the amendment and consider reviewing the foundation deed / memorandum of association to reflect the new regulation.

Our corporate team is always ready to assist you to be duly prepared for the envisaged changes, to represent shareholders at the general meeting and/or to help in the stage of founding a company and laying down the rules governing its future operation.

For the third time in a row, HAVEL & PARTNERS has been included in the renowned international ranking World Trademark Review 1000, which annually monitors major law firms and individual experts in the field of intellectual property and trademarks in more than 80 countries. Our law firm is also mentioned in the prestigious ranking of the world’s most influential leaders and specialists – Who’s Who Legal: Thought Leaders in the areas of Information Technology, Telecommunications and Media, Privacy and Data Security. Our media and media services team then achieved the highest possible rating given to law firms active in the Czech Republic according to the prestigious global rating Media Law International.

The international ranking World Trademark Review 1000 mentions HAVEL & PARTNERS together with partners Robert Nešpůrek and Ivan Rámeš and senior associate Tereza Hrabáková in its publication of the best specialists in the field of intellectual property and trademarks. With 15 experienced lawyers, our law firm has the largest advisory group specialising in this field on the Czech and Slovak markets.

“This success is proof of our exceptionally high-quality and long-standing work in the field of intellectual property law and trademarks, with last year our practice being dominated by transactions involving intellectual property rights and a number of large IP disputes. Not only thanks to this, but also thanks to our satisfied clients and long-term cooperation with foreign law firms, the volume of work in the field of IP advising is constantly increasing, and thus goes hand in hand with the constant expansion of our IP team,” said Robert Nešpůrek, the firm’s partner responsible for the intellectual property law practice.

Who’s Who Legal: Thought Leaders is another of the prestigious global ratings that has included our firm’s experts in the list of the world’s most influential leaders and specialists in the area of IP and IT law. The publication mentions our firm’s partners Robert Nešpůrek and Jan Diblík together with counsel Richard Otevřel. The area of technology law and intellectualproperty law is one of our mostimportant practices involving a total of more than 30 lawyers.

Thanks to their innovative approach, extensive experience and unique know-how in the Czech Republic and Slovakia, they are also pioneers in the legal fields of the future and regularly actively participate in the preparation of new laws (such as the Banking Identity Act or the Digital Services Right Act).

Our firm was also ranked among the best law firms for media law in the Czech Republic by the international guide to global media law leaders Media Law International. According to the guide, clients especially appreciate the professionalism and quality of expertise of HAVEL & PARTNERS in this area.

“The Media Law International award confirms our leading position among legal service providers advising on media and media services. Thanks to the concentration of excellent lawyers with detailed knowledge of the media market and the broad specialisation of our law firm, we are able to help clients with even the most demanding projects,” commented firm partner Václav Audes who leads, together with Robert Nešpůrek, the specialised media law team consisting of more than 15 lawyers, on another award received by HAVEL & PARTNERS.

Authors: Václav Audes, František Neuwirth, Denisa Fuchsová

In the Czech Republic, persons who undergo Covid-19 vaccination have been given the opportunity to claim financial compensation from the state if the vaccination (or, more precisely, the medicinal product containing a vaccine) causes harm. The Czech Parliament adopted Act No. 569/2020 Sb., on the Distribution of Medicinal Products Containing a Vaccine for Covid-19 Vaccination and on Compensation for Harm Caused to Those Vaccinated by These Medicinal Products (“Act No. 569/2020 Sb.”), which allows such compensation. According to the explanatory memorandum, this measure aims to “facilitate compensation of those who get vaccinated if they are harmed by the vaccination, thereby also indirectly promoting interest in Covid-19 vaccination.”

However, the state’s indemnification does not apply to all Covid-19 vaccines, but only to those purchased based on the European Commission decision.[1]

Until now, the state has been obligated to compensate for harm caused by compulsory vaccination, on the basis of the relatively recent Act No. 116/2020 Sb. on Compensation for Harm caused by Compulsory Vaccination (“Act No 116/2020 Sb.”). This act was adopted following, among others, the judgment of the Constitutional Court no. Pl. ÚS 19/14,[2] in which the Constitutional Court assessed the constitutionality of compulsory vaccination: the Constitutional Court did not find it unconstitutional, but noted that if the state introduces sanctions for persons who refuse compulsory vaccination, the state should also adequately address cases where the vaccinated person suffers harm as a result of the vaccination.

