Authors: David Krch, Vlaďka Laštůvková

At the end of this November, the Supreme Administrative Court rendered a judgment[1] in a dispute concerning the setting of a distribution model in the pharmaceutical industry in relation to VAT, annulling the Municipal Court in Prague’s decision under which a Czech pharmaceutical company was assessed an additional VAT on the consideration for marketing services (related to distribution) provided abroad. The Supreme Administrative Court held that in the present case the distribution of medicinal products and the provision of marketing services constituted two different supplies, since the recipient of the marketing services was not (unlike the distribution) the Czech pharmaceutical company’s customers, but a foreign company. The consideration for marketing services should not therefore have been included in the VAT base. The decisive factor in the dispute was the knowledge of the specifics of the pharmaceutical market.

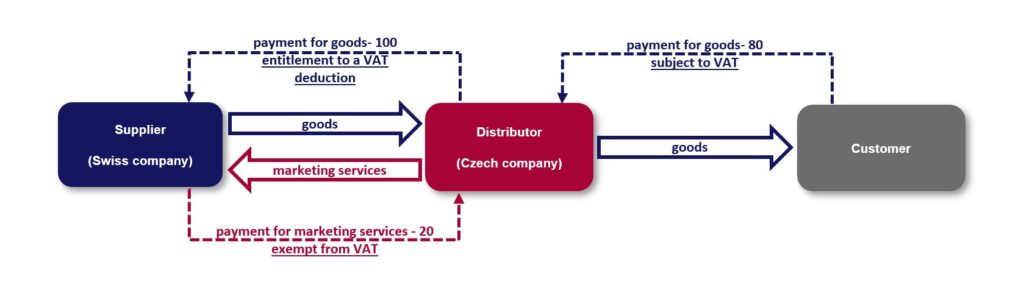

A Czech pharmaceutical company, as a distributor[2] of medicinal products (the “Distributor”), purchased medicinal products from a Swiss wholesaler (the “Supplier”) within the group and subsequently distributed (sold) them further to other persons on the Czech market at a regulated price (lower than the purchase price). At the same time, the Distributor provided marketing services to the Supplier in relation to these medicinal products in return for consideration, which ensured the Distributor’s profitability despite the loss-making sales in terms of transfer prices.

In terms of VAT, within the set model, in the Czech Republic, the Distributor paid VAT on the price at which it distributed (sold) the medicinal products. The Distributor reported the marketing services as the provision of a service with the place of supply outside the Czech Republic and, therefore, the income from such services was exempt from VAT in the Czech Republic (with a right to deduction). As a result, the Distributor was entitled to deduct input VAT at a higher rate than its output tax liability.

When assessing the model in question, the tax administrator concluded that the marketing services as an ancillary supply had been an integral part of the distribution as the main supply, and therefore assessed the Distributor a difference equal to the amount of VAT (excluding the relevant penalties) that would have been paid if the supply from the marketing services related to the distribution of medicinal products had been subject to Czech VAT. In its decision,[3] the Municipal Court in Prague agreed with that conclusion, inter alia, in view of the tax authorities’ assertion that the recipients of the marketing services were in fact the Distributor’s final (unspecified) customers.

More information on the Municipal Court in Prague’s decision can be found in our previous Tax Flash here.

The Distributor disagreed with the Municipal Court in Prague’s decision and filed a cassation complaint against it. The dispute was thus referred to the Supreme Administrative Court (the “SAC”), which finally[4] ruled on 23 November 2021 that the distribution of medicinal products and the provision of marketing services constituted different supplies in the present case. According to the SAC, only the income from the sale of medicinal products should have been included in the VAT base, and not also the income from marketing services.

Judgment of the Supreme Administrative Court

The SAC identified the fundamental question in the entire dispute as the assessment as to “whether or not the distribution of medicinal products and the marketing services provided by the complainant [the Distributor] constitute a single supply for VAT purposes”[5] (a question of law). In order to answer that question, it was necessary to establish “which person or persons were the recipients of the marketing services”[6](a question of fact).

As for the question of fact, the SAC concluded that the recipient of the marketing services in the present case had been the Supplier, not the Distributor’s customers. In justifying that conclusion, the SAC relied, inter alia, on the difference between the provision of marketing information to customers and the nature of marketing services and the specificities of the pharmaceutical market, in particular the different position of individual pharmaceutical companies within the group (e.g., manufacturer vs. distributor[7]), the position of different entities on the pharmaceutical market (i.e. patients, doctors, wholesalers, etc.) and the possibility of providing marketing information concerning medicinal products directly to patients.

When considering the main question in the dispute, the SAC subsequently concluded that the distribution of medicinal products and the provision of marketing services in the present case had constituted different supplies, not a single supply. In addition to the identification of the recipient of the marketing services, the SAC considered, inter alia, the following facts: how the consideration appears from the perspective of the ‘average customer’, whether the prohibition on exceeding the total value of the consideration paid by the final customer is complied with, and the specificities of the pharmaceutical market.

In its judgment, the SAC first of all answered the question whether in the present case the Distributor’s customer could actually be considered the recipient of the marketing services (could not) and made it clear that factual knowledge of the (not only pharmaceutical) environment was crucial for decision-making in similar disputes.

At the same time, the SAC has to some extent alleviated concerns that, following this case, there would be a need to review business models based on similar principles across the pharmaceutical market in view of the increased risk of across-the-board additional VAT assessment on companies applying this model. Nevertheless, it should be stressed out that each business model must be treated individually, and the risks (not only from a VAT perspective) must be assessed in relation to the circumstances of the specific case.

Last but not least, the case under review has shown, in particular taking into account the previous decisions in the case, that in the context of tax audits it is always necessary to proceed with caution and to assess any statement towards the tax administrator comprehensively, since what seems appropriate in one proceeding may cause serious complications in another proceeding.

The authors also add that the SAC’s judgment is also significant for distributors in the pharmaceutical market for the purposes of transfer pricing rules. The fact that distributors across the entire pharmaceutical market in the Czech Republic have been making losses on the distribution of medicinal products for a long time is primarily determined by the system of price regulation of medicinal products applied by the Czech Republic, which in many cases does not allow distributors to generate a reasonable profit.

The result is a situation where foreign suppliers of medicinal products artificially generate and report in their home country a part of the profit from the distribution of medicinal products that should be reported by domestic distributors in the Czech Republic. Ultimately, they have no choice but to seek additional sources of operational financing, such as providing the marketing services back to the group, which were the subject of this dispute.

If this system, which the Czech Republic has enforced from distributors through its price regulation system, were to be further penalised at the distributor level by additional VAT assessments, this would, according to the authors, be a completely absurd situation where the Czech Republic, through its own price regulation policy, is forcing distributors into alternative methods of financing for which it is subsequently penalising them. The authors therefore highly appreciate the quality of the judgment of the SAC that assessed the case very precisely in light of all the specifics of the distribution of medicinal products in the Czech Republic.

[1] Judgment of the Supreme Administrative Court of 23 November 2021, Case No. 3 Afs 54/2020 (the “Judgment”).

[2] In its reasoning, the Municipal Court states, inter alia, that in the package leaflets primarily the Distributor is referred to as the marketing authorisation holder. It is not clear to what extent the Municipal Court distinguishes between the marketing authorisation holder itself and its agent in the territory in question.

[3] Judgment of the Municipal Court in Prague of 5 December 2019, Case No. 6 Af 90/2016.

[4] The case was returned to the Appellate Financial Directorate, which is, however, bound in further proceedings by the legal opinion of the SAC expressed in the reasoning of the Judgment.

[5] Para 33 of the Judgment.

[6] Para 40 of the Judgment.

[7] Similarly, in our opinion, it is also necessary to take into account (although the SAC does not explicitly mention this example) the different position of the marketing authorisation holder and its agent on local markets.

Genesis Private Equity Fund III (GPEF III ) of the Genesis Capital group sold its 85.9% interest in QUINTA-ANALYTICA, a major Czech provider of research and regulatory services to the pharmaceutical and biotechnology industries and producers of generic pharmaceuticals. The HAVEL & PARTNERS’ team provided Genesis Capital with comprehensive legal services related to the sale of the stake, which was acquired by LVA Holding from the portfolio of BBA Capital Partners.

Legal advice in this significant transaction in the pharmaceutical industry was provided to the seller by Václav Audes (Partner), Veronika Filipová (Senior Associate), and Filip Pavlík (Legal Assistant).

Genesis Capital offers small and medium-sized enterprises in Central Europe assistance in financing their growth and development. The group has been cooperating with HAVEL & PARTNERS on a long-term basis; in 2016 the firm’s legal team also provided comprehensive legal services during the company’s entry into QUINTA-ANALYTICA. The share purchase at that time was a prime example of how succession issues are to be handled. GPEF III became the majority owner of QUINTA and kick-started its growth strategy.