Covid-19 vaccination is not compulsory. However, Act No. 569/2020 Sb. sets out that harm caused by Covid-19 vaccination and the scope of the compensation shall be assessed analogically under the rules for compensation for harm caused by compulsory vaccination, namely under Act No. 116/2020 Sb. Covid-19 vaccination is therefore the first non-compulsory vaccination for which it will be possible to claim damages from the state.

An application for compensation for harm caused by the Covid-19 vaccination should be submitted to the Ministry of Health, as is the case for compulsory vaccination. If the injured party is not satisfied with the way the Ministry handles their application, they may seek damages in court. However, an action against the state can be brought only provided that the right to compensation is first exercised at the Ministry, which is a precondition for bringing such an action.

To facilitate the legal position of a patient applying for compensation for harm caused by the compulsory vaccination, Act No. 116/2020 Sb. envisages that for some likely consequences caused by the vaccination, the injured person will not have to demonstrate a causal link between the vaccination and the harm caused, as a legal presumption of causality applies in such a case. The likely consequences of a given vaccination are to be determined by an implementing decree.

Its draft was published by the Ministry of Health in March 2020 already; therefore, it does not mention any likely consequences of Covid-19 vaccination. If, even in the final version of the decree, Covid-19 vaccination is not mentioned, the position of those harmed by Covid-19 vaccination will be more difficult as they will not be able to rely on the legal presumption of a causal link. In that case, it would largely be up to the Ministry of Health how it will assess the consequences of the vaccination and how willing it will be to satisfy any patients’ claims.

This law naturally does not affect in any manner the potential liability of other parties. Vaccine manufacturers will remain liable for harm caused by defective vaccines under the relevant provisions of the Czech Civil Code, which implement the EU Directive on the approximation of the laws, regulations and administrative provisions of Member States concerning liability for defective products (the so-called Product Liability Directive).

However, it would be necessary in this case for the harm to be caused by a defect in the vaccine. In connection with vaccination, harm often arises because of the body’s response to the vaccine, but this will usually not be considered a defect in the vaccine. In this context, the Commission has undertaken to compensate manufacturers for the damage they would suffer from any civil litigation, which has attracted some controversy and has also been the subject of the European Parliament’s interpellation for the Commission (such as the question for written answer No. P-000192/2021).

Finally, individuals who have suffered harm because of vaccination will also be able to claim compensation from the health service provider who administered the vaccine should the provider breach their obligations in administering the vaccine (e.g. a breach of recognized standards of medical care) or if the provider administers a defective vaccine (for example, a vaccine that has not been stored in accordance with the manufacturer’s instructions, etc.).

[1] Act No. 569/2020 Sb. expressly refers to Commission Decision C(2020) 4192 of 18 June 2020 approving the agreement with Member States on procuring Covid-19 vaccines on behalf of the Member States and related procedures.

[2] Judgment of the Constitution Court of 27 January 2015, case no. Pl. ÚS 19/14.

By providing comprehensive legal advice to the Elevator Ventures fund, the law firm HAVEL & PARTNERS ensured the entry of this Austrian investor into the Czech company operating Twisto payment services.

Elevator Ventures Beteligungs, a venture capital fund of Vienna-based Raiffeisen Bank International (RBI), has acquired a minority stake in Twisto payments a.s. M&A advice on this transaction was provided by the firm’s partner Jan Koval, senior associate Tomáš Navrátil and associate Josef Bouchal. The regulatory aspects of the transaction were supervised by associate Martin Stančík and the deal also required professional advice on intellectual property and information technology law, which was provided by associate Tomáš Chmelka.

Twisto has been popularizing deferred payments in the Czech Republic for over seven years, and more than 1.6 million customers have used its services. “We were amazed at how easy the Twisto solution is for customers to manage their daily payments and finances. Its strong traction in Central Europe proves that it serves the real demand of customers in this region. We look forward to supporting Twisto in its ambition to bring its solutions to more markets in continental Europe,” said Maximilian Schausberger, CEO of Elevator Ventures, about the transaction.

At the same time, another international investor entered into Twisto, the Australian company ZIP, which is one of the world leaders in retail digitalization, specifically in the area of finance and payments. In 2018, the service successfully entered the Polish market. Twisto now wants to use the investment to innovate deferred payments throughout the entire Central European region.