QUINTA-ANALYTICA, headquartered in Prague, is one of the largest independent companies in Central and Eastern Europe in the field of services for the pharmaceutical industry and the production of generic pharmaceuticals. It specialises in pharmacokinetics and BA/BE clinical trials, bioanalytics, analyses of medicinal products, quality control, stability studies, and other specific services.

During its six-year partnership with Genesis Capital, the company has expanded its portfolio of services, diversified its customer portfolio, and continued to grow not only in Europe but also in North America. Jan Tauber, chairman of Genesis Capital Equity, says: “Over the six years of the partnership, the management has safely guided the company through difficult periods, most notably the period of negative impacts of the COVID-19 pandemic. The company is currently in good shape, ready for further growth and development with a new owner.”

QUINTA-ANALYTICA employs over 200 experienced professionals who provide a broad portfolio of services to the largest global companies in the pharmaceutical industry. In 2020, it opened a modern and innovative laboratory in Brno. In 2021, the company aims to generate revenues of €16 million.

In the TOP 10 largest law firms ranking, which is compiled by the daily SME and The Slovak Spectator according to combined measurable criteria, HAVEL & PARTNERS is the largest Czech law firm, the fourth largest regional law firm and the fifth largest law firm operating on the Slovak market. It also took the top spot this year in Intellectual Property law and Competition law. In addition, it took second place in the M&A category and was also ranked among the top 10 largest law firms advising on Real Estate, Banking and Finance.

HAVEL & PARTNERS has again strengthened its position in the overall ranking of the TOP 10 largest law firms by two places year-on-year. In addition, in the ranking, which reflects the number of deals for which a law firm was rewarded more than EUR 20,000, HAVEL & PARTNERS was ranked first regionally, and in the overall ranking it took an excellent second place, also strengthening its position by two places year-on-year in both rankings. “We very much appreciate our top places in the TOP 10 largest law firms ranking and we are pleased that we are steadily rising in all rankings, despite the ongoing coronavirus crisis. We want to continue to strengthen our position as the largest and most successful Czech-Slovak law firm, which is the first choice for Czech companies operating in Slovakia and Slovak companies operating in the Czech Republic. I thank our clients for their trust and all our colleagues in Slovakia for their commitment, loyalty and teamwork,” said Jaroslav Havel, the firm’s founder and managing partner.

Taking winning places in the TOP 10 rankings not only confirms the prominent position of HAVEL & PARTNERS on the legal services market, but also speaks for the high quality of the services provided, the exceptional versatility of the specialised teams and the cutting-edge know-how of the firm’s lawyers.

The firm won in the Intellectual Property law category, where it was ranked first among the ten largest and most prestigious law firms: “We are extremely pleased and honoured to be ranked number one in Intellectual Property law among the largest law firms. We are trying to build our IP practice and team organically with a long-term perspective, and we consider our ranking in the TOP 10 in this category as proof and the result of our high-quality, long-term work in this field. This success goes hand in hand with the constant expansion and strengthening of our team’s specialisation, which would not be possible without the trust of satisfied clients and the ever-increasing number of interesting cases that we have the opportunity to address for them not only in Slovakia and the Czech Republic, but also internationally,” added firm partner Štěpán Štarha.

The firm also won in the Competition law category and thus became the most successful law firm in this field in Slovakia. “We very much appreciate our success in Slovakia. We started systematically building our competition advisory practice here ten years ago, since then we have worked on large projects and have gained the trust of many major Slovak clients. We would like to thank them for that. The award is a confirmation that we are on the right track and an encouragement to keep improving,” said Robert Neruda, adding: “We are the only firm on the market that effectively combines legal and economic competition law advice. This enables us to offer our clients unique know-how for solving complex competition and regulatory issues.”

In the field of Mergers & Acquisitions, the firm has improved in the ranking compared to last year and moved up to an excellent second place. This ranking continues to confirm HAVEL & PARTNERS’ leading position in the field of Mergers & Acquisitions, in which it has been the market leader for more than 10 years, not only in the Czech Republic, but also in Slovakia and across Central Europe. “The year 2020 was exceptionally good for the firm in the field of Mergers & Acquisitions. I consider our top ranking in the TOP 10 largest law firms in the field of Mergers & Acquisitions in Slovakia to be a confirmation of our firm’s growing position on the Slovak market,” added Ondřej Majer, the firm’s partner co-responsible for M&A.

The TOP 10 ranking, the results of which were published on 30 November 2021, has been compiled since 2015 by the daily SME in cooperation with the English-language newspaper The Slovak Spectator according to combined objective criteria.

Methodology:

The ranking of the TOP 10 largest law firms in Slovakia was compiled in cooperation with the English-language newspaper The Slovak Spectator. The ranking was influenced by six criteria (for the number of lawyers and number of deals, data from 2020 were taken into account; for revenue and profit, the averages for 2018-2020 were taken into account). The weight of each criterion was as follows: number of lawyers (30% weight); number of law graduates (excluding attorneys) practising longer than three years (16% weight); number of law graduates (excluding attorneys) practising less than three years (8% weight); revenue from the sale of own products and services (23% weight); profit after tax (7%); number of deals for which a law firm was rewarded more than EUR 20,000 (16% weight).

The full results are available HERE

As part of a real estate deal, HAVEL & PARTNERS provided comprehensive legal advice to the investment group Czechoslovak Capital Partners in connection with the acquisition of a rental property at Tusarova 41, Prague 7, Holešovice.

The expert team led by Lukáš Syrový (Partner) and Jan Fikar (Managing Associate) provided transactional advice, including due diligence and preparation of contractual documentation. The legal advice also included securing bank financing, which enabled the refinancing of the investors’ invested funds and the implementation of a future investment plan in the form of an overall reconstruction and a roof extension of the property.

The investment group Czechoslovak Capital Partners was formed by the transformation of a fund of qualified investors, Šestý uzavřený investiční fond. The fund was established in 2012 pursuant to Act No. 240/2013 Sb., on Investment Companies and Investment Funds, as amended. The fund has been active in the investment market for 9 years and has gained ample experience across the investment spectrum. More than CZK 3 billion has been invested through the fund since its formation.

Authors: Robert Nešpůrek, Pavel Amler, Tomáš Chmelka

Let’s start with one of the most interesting and still relatively unexplored phenomena of the crypto world known as non–fungible tokens (NFTs).

The fundamental difference between NFTs and other popular crypto assets, typically fungible crypto assets (cryptocurrencies – Bitcoin, Ethereum), is their uniqueness and originality.

An NFT can be broadly defined as a record or certificate written on a blockchain[1] that represents or is directly linked to an object from the real or digital world (paintings, game objects, tweets or collages, etc.). This record consists of metadata that certifies the existence of certain rights of the subject to the object (mostly the existence of property rights). However, the use of NFTs does not end with this creative approach to the art trade. It turned out that NFTs can serve as the basis for entire computer games.[2]

The size of the NFT gaming market is estimated to amount to approximately 12 billion US dollars and the exponential growth of the past few years is expected to continue into the future. The use of blockchain and NFTs in computer gaming thus has the highest potential to skyrocket.

Although at first glance, the main character in blockchain may seem to be the private sphere, the opposite is true; public authorities, which are very well aware of its benefits, tend to use this technology also.

The introduction of central bank digital currencies (“CBDCs”), which create a direct receivable from the central bank that directly guarantees the type of currency, is increasingly mentioned in connection with the use of blockchain by state authorities. One of these types of currency is envisaged to be introduced by the European Union in its digital euro project establishing a direct receivable from the European Central Bank (the “ECB”).

The digital euro project is primarily a response to the receding trend of using cash in some countries and the ECB sees it as an adequate alternative to cash. In cryptocurrency terminology, the digital euro is a stablecoin, the value of which is linked to a specific fiat currency (hence its value is to some extent predictable). Its introduction could thus enhance financial inclusion, among other things, especially because it is relatively easily accessible and secure.

However, the digital euro project is still in its early stage of preparation, which the ECB launched relatively recently (the official launch took place on 14 July 2021). The final part of the project is expected to consist of several stages, in each of which the ECB will focus on individual parts of the project in greater detail (technical part, legal part and development part).

In the best-case scenario, the digital euro could come to light in 2026, but even so, this is still only a preliminary estimate and we must take into account unexpected problems or variations that may arise during its development and could delay its final launch. From a global perspective, around 80 countries, representing more than 90% of the world’s GDP, are currently considering the possibility of issuing their own CBDC. [3]

Not only the ECB, but also the European Commission is venturing into the world of blockchain technology. Together with members of the European Blockchain Service[4], it launched a European blockchain project in 2018 called the European Blockchain Services Infrastructure (the “EBSI”) with the aim of creating a single distributed database for the EU eGovernment.

The EBSI currently has four main options of use. These are the introduction of a European Digital Identity, the digitisation of notarisations, trusted data sharing among state authorities in the EU and the possibility of making it easier to obtain education credentials (diplomas). For each use, a working group has been set up to develop a European blockchain application prototype. Work is currently underway to introduce three more modes of use – financing SMEs, facilitating access to social services and processing asylum applications.