HAVEL & PARTNERS has provided comprehensive legal advice to Raiffeisenbank on the purchase of 100% of the Equa bank shares from AnaCap Financial Partners. The firm’s M&A team that handled the transaction was led by partner Jan Koval, counsel Petr Dohnal and associate Josef Bouchal. The parties have decided not to disclose the value of the transaction.

Completion of the transaction is planned for the end of Q2 2021, as it is subject to regulatory approval. Raiffeisenbank is one of the five largest national banks, which has been providing banking services in the Czech Republic since 1993, and acquired Equa bank from AnaCap Financial Partners, a London-based private financial services investor.

“Raiffeisenbank is a sound, capital-strong and stable financial institution with ambitions to continue to grow, both organically and through acquisitions. The Czech Republic is one of the key markets,” says Igor Vida, Chairman of the Board of Directors and CEO of Raiffeisenbank, about the acquisition.

Equa bank is a Czech bank providing comprehensive services, which primarily focuses on individuals and small-and medium-sized enterprises, with almost half a million customers. In case of the successful completion of the transaction, the plan is to merge Equa bank with Raiffeisenbank, which will enable fulfilling the joint business potential of both banks.

Authors: David Krch, Josef Žaloudek, Martin Bureš

We would like to remind you that the “tax package” for 2021 in the Czech Republic has been published in the Collection of Laws under No. 609/2020 Coll., bringing about relatively significant changes to the personal income tax (“PIT”).

In this reminder, we would like to briefly emphasize just one of them: where we were accustomed to applying a flat 15% PIT rate, the new PIT rate is now applied up to 23%. The threshold is annual and is calculated as 48 times the average monthly wage (for 2021 this threshold is approximately CZK 1,700,000), while the PIT base above this threshold will be newly taxed at the tax rate 23%. This applies, for example, to certain interest income, rental income, the sale of cryptocurrencies or property, and various other “one-off” income, provided that this income is not exempt from PIT.

Could any of the above-mentioned income “above the threshold” apply to you? Do not hesitate to contact us. Our experts will assess your specific situation and together we will find the most effective solution.

The law firm HAVEL & PARTNERS has become the most attractive employer among law firms in the Czech Republic in 2021 for the seventh time in a row, according to the Top Employers in 2021 study. The survey is organised by the Association of Students and Graduates on an annual basis. The most attractive employers are selected by students at Czech universities, who assess firms on the basis of their work environment, professional education offered, corporate social responsibility or chances for high income in the future.

“I’m pleased to see that our firm is still the most attractive employer for the new generation of lawyers. At HAVEL & PARTNERS, we realise that a successful firm cannot be built without good quality people. That’s why we are trying to search for prospective legal talents among students, who can then experience professional growth under the leadership of their experienced senior colleagues and acquire valuable experience while working in the largest independent law firm in Central Europe,” said Jaroslav Havel, the firm’s managing partner.

With its 240 lawyers and tax advisors, HAVEL & PARTNERS boasts the strongest team on the Czech and Slovak markets offering comprehensive services in all areas of law and business. Currently, our firm cooperates with over 50 students. Being led by experienced senior lawyers and top experts, the students quite soon get in touch with the most demanding clients from among leading Czech and foreign companies and the most successful entrepreneurs.

“We thank the students for their votes in the TOP Employers survey. HAVEL & PARTNERS is a stable firm with a trustworthy brand not only thanks to its continuous economic growth but also persistent growth in the quality and offer of our services. This is what makes us such an attractive employer among students. In our firm, they get immediate access to the unique know-how that the firm has been building for twenty years and can therefore experience work providing legal services in a large law firm from the early stages of their career. Talented students have a chance to work on exceptionally attractive cases. We also give them a chance for continuous and especially fast career growth. We are looking forward to entering into successful cooperation with a number of them in the future,” Daniel Soukup, the HR Manager at HAVEL & PARTNERS, commented on the firm’s victory in the survey.

HAVEL & PARTNERS, the largest Czech-Slovak law firm has recorded continuing economic growth in 2020. Its total turnover was up by more than 8% year-on-year with the first six months of the year being especially successful as the growth of revenues from the sale of services reached 17%. The revenues from the sale of services totalled CZK 789.1 million, recording an 8.7% growth year-on-year in the Czech offices of HAVEL & PARTNERS. The Slovak office also recorded growth. The rising turnover was adequately mirrored in increased profitability. The turnover of the entire group, including the debt collection agency Cash Collectors and tax advisory services, once again exceeded the CZK 1 billion threshold.