Blockchain is therefore undoubtedly one of the biggest technological agents in the past few years. Thanks to its broad application options, it has the potential to influence the current (not only technological) status quo in society. Although this technology certainly has its own pitfalls and limits, it will undoubtedly be very interesting to see what new forms of application blockchain will bring us in the future in real life and what new trends this technology will come up with in the future.

In early October 2021, the National Cyber and Information Security Agency (the NÚKIB) issued its first ever protective measure under the Cyber Security Act[5], which imposes an obligation on operators of information systems crucial for the functioning of the state and the safety of its inhabitants (especially ministries, key authorities and regions, including the capital city of Prague, as well as some private sector entities) to secure their e-mail boxes.

The aim of this measure is primarily to secure, in a uniform manner, the communication between public authorities, internally within these public authorities, and, where appropriate, between public authorities and other obligated persons within the private sector. The purpose is to reduce the risk of cyber-attacks, in particular man-in-the-middle attacks, where the infringer is in the middle of the communication between the sender and the recipient of the mail and can read it or change its content on the way.

In addition to this measure, the NÚKIB has also issued a detailed methodology as a guide on how to put in place e-mail communication protection.

Although this measure is not binding for all information system operators, we recommend that you at least get acquainted with it and, if necessary, adopt similar measures in your company to enhance security.

In September earlier this year, the Supreme Court issued a landmark decision under case No. 23 Cdo 2793/2020 on unfair competition for cloud storage sites in the safe haven regime – a regime where the operators of such sites have limited liability for content uploaded by users to their websites.

The subject of this dispute was the conduct of several cloud sites in providing financial remuneration to users who actively upload files with copyrighted content to their sites. A greater number of downloads of such files clearly led to an increase in the remuneration to such users.

The Supreme Court found this conduct to be unfair competition and held that liability for such conduct was not limited by the safe haven rules.

Thus, if a cloud storage pays users a remuneration that depends on the number or extent of downloads of data files stored by other users without adequately verifying whether the remuneration is not paid in connection with endangering or infringement of intellectual property rights, the cloud is very likely engaging in unfair competition.

If you are an operator of certain storage sites, we recommend that you check whether you meet all the conditions of a safe haven and whether you are not, for example, engaging in similar unfair competition.

[1] Blockchain is a type of distributed ledger technology, the main essence of which is defined in the name itself. A chain of interconnected and interdependent blocks forms a database that is not covered and coordinated by any superior entity and instead is functioning based on the consensus of all its users.

[2] One of the most popular games is Axie Inifinity, where users can buy, sell and bet on various digital pets called Axies.

[3] For a graphical comparison of the CBDC status in different parts of the world, go to https://www.atlanticcouncil.org/cbdctracker/

[4] Members are the EU Member States, Norway and Liechtenstein.

[5] Act No. 181/2014 Sb., on Cyber Security and on Amendments to Related Acts (the Cyber Security Act), as amended.

In November, the largest Czech-Slovak law firm HAVEL & PARTNERS welcomed a new partner – Martin Peckl (44). Until now, he was a partner in the Czech law firm Vejmelka & Wünsch. An expert in mergers and acquisitions, real estate law, business law and company law, and a Czech and German native speaker, Martin is becoming a key member of the specialised team at HAVEL & PARNERS providing comprehensive legal services to German-speaking clientele.

“One of our strategic priorities is the expansion of services oriented at key accounts that have business connections with German-speaking countries. The DACH region (Germany, Austria, Switzerland) is experiencing steeply growing demand among Czech and Slovak companies seeking legal and tax support during their expansion into DACH markets. Our team of over 25 German-speaking experts is the largest in the Czech Republic and Slovakia. With his long-term experience as a lawyer working for clients seated in the DACH region, Martin Peckl will be co-managing the team along with Marek Lošan, Adéla Havlová and other partners,” commentedJaroslav Havel, the firm’s managing partner, on Martin’s engagement as a new partner in the firm.

HAVEL & PARTNERS offers comprehensive legal services in all relevant areas of law including related tax services to clients from German-speaking countries – be they companies and private investors from these countries or Czech exporters to or investors in these countries.

Martin Peckl provides legal advice in German, English and Czech. These services comprise e.g. carrying out strategic investments, founding and managing joint ventures, supplying investment units and project financing.