“Our outstanding economic results and the increase in turnover even during the Covid-19 crisis reflects our ability to quickly adapt to the situation in the market and flexibly respond to our clients’ needs. Thanks to our long-term expertise and macroeconomic data, we had been anticipating a crisis with a major impact on the economy for a long time and had been intensely preparing for it, be it in terms of the scope of our services, rigorous financial management as well as digitisation. Even though the crisis eventually hit us in a different form, we were quickly able to respond to it,” said Jaroslav Havel, the law firm’s managing partner, commenting on the firm’s economic success. He asserts that the significant growth in turnover was achieved despite the fact that in spring, the firm temporarily decreased the hourly rates to all its clients affected by the Covid-19 pandemic that asked for a discount, and doubled its free legal advisory to 1500 hours/month. “I am convinced that our commitment and high professionalism as well as flexibility of all our teams combined with individual approach to clients and the development of our mutual strategic partnerships in these tough times was and still remains our key competitive advantage,” Havel added.

HAVEL & PARTNERS’ revenues have been continuously growing since its incorporation in 2001. This has been possible mainly thanks to the provision of legal and related tax services to leading Czech, Slovak and multinational companies and Czech and Slovak entrepreneurs, including approximately a third of the wealthiest Czechs and Slovaks. In 2020, the fastest growing areas again comprised mergers and acquisitions, litigations and arbitrations, insolvencies and restructurings, regulatory matters, and public procurement. The advisory group focusing on competition law and economy also kept growing.

Last year was also historically the most successful year for HAVEL & PARTNERS in terms of the most prestigious global and domestic awards it won: the law firm became the absolute winner of the award Law Firm of the Year in the Czech Republic and also ranked first in Slovakia. It also won the Chambers Europe Awards, the most prestigious global award, for the best Czech law firm.

“I am glad that the firm’s expertise, loyalty and the utmost commitment of our colleagues and their ability to cope with all the adverse circumstances that the pandemic brought was appreciated not only by our law firm’s management, but also by an independent panel and primarily by our clients. For our clients, on the other hand, this was a confirmation that they are cooperating with the best law firm on the market, which is the leader not only in times of prosperity but also in times of crisis and is able to assist them with the aftermaths of the crisis quickly and efficiently,” Havel added.

Authors: David Neveselý, David Krch, Josef Žaloudek

As a follow-up on our previous Tax Flash on this topic, let us remind you of the two changes in income tax with an international element, which already have or are soon expected to come into effect (or to the end of the applicable time limit).

1. Controlled foreign company rule – the duty to “additionally” pay taxes in the Czech Republic for certain foreign subsidiaries (both direct and indirect), generally if they do not carry on a substantive economic activity and the respective foreign tax is lower than a half of the Czech tax that would apply if the subsidiary’s tax base were subject to Czech tax and its income generated in the Czech Republic. The rule is applied for the first time to the tax period that is the fiscal year starting after 31 March 2019 and the calendar year of 2020.

2. Obligatory reporting to the tax authority of cross-border structures (potentially) providing a tax advantage – a precise description including the given tax advantage must be provided to the tax authority; this will apply retroactively to structures implemented from 25 June 2018! Depending on the time aspects of the specific structure or its changes, the report must be submitted by 30 January, 28 February or 30 April 2021. All information is available in our latest Tax Flash.

Do not hesitate to contact us regarding this matter. Our experts will examine your particular situation and we will find the best solution/remedy, or assess the risks.

Source: Estate (January 2020)

In 2021 HAVEL & PARTNERS celebrates its 20th anniversary. How did a small firm established by a group of five young lawyers become number one in the legal profession with 2.5 thousand clients, constant growth, the winner of prestigious awards for its expertise and service quality, an exceptional brand and the most sought-after employer in the industry?

Its success is based on a client-focused approach, a comprehensive range of first-rate legal and tax advisory services and mainly the ability to adapt as fast as possible to the current market and client needs and requirements. “From a legal and tax point of view, we guide the client through their business and help them develop further,” says Jaroslav Havel, the firm’s managing partner.