Martin has taken part in a number of acquisition transactions both on the side of sellers and buyers, particularly in the area of residential social services, office buildings, the energy, construction, real estate development, engineering and automotive industries.

Before joining our firm, he worked for the major international law firm Freshfields Bruckhaus Deringer and from 2002 for its successor Czech law firm Vejmelka & Wünsch, where he had been a partner for the past 13 years.

An expert team from HAVEL & PARTNERS has been involved in the Distribution Law Center (DLC) international project managed by the leading Brussels-based law firm contrast. The objective of this unique platform is to create a website where relevant information and rules regarding supplier-customer relations for more than 27 jurisdictions will be fully available in one place.

HAVEL & PARTNERS experts are involved in the preparation of an ongoing information service, including newsletters for foreign and domestic contacts. The purpose of these activities is to prepare clients and the professional public to the maximum extent possible for major changes in the field of distribution relations. In 2022, the Block Exemption Regulation and the rules for assessing vertical agreements will be significantly revised. This change will affect almost all distribution relations, which will need to be modified accordingly.

“This is a unique project focusing on competition and commercial law issues related to the distribution of goods in Europe. DLC has the ambition to become a universal legal hub for anyone wishing to distribute their goods in multiple EU countries. In one place, it provides basic information on the legislation and decision-making practice of competition authorities and courts in more than 27 jurisdictions in a clear and understandable form,” said partner Robert Neruda.

HAVEL & PARTNERS is the exclusive contributor to the platform for the Czech Republic and Slovakia. It has joined other major European law firms cooperating on the project, forming an EU-wide network of experts in this field.

On behalf of HAVEL & PARTNERS, partner Štěpán Štarha, senior associate Radek Riedl, associate Vladislav Bernard and other experts in the field of setting up and adjusting distribution relations are working on the project together with Robert Neruda. Thanks to international cooperation, the project will offer a comprehensive overview of the legal aspects of distribution systems not only under EU law, but also under the conditions set out by individual national legal systems.

The law firm HAVEL & PARTNERS took part in another very successful IPO on the START market. Capital market specialists – Jan Topinka, a Partner, Jiří Kunášek, a Managing Associate, Martin Stančík, a Senior Associate, and Josef Bouchal, an Associate – provided comprehensive legal advice to FIXED.zone, the leading Czech manufacturer and distributor of accessories for mobile devices, during its first IPO.

“We are thrilled that we were able to assist by providing our comprehensive services – from the initial preparations through the transformation of the issuer, drafting the prospectus, ensuring market acceptance and on to the final settlement. We were a true guide for our client throughout the entire transaction,” said Jan Topinka.

The outcomes of the two-week IPO of the Czech manufacturer and distributor of accessories for mobile devices showed that the number of orders nearly tripled the number of offered shares totalling 222,000. “The IPO figures are a major surprise for us. We are happy to see such an astonishing demand for our shares, especially among Czech investors,” said Daniel Havner, the founder of the company and its majority shareholder. Through its entry on the stock exchange, the company intends to further boost the company’s growth, expand to new European markets and develop innovative products.

Seated in the city of České Budějovice, FIXED.zone has over 90 employees. It produces chargers, holders, cases and other accessories for mobile phones and tablets. With its smart SMILE Pro locator, the company confidently competes with the leading global manufacturers. The company’s ambition is to become an EU-wide leader in its field by combining its own development, flexibility and opening new market segments.

Authors: Robert Nešpůrek, Petr Bratský

The deadline of 17 December 2021 for the implementation of the Whistleblower Directive (Directive (EU) 2019/1937 of the European Parliament and of the Council) is fast approaching. Under the Directive, private entities with more than 50 employees and most public entities will have to introduce communication channels and processes for internal whistleblowing.

A number of global and major national companies already have centralised group-wide reporting systems in place and have relied on sufficiency of this global solution beyond 17 December 2021, but the European Commission has clearly rejected this interpretation.

The idea of a centralised reporting system was rejected by the European Commission in its interpretation guidelines responding to a joint letter from industry associations from several Member States.

The Commission explained that the Directive makes it clear that any private entity with more than 50 employees is required to implement an internal reporting system, regardless of whether or not the entity is part of a corporate group. Any other interpretation would be contra legem.

The Directive does not prohibit centralised group-wide whistleblowing systems, but these can only exist in parallel to reporting systems at the level of individual companies. The Commission has justified its opinion on the grounds that the system is more efficient if the problem is dealt with at the level of the company where the case was reported and by the different legal regulations that will be adopted at the national level. All Member States will have to respect this interpretation in implementing the Directive. Therefore, if you have more than 50 employees, you should start preparing for the implementation of your own whistleblowing system even if you already have a global whistleblowing system in place within your group.

Where subsidiaries have up to 249 employees, they may, in accordance with the Directive, pool the resources for investigating a report with their parent company, but the following conditions must be complied with, as interpreted by the Commission:

In the case of large companies, i.e. if the subsidiary has more than 249 employees, resource pooling is not allowed. Each such company must have established its own internal whistleblowing system that is independent of the group’s central whistleblowing system and must have sufficient capacity available to deal with such notifications.

Even if you do not have systematic investigation sharing in place within the group, there may be situations in which dealing with reported breaches at the parent company level is the only effective solution. These are situations where the report relates to a structural problem within the group or multiple companies within the group and where the company at which the breach was reported does not have the competence to effectively resolve the problem. In such cases, as the European Commission explains, the whistleblower should be informed of this fact and asked to agree to the case being transferred within the group to an entity that is competent to resolve the problem. However, this entails considerable risks. If the whistleblower does not agree to the transfer of the reported matter, he or she must be allowed to withdraw the report and submit it through external channels, which in the case of the Czech Republic will be a newly established office within the Ministry of Justice. The group therefore risks losing control of the reported case and the related potential reputational damage, material and non-material damage, high costs, protracted litigation, and other adverse consequences.

For many global companies, the Commission’s interpretation is surprising. The centralisation of whistleblowing systems allowed for a concentration of practices and experiences, a consistent approach to whistleblowing across the group, and efficient problem-solving at a lower cost.

Although the European Commission’s interpretation is not binding, it will be interesting to see whether individual states will tend to oppose this interpretation and transpose the Directive into their legal systems more benevolently. It is already clear, however, that companies with more than 50 employees that do not put in place a workable whistleblowing system for their whistleblowers will risk having their whistleblowers report externally, to the authorities or sometimes directly to the media. And that is always the most painful solution for a company.

We therefore recommend that all groups review their centralised whistleblowing systems, decentralise them or implement new whistleblowing systems at the level of individual subsidiaries to comply with the requirements of the Directive. We believe that for smaller players a whistleblowing system can always be set up in a cost-effective and proportionate manner, taking into account the cost and size of the company and its internal workings. It will be good to use permitted forms of group-wide resource sharing and sometimes it will make sense in terms of cost and competences to outsource the management of the whistleblowing systems to a third party.

For more information on whistleblowing and the full range of our whistleblowing services, please visit the HAVEL & PARTNERS website. For our clients, we ensure the implementation of whistleblowing channels, and processes for receiving and verifying reports, we can take over the administration of the entire system and act as the party responsible for receiving reports and handling the whistleblowing process. As part of our services we can design a whistleblowing system for your company and/or group of companies so that it is functional, cost-effective and meets the new legal requirements.

The largest Czech-Slovak law firm HAVEL & PARTNERS has confirmed its unique position on the market, having won five awards in the 14th year of the Czech Law Firm of the Year. Like last year, HAVEL & PARTNERS received the main award for the Best Czech Law Firm and the award for the Best Client Service, and in addition, it triumphed in three categories – Mergers & Acquisitions, Telecommunications & Media and Health Law. The award ceremony was held on 1 November at Žofín Palace in Prague.

In addition to its repeated victory at the Chambers Europe Awards, the most prestigious global ranking, the firm once again dominated the Czech Law Firm of the Year awards, organised by EPRAVO.CZ under the auspices of the Czech Bar Association and the Ministry of Justice of the Czech Republic.

HAVEL & PARTNERS’ track record in this competition confirms its long-standing position as the leader in the Czech legal market: the firm has won the main award for the Best Czech Law Firm and the award for the Best Client Service for the 5th time in the last seven years, in addition to winning in three sector categories.

“This is our biggest achievement ever and the best result in the history of this competition as well – no other law firm has ever won so many awards in one year, including the main and client awards. We are very appreciative of this; it is the best ending for our firm’s 20th anniversary,” said Jaroslav Havel, the managing partner. “I would like to thank all my colleagues for their dedication, loyalty and teamwork, as well as our clients for their trust which motivates us to continuously work on ourselves, enhance our services and bring them added value,” added Mr Havel.

The triumph in the M&A category for the third time in a row confirms HAVEL & PARTNERS’ leading position in this area in the market, not only in the Czech Republic. The firm has also won a number of awards in Slovakia and has been at the top of the list in terms of the number of completed transactions in the entire CEE region for more than 10 years.