The firm was established in 2001 by a group of five young lawyers with the aim of building a firm with the highest standard of legal services and international reach. With their extraordinary efforts, strategic management of the firm as well as their courage to take risks, they gradually succeeded in fulfilling this vision. Today, with its 240 lawyers and tax advisors and a total of 500 employees, including employees of the affiliated collection agency Cash Collectors, HAVEL & PARTNERS is the largest independent law firm in Central Europe. It has offices in Prague, Brno, Olomouc, Ostrava and Pilsen, as well as in Bratislava, Slovakia.

The recipe for success is the best lawyers, efficient management and strategic development. Last year, HAVEL & PARTNERS managed to continue the achievements it made in previous years despite the COVID-19 pandemic and closed the year as the most successful in the firm’s history. Similar achievements were also accomplished during the financial crisis in 2008 to 2012. All because the firm sees crises as opportunities.

“We have been expecting a crisis with an impact on the economy for a long time and we prepared for it in advance. When it struck, although in a different form than we expected, we had something to build on and were able to immediately focus on our clients,” explains Jaroslav Havel, managing partner, adding: “We try to apply the most proactive approach. We focus on the clients and their business and work intensively with them to get ahead of others.“ It is this approach that has allowed the firm to keep growing every year in terms of turnover, personnel and the quality and scope of services.

The firm has been thriving not only in terms of its financial results. It has also received a number of important awards. HAVEL & PARTNERS has repeatedly won the prestigious Law Firm of the Year awards. Based on the total number of all nominations and awards in all years of this competition, it is the most successful law firm with the most comprehensive services in the Czech Republic and Slovakia. In 2020 HAVEL & PARTNERS was also named the Best Czech Law Firm at the Chambers Europe Awards. It has also repeatedly won the Czech Business Superbrands award for its exceptional brand and is also the most sought-after employer in its branch of business.

Besides a focus on clients, one of the firm’s greatest assets is also the extensive portfolio of services that meet the highest standards of the legal profession. HAVEL & PARTNERS offers advice in all branches of law and business sectors. The firm’s flagship is services relating to acquisitions, divestitures and mergers of companies operating in all manner of sectors. The portfolio also includes advice on financing, taxes and other issues.

In the 20 years of its existence, HAVEL & PARTNERS has built one of the most stable client bases on the market in Central Europe. It provides services to a total of 2,500 clients from among major Czech and foreign companies and state institutions. Its regular clients include leading Czech and Slovak entrepreneurs.

HAVEL & PARTNERS builds its relationships with private clients by developing a long-term strategic partnership. That is why prominent clients, including about a third of the richest Czechs and Slovaks, are taken care of by a dedicated specialised team that the firm was the first to create on the market 13 years ago. With more than 25 mostly senior lawyers and another 12 tax experts, it is the largest advisory group in Central Europe.

“We know our clients and keep track of their business, family relationships or property situation. We know what visions and goals they have. Thanks to this, we can respond to their requirements immediately depending on the current situation,” says Jaroslav Havel.

HAVEL & PARTNERS advises business owners or representatives and their families on the management and long-term protection of their personal and business property as well as on foreign investments and taxes. Over the past 10 years, the firm has set up several hundreds of family holding companies and holding structures, and dozens of trusts. It also focuses on complicated probate proceedings, family law and, last but not least, on succession.

HAVEL & PARTNERS also provides comprehensive advice on real estate and construction law, with the further development of these services being one of the firm’s top priorities. A team of 30 experienced lawyers, including 6 partners, have extensive know-how. The are able to advise cities, architects, designers, construction companies, developers, investors, funds and asset managers in all fields of their business, from legislation (for example, the firm takes part in the preparation of new building regulations), construction preparation and planning, financing and implementation, to effective management and protection of existing real estate investments.

Since the beginning of the coronavirus crisis, HAVEL & PARTNERS has also been actively involved in dealing with the adverse consequences of the pandemic on real estate law. With its broad specialisation and maximum time flexibility, the real estate team is ready to offer clients immediate assistance.

Authors: Robert Nešpůrek, František Korbel, Dalibor Kovář

All our lives we have been asked from time to time to present our ID card, passport or other proof of identity. Therefore, it is hard for us to imagine that soon this will no longer be required. But it’s time for this to change. A whole new world of remote identification is emerging that will be automatic, free of charge and instantly available to more than one half of all Czech citizens. Let us welcome bank identity, one of the most trustworthy and widely used digital identification methods today.

Bank identity is expected to be deployed in the first half of 2021. Its appropriate and timely use may give you an advantage over your competitors.

We got used to trusting our banks and thanks to the permanent development of electronic services and exponentially growing number of possibilities for their application, we commonly procure our matters online. But we still have not gotten used to the idea that we can completely, reliably, electronically authenticate our identity at any time, remotely, without encountering other persons and without any waiting.

Under the Czech legal regulation of electronic identification there has been a state-run electronic identification means – an electronic ID card – available for more than two years now. From the legal point of view, an electronic identity offers a higher level of guarantee than bank identity, however, on the other hand it is necessary to make some efforts and invest some money – to purchase an electronic ID card reader for instance.

Moreover, the possibilities for using an electronic ID are unfortunately very limited. The state is not the best promoter or trader. This type of identity works only for persons who must verify identity under law (such as obligated entities under the AML legislation) or as a part of the exercise of official tasks (so called competencies). This is another reason why the current electronic identities have been used hesitantly and infrequently in practice so far.

But now a revolution in electronic identity checking will come to fore with bank identity. Thanks to bank identity it will be possible to electronically authenticate the identity of individuals (or select information about them) with the use of secured access codes for internet banking. All that without the need to remember any new passwords or to have a special reader. Clients will continue using only what they are familiar with very well – internet banking log-in via a computer or mobile phone. Nothing else. In addition, the user will not pay anything for such authentication.

In this connection, Czech legal regulations use the term electronic identification means – a simple alternative to physical identity documents for individuals’ digital acts in the online world. Thus, these include acts in the public as well as the private sector. But bank identity will not only be about authenticating and transferring client data with the client’s consent. It will also offer users a simple and comfortable log-in with a single digital identity for dozens of user accounts across the Internet (called single sign-on) or simple subsequent payment authorisation. Therefore, it will not be necessary to remember different log-in methods for e-shops and digital services or to fill in complicated forms. Bank identity may thus bring up to 5.5 million potential users to the public and private sector whose identity will be easily authenticable at a distance.

Bank identity is at the same time an electronic signature method. It has already proven to work well in Nordic countries. In Norway, electronic identification and the related signing with a bank identity is used by nearly 90% of the working age population and even by up to 97% of the working population aged 20 to 54 years. The first Czech banks have already informed us that with the use of bank identity they will enable signing electronic documents in a trustworthy environment. For example, Komerční banka already launched its service MůjPodpis (MySignature) several months ago.

In addition, bank identity will also involve a control aspect – anyone will be able to check where and for what purpose their bank identity was used.

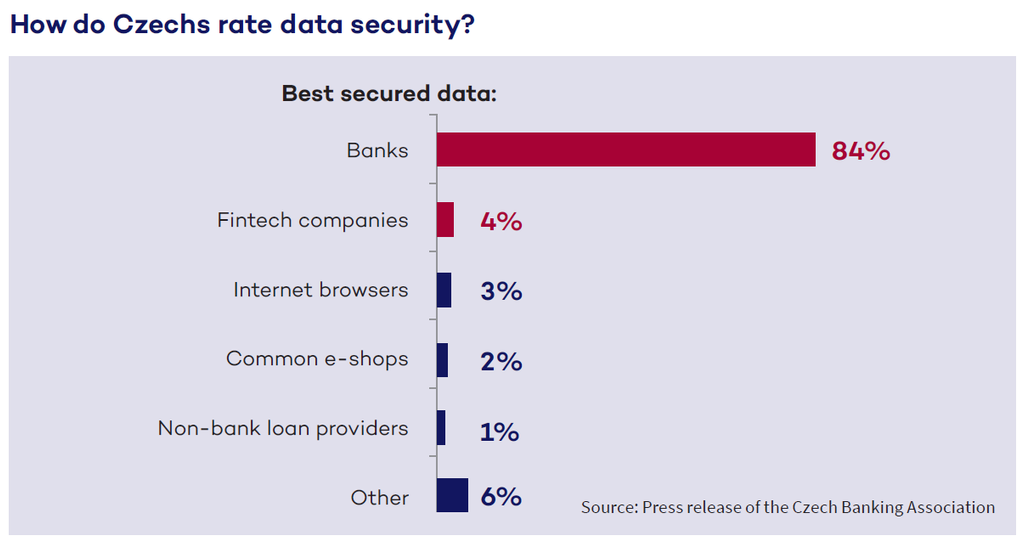

Inspired particularly by Nordic countries, bank identities are a well-tested and functional concept – banks own the basic infrastructure and have their clients, at the same time they are the only institutions on the market to have already authenticated the majority of individuals and transferred their identity via bank identity to the digital world. Apart from that, studies show that consumers prefer banks to government, retail or social platforms as providers of digital identity because they trust them; Czech consumers are no exception.