And this is even the seventh time the firm has received the award in Telecommunications and Media, which is one of its most important specialisations and its experts have extensive experience in the largest telecoms law projects in the Czech and Slovak markets.

One of the new developments in this year’s awards was the introduction of the Health Law category, which was immediately dominated by HAVEL & PARTNERS, which is another key area of its specialisation.

In 15 categories HAVEL & PARTNERS was ranked among the highly recommended firms (top tier). In Criminal Law, in which HAVEL & PARTNERS is not directly involved, SEIFERT A PARTNEŘI, HAVEL & PARTNERS’ exclusive partner in criminal law advisory, was named among the top-ranked law firms.

“These achievements testify not only to the high level of the services provided, but also to the exceptional versatility of the practice groups within the firm and the excellent know-how of our colleagues,” added Jaroslav Havel.

According to the results of all previous years of the awards, HAVEL & PARTNERS remains the most successful and all-encompassing law firm in the Czech Republic and Slovakia based on the total number of all nominations and awards.

At their assembly, attorneys-at-law elected all four representatives of the law firm HAVEL & PARTNERS, nominees of the Moderní advokacie platform, to the supreme bodies of the Czech Bar Association. For the next four years, František Korbel, a partner in the law firm, will be a member of the Board of Directors of the Czech Bar Association. Partner Josef Hlavička has become a member of the Supervisory Council, while Dušan Sedláček and Jan Šturm, both partners in the law firm, will serve their terms in the Bar Disciplinary Commission.

Moderní advokacie is an informal platform associating cooperating Czech and international law firms. Eight of its representatives have won seats in the 11-member Board of Directors of the Czech Bar Association. According to the representatives of the platform, the Czech Bar Association is designed as an independent professional organisation providing a modern regulatory framework for the performance of the legal profession, it protects the independence of attorneys-at-law and promotes the right to legal assistance.

Under the leadership of the platform, the bar association should exercise, independently of the state, supervisory and disciplinary powers, ensure the professional training of junior lawyers, the education of attorneys-at-law and take an active part in the law-making process and modernisation of the performance of the legal profession, the judiciary and public administration.

“We are grateful to our colleagues for their support and trust in nominating us to the management bodies of the Czech Bar Association. We are looking forward to cooperating with all the members of the Board of Directors and to good work relations in the supreme bodies. We are ready to work hard throughout the coming four years to ensure the Czech legal profession is self-confident and independent, and forms an integral and irreplaceable part of the system of the provision of legal assistance,” commented František Korbel on the outcomes.

A total of 2,397 attorneys-at-law took part in the elections to the governing bodies of the Czech Bar Association at its 8th assembly. The Czech Bar Association is the largest organisation associating legal professionals in the Czech Republic, it performs public administration in the legal profession and is a guarantor of the quality of legal services provided by attorneys-at-law

HAVEL & PARTNERS’ professional team provided long-term legal advice to the Ministry of Defence of the Czech Republic in connection with the preparation and negotiation of an inter-governmental contract for the purchase of the SPYDER Israeli air defence system from the state-owned company Rafael Advanced Defense Systems Ltd. for the Army of the Czech Republic at CZK 13.7 billion (incl. VAT), as well an agreement for maintenance and servicing of the system for a fee of up to CZK 6.2 billion over a period of 20 years from the delivery of the system in 2026. The Czech Republic signed both contracts with the Israeli counterparty on 5 October 2021.

Comprehensive legal advice to the Ministry of Defence of the Czech Republic was provided by Petr Kadlec (partner), Martin Ráž (counsel), and Ivo Heger (associate), supported by Ondrej Čurilla (counsel) and Petra Kašpárková (associate) in the area of public procurement, and Josef Žaloudek (counsel) and Kristýna Šlehoferová (tax advisor) in the area of taxes.

SPYDER is an Israeli Short Range Air Defence (SHORAD) system designated to detect, identify and eliminate airborne targets. This ensures, among other things, the protection of urban agglomerations, nuclear power plants, industrial centres, airports and other important facilities from the threat of air attack. SPYDER is combat proven and is the first successful delivery of this sophisticated defence system to a NATO member state.

Deliveries of four SPYDER batteries will take place gradually until 2026. The new system will replace the obsolete Soviet-made KUB missile systems from the 1970s in the Czech Army’s arsenal. The contract is also a great opportunity for the Czech defence industry, especially the company RETIA and the state-owned enterprise Vojenský technický ústav.