Thus, the introduction of bank identity in the Czech Republic was inspired by the banking sector already in 2017. However, Czech laws did not permit banks to provide electronic identification back then. The Czech Banking Association, as the representative of Czech and international banks, approached the subject from the legislative point of view. With the help of the ICT Union, attorneys from HAVEL & PARTNERS and ROWAN LEGAL and a group of active PMs from the public administration committee drafted Act no. 49/2020 Sb. Although this piece of legislation constitutes an amendment to the Banking Act, the AML Act and other laws, the most apt name for it is the Act on Bank Identity, unofficially abbreviated as the BankID.

This act will enter into effect on 1 January 2021. It broadens the existing group of activities that banks are authorised to carry out by the provision of electronic identification and authentication, services creating trust and other related services. It will also enable banks (and insurance companies) to access the basic registers and other public administration information systems and to check whether their clients’ data are up to date.

If banks or branches of international banks decide to provide these services, they must enable, free of charge, electronic authentication of their clients’ identity also for the use of online services to state, municipal and regional authorities. In exchange, banks will be able to provide these services to the rest of the public sector and to commercial companies, weather directly or via the new company Bankovní identita a.s., a joint venture of the three largest banks on the Czech market – Česká spořitelna, Československá obchodní banka and Komerční banka. The price for the use of electronic identification, authentication or signing services will not be paid by the end user but by the service provider (retailer), who uses the service to identify their clients. A similar set-up for payment cards has been in place for many years.

Providers of e-commerce and services will be willing to invest in bank identity only if they can see benefits for their businesses. Participating banks, and the fact that identification by means of bank identity will also be sufficient to comply with the mandatory AML identification standard for the use of government and public sector on-line services, make bank identity trustworthy. Therefore, we can see the potential for its use primarilyin the financial sector as a single means for on-line identification and payments. In Norway, bank identity is used in more than ¾ of all transactions in the financial sector. Thanks to the use of bank identity the average time required for processing a mortgage application was reduced from 16 days to several hours.

Bank identity will also become important for e-commerce in relation to a part of post-paid services such as fuel cards, energy or telecommunications. The use of bank identity can thus also be interesting for mobile operators or distribution companies.

Bank identity will also be very useful for eGovernment services – typical examples include access to secured registers, portals or files, electronic elections, communication with tax authorities, on-line incorporation of a new firm and further applications during the gradual digitalisation of government services thanks to the implementation of the Act on the Right to Digital Services (no. 12/2020 Sb.).

Another domain for the application of bank identity is employment – in particular in the digitalisation of payroll and tax procedures and to facilitate the recruitment of new employees at larger companies.

Technological partners (ICT suppliers) capable of suitably connecting the bank’s electronic identification with their own services who will simply include the price for the use of bank identity in the price of the service will assume a key position. Naturally, banks cannot appropriately help their clients integrate the solutions in preparation (as they possess only limited technical knowledge), cannot provide technical support for these solutions and often identify use cases in which bank identity can be used outside the banking sector. Thus, in the distribution model of services relating to bank identity, banks must count on their technological partners – typically in commerce, electronic signatures, document keeping, log-in and identity management.

In the Czech Republic this will be the uniform, and by far most frequent, solution for digital identity authentication, taking the way in which society works to a whole new level. In Norway they say with exaggeration that a bank needs to be visited only once in a lifetime – just to set up a bank identity. All the rest can be done afterwards with its help, whether in the private or public sector.

It is expected that bank identity will be launched in the first half of next year. Its appropriate and timely use will undoubtedly be a competitive advantage. The bank identity may lead to increased efficiencies of processes for all participants – simple, comfortable and gratuitous use of a single means of identification and payment for individuals, a competitive advantage and interesting savings for service providers in comparison with their own identification solutions, the possibility for banks to get closer to their clients and to provide them with more comprehensive services, and a brand new gratuitous channel with millions of verified users for the digital services of the state, municipalities and regions.

Our digitalisation legal team, whose members co-authored the Bank Identity Act and participated in the development of this solution from the very beginning, will be happy to help you assess the details of bank identity and implement banking identity means.